Wuxi Huaguang Environment & Energy Group Co.,Ltd. (SHSE:600475) Stock Catapults 27% Though Its Price And Business Still Lag The Market

Wuxi Huaguang Environment & Energy Group Co.,Ltd. (SHSE:600475) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.3% in the last twelve months.

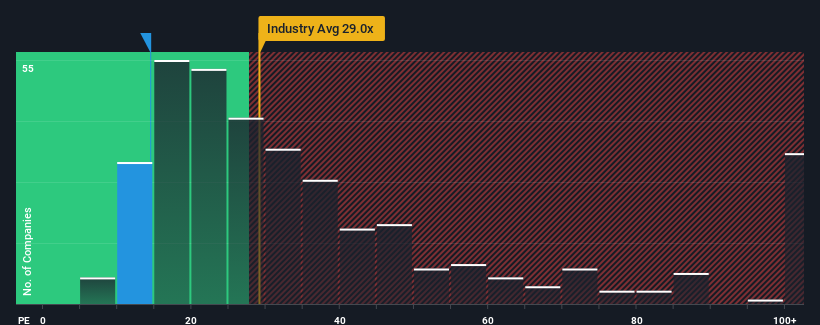

In spite of the firm bounce in price, Wuxi Huaguang Environment & Energy GroupLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.5x, since almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 56x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Wuxi Huaguang Environment & Energy GroupLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Wuxi Huaguang Environment & Energy GroupLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Wuxi Huaguang Environment & Energy GroupLtd's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 42% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 23% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

With this information, we can see why Wuxi Huaguang Environment & Energy GroupLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Wuxi Huaguang Environment & Energy GroupLtd's P/E

Wuxi Huaguang Environment & Energy GroupLtd's recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Wuxi Huaguang Environment & Energy GroupLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Wuxi Huaguang Environment & Energy GroupLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Wuxi Huaguang Environment & Energy GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Huaguang Environment & Energy GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600475

Wuxi Huaguang Environment & Energy GroupLtd

Wuxi Huaguang Environment & Energy Group Co.,Ltd.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives