Take Care Before Diving Into The Deep End On Fujian Longking Co., Ltd. (SHSE:600388)

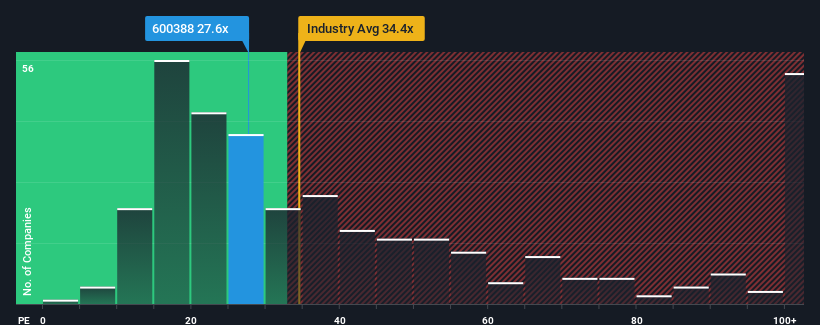

With a price-to-earnings (or "P/E") ratio of 27.6x Fujian Longking Co., Ltd. (SHSE:600388) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 35x and even P/E's higher than 69x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Fujian Longking has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Fujian Longking

How Is Fujian Longking's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Fujian Longking's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. This means it has also seen a slide in earnings over the longer-term as EPS is down 44% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 141% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 39% growth forecast for the broader market.

In light of this, it's peculiar that Fujian Longking's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Fujian Longking's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Fujian Longking currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 4 warning signs for Fujian Longking that you need to take into consideration.

Of course, you might also be able to find a better stock than Fujian Longking. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600388

Fujian Longking

Engages in the manufacture and sale of environmental protection equipment worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives