- China

- /

- Construction

- /

- SHSE:600133

Here's Why We Think Wuhan East Lake High Technology Group (SHSE:600133) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Wuhan East Lake High Technology Group (SHSE:600133). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Wuhan East Lake High Technology Group's EPS skyrocketed from CN¥0.71 to CN¥0.99, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 38%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Wuhan East Lake High Technology Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Despite consistency in EBIT margins year on year, Wuhan East Lake High Technology Group has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

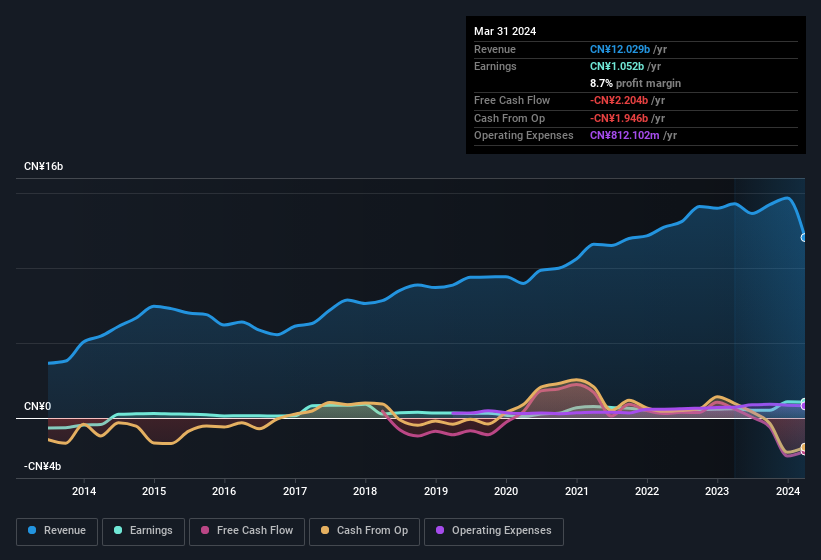

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Wuhan East Lake High Technology Group Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Wuhan East Lake High Technology Group, with market caps between CN¥7.2b and CN¥23b, is around CN¥1.3m.

The Wuhan East Lake High Technology Group CEO received total compensation of just CN¥584k in the year to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Wuhan East Lake High Technology Group Worth Keeping An Eye On?

You can't deny that Wuhan East Lake High Technology Group has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. It is worth noting though that we have found 3 warning signs for Wuhan East Lake High Technology Group (1 is a bit concerning!) that you need to take into consideration.

Although Wuhan East Lake High Technology Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan East Lake High Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600133

Wuhan East Lake High Technology Group

Wuhan East Lake High Technology Group Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives