- China

- /

- Construction

- /

- SHSE:600326

Tibet Tianlu Co., Ltd.'s (SHSE:600326) P/S Is Still On The Mark Following 30% Share Price Bounce

The Tibet Tianlu Co., Ltd. (SHSE:600326) share price has done very well over the last month, posting an excellent gain of 30%. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

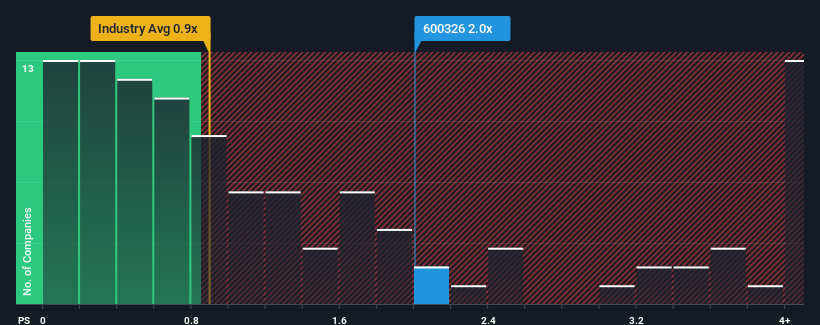

After such a large jump in price, when almost half of the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Tibet Tianlu as a stock probably not worth researching with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Tibet Tianlu

How Tibet Tianlu Has Been Performing

Tibet Tianlu's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tibet Tianlu.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Tibet Tianlu's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. Still, lamentably revenue has fallen 47% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 26% over the next year. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Tibet Tianlu's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Tibet Tianlu's P/S

Tibet Tianlu's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Tibet Tianlu's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Tibet Tianlu (including 1 which is potentially serious).

If these risks are making you reconsider your opinion on Tibet Tianlu, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Tianlu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600326

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives