Saurer Intelligent Technology Co. Ltd's (SHSE:600545) Prospects Need A Boost To Lift Shares

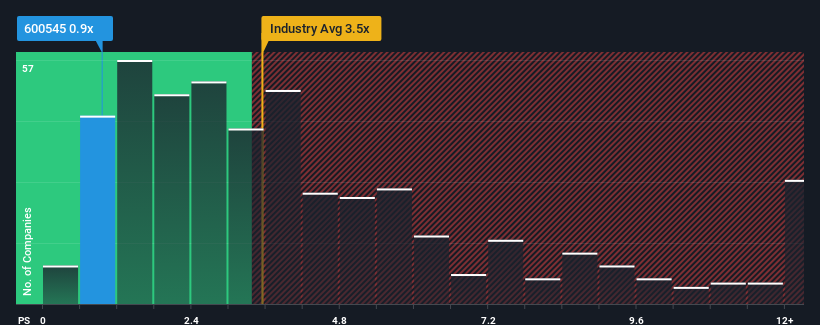

With a price-to-sales (or "P/S") ratio of 0.9x Saurer Intelligent Technology Co. Ltd (SHSE:600545) may be sending very bullish signals at the moment, given that almost half of all the Machinery companies in China have P/S ratios greater than 3.5x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Saurer Intelligent Technology

What Does Saurer Intelligent Technology's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Saurer Intelligent Technology over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Saurer Intelligent Technology's earnings, revenue and cash flow.How Is Saurer Intelligent Technology's Revenue Growth Trending?

Saurer Intelligent Technology's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

In light of this, it's understandable that Saurer Intelligent Technology's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Saurer Intelligent Technology's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Saurer Intelligent Technology revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Saurer Intelligent Technology (2 are concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Saurer Intelligent Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600545

Saurer Intelligent Technology

Saurer Intelligent Technology Co.,Ltd. engages in the research and development, production, and sale of textile machinery and components for fibre and yarn processing worldwide.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives