Positive Sentiment Still Eludes Shuangliang Eco-Energy Systems Co.,Ltd (SHSE:600481) Following 29% Share Price Slump

Shuangliang Eco-Energy Systems Co.,Ltd (SHSE:600481) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

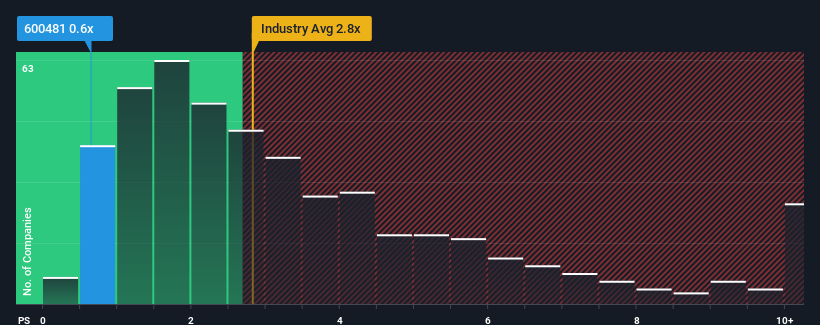

Following the heavy fall in price, Shuangliang Eco-Energy SystemsLtd may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.8x and even P/S higher than 5x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shuangliang Eco-Energy SystemsLtd

What Does Shuangliang Eco-Energy SystemsLtd's P/S Mean For Shareholders?

Shuangliang Eco-Energy SystemsLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shuangliang Eco-Energy SystemsLtd.How Is Shuangliang Eco-Energy SystemsLtd's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Shuangliang Eco-Energy SystemsLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 77% as estimated by the two analysts watching the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Shuangliang Eco-Energy SystemsLtd's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Shuangliang Eco-Energy SystemsLtd's P/S

Shares in Shuangliang Eco-Energy SystemsLtd have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Shuangliang Eco-Energy SystemsLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Shuangliang Eco-Energy SystemsLtd (1 is potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600481

Shuangliang Eco-Energy SystemsLtd

Provides energy saving, air cooled condensers, and sea water desalination products primarily in China.

High growth potential and fair value.

Market Insights

Community Narratives