- China

- /

- Electrical

- /

- SHSE:600312

Does Henan Pinggao ElectricLtd (SHSE:600312) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Henan Pinggao ElectricLtd (SHSE:600312), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Henan Pinggao ElectricLtd

How Fast Is Henan Pinggao ElectricLtd Growing Its Earnings Per Share?

Over the last three years, Henan Pinggao ElectricLtd has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Henan Pinggao ElectricLtd's EPS catapulted from CN¥0.43 to CN¥0.83, over the last year. Year on year growth of 91% is certainly a sight to behold.

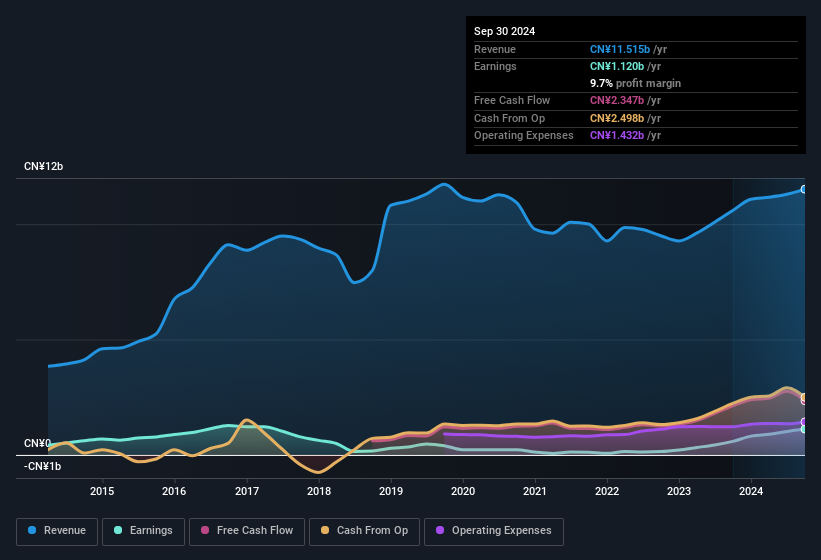

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Henan Pinggao ElectricLtd shareholders is that EBIT margins have grown from 5.9% to 11% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Henan Pinggao ElectricLtd's future EPS 100% free.

Are Henan Pinggao ElectricLtd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥15b and CN¥47b, like Henan Pinggao ElectricLtd, the median CEO pay is around CN¥1.6m.

Henan Pinggao ElectricLtd offered total compensation worth CN¥897k to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Henan Pinggao ElectricLtd Deserve A Spot On Your Watchlist?

Henan Pinggao ElectricLtd's earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Henan Pinggao ElectricLtd has the hallmarks of a quality business; and that would make it well worth watching. It is worth noting though that we have found 1 warning sign for Henan Pinggao ElectricLtd that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Henan Pinggao ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600312

Henan Pinggao ElectricLtd

Researches and develops, manufactures, sells, and services high voltage, super-high voltage, and ultra-high voltage AC/DC switchgear in China.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives