China CSSC Holdings Limited's (SHSE:600150) Share Price Could Signal Some Risk

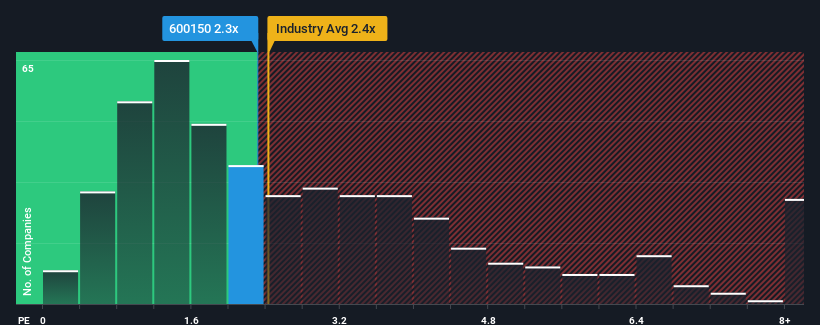

With a median price-to-sales (or "P/S") ratio of close to 2.4x in the Machinery industry in China, you could be forgiven for feeling indifferent about China CSSC Holdings Limited's (SHSE:600150) P/S ratio of 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for China CSSC Holdings

How Has China CSSC Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, China CSSC Holdings has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think China CSSC Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For China CSSC Holdings?

The only time you'd be comfortable seeing a P/S like China CSSC Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. The latest three year period has also seen an excellent 48% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 4.7% as estimated by the five analysts watching the company. With the industry predicted to deliver 22% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that China CSSC Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of China CSSC Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for China CSSC Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600150

China CSSC Holdings

Engages in the shipbuilding and repair businesses in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives