Investors Don't See Light At End Of Saurer Intelligent Technology Co. Ltd's (SHSE:600545) Tunnel And Push Stock Down 25%

To the annoyance of some shareholders, Saurer Intelligent Technology Co. Ltd (SHSE:600545) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

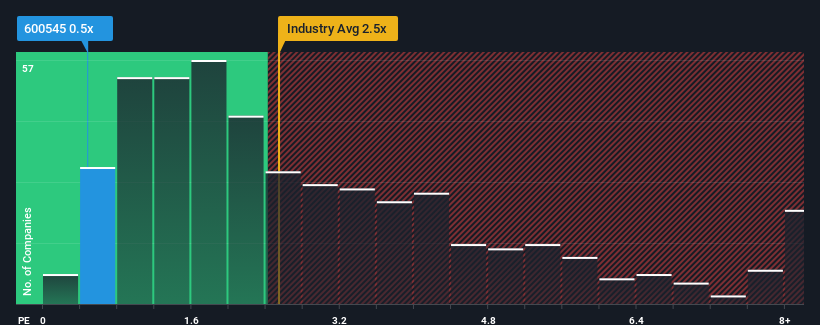

Even after such a large drop in price, Saurer Intelligent Technology may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.5x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Saurer Intelligent Technology

How Has Saurer Intelligent Technology Performed Recently?

Revenue has risen firmly for Saurer Intelligent Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Saurer Intelligent Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Saurer Intelligent Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Saurer Intelligent Technology's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. Pleasingly, revenue has also lifted 51% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Saurer Intelligent Technology's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Saurer Intelligent Technology's P/S?

Shares in Saurer Intelligent Technology have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Saurer Intelligent Technology maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you take the next step, you should know about the 1 warning sign for Saurer Intelligent Technology that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Saurer Intelligent Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600545

Saurer Intelligent Technology

Saurer Intelligent Technology Co.,Ltd. engages in the research and development, production, and sale of textile machinery and components for fibre and yarn processing worldwide.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives