Saurer Intelligent Technology Co. Ltd (SHSE:600545) Not Doing Enough For Some Investors As Its Shares Slump 25%

Unfortunately for some shareholders, the Saurer Intelligent Technology Co. Ltd (SHSE:600545) share price has dived 25% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

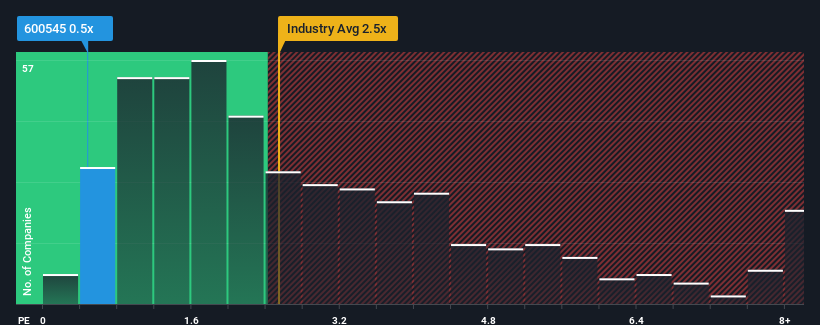

Although its price has dipped substantially, Saurer Intelligent Technology's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Machinery industry in China, where around half of the companies have P/S ratios above 2.5x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Saurer Intelligent Technology

What Does Saurer Intelligent Technology's Recent Performance Look Like?

The revenue growth achieved at Saurer Intelligent Technology over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Saurer Intelligent Technology's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Saurer Intelligent Technology would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 51% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Saurer Intelligent Technology is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Saurer Intelligent Technology's P/S

Shares in Saurer Intelligent Technology have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Saurer Intelligent Technology revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Saurer Intelligent Technology that you need to be mindful of.

If these risks are making you reconsider your opinion on Saurer Intelligent Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600545

Saurer Intelligent Technology

Saurer Intelligent Technology Co.,Ltd. engages in the research and development, production, and sale of textile machinery and components for fibre and yarn processing worldwide.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives