- China

- /

- Electrical

- /

- SHSE:600550

Baoding Tianwei Baobian ElectricLtd (SHSE:600550) pulls back 5.3% this week, but still delivers shareholders favorable 6.6% CAGR over 5 years

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Baoding Tianwei Baobian ElectricLtd share price has climbed 38% in five years, easily topping the market decline of 1.4% (ignoring dividends).

While the stock has fallen 5.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Baoding Tianwei Baobian ElectricLtd

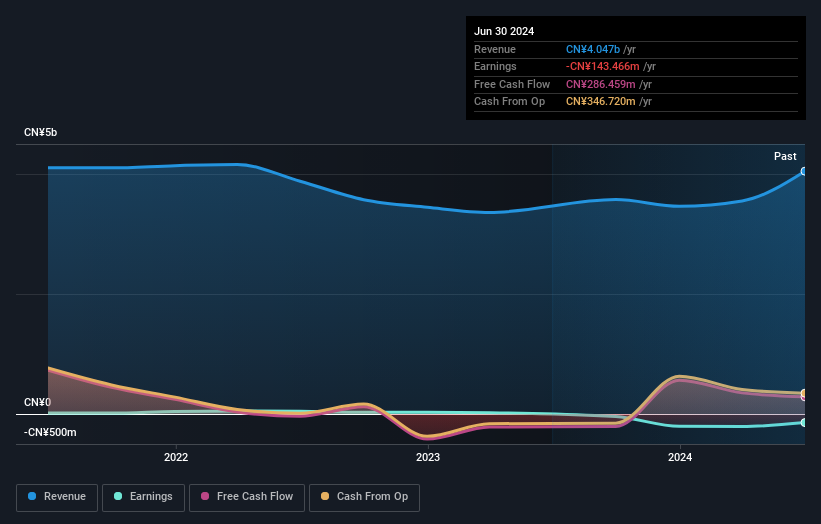

Baoding Tianwei Baobian ElectricLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Baoding Tianwei Baobian ElectricLtd saw its revenue grow at 1.1% per year. Put simply, that growth rate fails to impress. While it's hard to say just how much value the company added over five years, the annualised share price gain of 7% seems about right. We'd be looking for the underlying business to grow revenue a bit faster.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Baoding Tianwei Baobian ElectricLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While it's never nice to take a loss, Baoding Tianwei Baobian ElectricLtd shareholders can take comfort that their trailing twelve month loss of 4.7% wasn't as bad as the market loss of around 15%. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Baoding Tianwei Baobian ElectricLtd better, we need to consider many other factors. Even so, be aware that Baoding Tianwei Baobian ElectricLtd is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Baoding Tianwei Baobian ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600550

Baoding Tianwei Baobian ElectricLtd

Manufactures and sells power transmission and transformation equipment in China and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives