- China

- /

- Electrical

- /

- SHSE:600550

Baoding Tianwei Baobian Electric Co.,Ltd.'s (SHSE:600550) 29% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Baoding Tianwei Baobian Electric Co.,Ltd. (SHSE:600550) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 179% following the latest surge, making investors sit up and take notice.

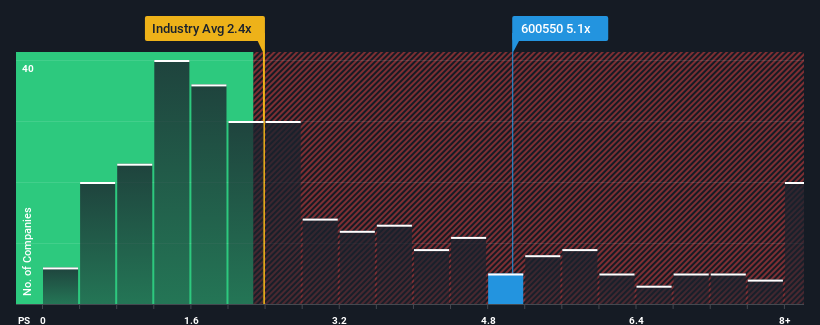

Since its price has surged higher, you could be forgiven for thinking Baoding Tianwei Baobian ElectricLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.1x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Baoding Tianwei Baobian ElectricLtd

What Does Baoding Tianwei Baobian ElectricLtd's Recent Performance Look Like?

The revenue growth achieved at Baoding Tianwei Baobian ElectricLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Baoding Tianwei Baobian ElectricLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Baoding Tianwei Baobian ElectricLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Baoding Tianwei Baobian ElectricLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. The latest three year period has also seen a 12% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this information, we find it concerning that Baoding Tianwei Baobian ElectricLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Baoding Tianwei Baobian ElectricLtd's P/S?

The strong share price surge has lead to Baoding Tianwei Baobian ElectricLtd's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Baoding Tianwei Baobian ElectricLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Baoding Tianwei Baobian ElectricLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Baoding Tianwei Baobian ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600550

Baoding Tianwei Baobian ElectricLtd

Manufactures and sells power transmission and transformation equipment in China and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives