Henan Huanghe Whirlwind Co., Ltd. (SHSE:600172) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

To the annoyance of some shareholders, Henan Huanghe Whirlwind Co., Ltd. (SHSE:600172) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

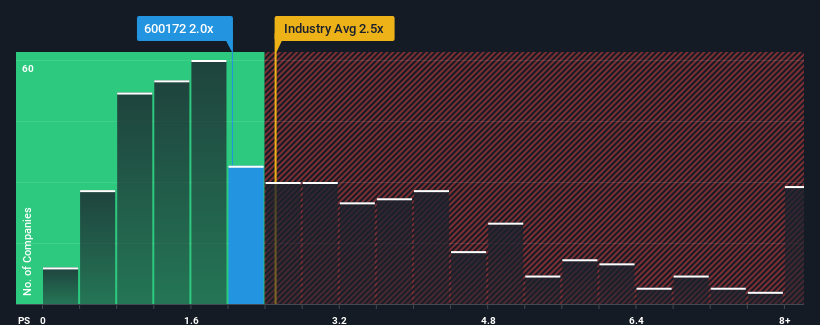

In spite of the heavy fall in price, it's still not a stretch to say that Henan Huanghe Whirlwind's price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 2.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Henan Huanghe Whirlwind

How Has Henan Huanghe Whirlwind Performed Recently?

For example, consider that Henan Huanghe Whirlwind's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Henan Huanghe Whirlwind will help you shine a light on its historical performance.How Is Henan Huanghe Whirlwind's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Henan Huanghe Whirlwind's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 39%. As a result, revenue from three years ago have also fallen 48% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 23% shows it's an unpleasant look.

With this information, we find it concerning that Henan Huanghe Whirlwind is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

Henan Huanghe Whirlwind's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Henan Huanghe Whirlwind currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 1 warning sign for Henan Huanghe Whirlwind that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Henan Huanghe Whirlwind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600172

Henan Huanghe Whirlwind

Engages in the manufacture and sale of carbon-based new materials in China and internationally.

Imperfect balance sheet very low.

Market Insights

Community Narratives