Stock Analysis

- China

- /

- Commercial Services

- /

- SZSE:301175

Exploring Undiscovered Gems In China July 2024

Reviewed by Simply Wall St

As of July 2024, the Chinese market has shown volatility with key indices like the Shanghai Composite and CSI 300 experiencing notable declines. This movement reflects broader economic concerns, despite recent aggressive rate cuts by the People's Bank of China aimed at stimulating growth. In such a market environment, identifying good stocks often involves looking for companies with robust fundamentals, potential for market share expansion, and resilience to macroeconomic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiang Publishing & MediaLtd | NA | -5.93% | 2.80% | ★★★★★★ |

| Changzhou Zhongying Science & Technology | NA | 11.49% | 22.06% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -10.22% | -26.80% | ★★★★★★ |

| Center International GroupLtd | 35.04% | 4.82% | -39.58% | ★★★★★★ |

| Hydsoft TechnologyLtd | 9.94% | 18.09% | 11.48% | ★★★★★★ |

| Founder Technology GroupLtd | 7.56% | -8.80% | 15.53% | ★★★★★★ |

| Beilong Precision Technology | 14.94% | 15.35% | 2.32% | ★★★★★★ |

| Pamica Technology | 7.24% | 8.88% | 16.48% | ★★★★★☆ |

| Ningbo Henghe Precision IndustryLtd | 57.08% | 5.10% | 33.23% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 88.62% | 3.34% | 66.80% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Bank of Xi'anLtd (SHSE:600928)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank of Xi'an Co., Ltd. operates as a comprehensive financial services provider, offering corporate, commercial, and personal banking solutions across China, with a market capitalization of approximately CN¥14.36 billion.

Operations: The company generates revenue through its core operations, consistently achieving a net income margin of approximately 55%. It operates with no cost of goods sold and maintains high operational expenses, which have gradually increased over the years.

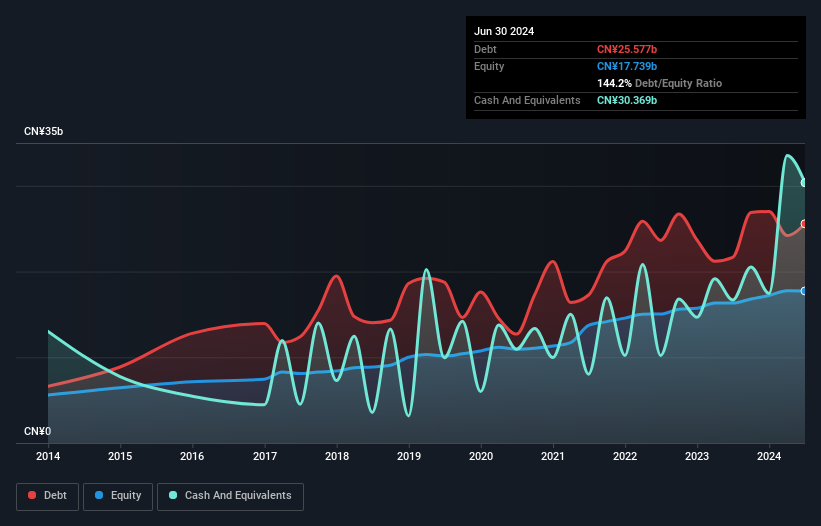

Bank of Xi'an, often overlooked, is trading at 5.8% below its estimated fair value, suggesting potential for investors seeking untapped opportunities. With total assets of CN¥441.1B and a robust balance sheet featuring CN¥308.0B in deposits and CN¥214.3B in loans, the bank demonstrates stability. Notably, its bad loans are well-managed at 1.4%, reflecting prudent risk control. Despite an earnings growth of only 0.5% last year—lagging behind the industry's 5.1%—its financial health remains solid with a sufficient bad loan allowance covering over twice the necessary amount (203%).

Jiangsu Zhangjiagang Rural Commercial Bank (SZSE:002839)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhangjiagang Rural Commercial Bank Co., Ltd. operates as a provider of various banking products and services in China, with a market capitalization of approximately CN¥8.57 billion.

Operations: The company generates its revenue primarily through financial services, maintaining a consistent gross profit margin of 100% over multiple years. It manages substantial operating expenses, which have grown in line with revenue increases, reflecting expanded operational scale and possibly increased administrative activities.

Jiangsu Zhangjiagang Rural Commercial Bank, with a robust balance sheet featuring CN¥216.5B in assets and CN¥17.8B in equity, stands out as an undervalued gem, trading 54% below its fair value. The bank's prudent financial management is evident from its 1% bad loans ratio and a 424% allowance for these loans, ensuring stability. Recently affirming dividends at CNY 2 per 10 shares reflects confidence in sustained profitability, bolstered by a consistent earnings growth of nearly 16% over the past five years.

Beijing China Sciences Runyu Environmental Technology (SZSE:301175)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing China Sciences Runyu Environmental Technology Co., Ltd. is a company that specializes in environmental protection technologies and services, with a market capitalization of CN¥6.64 billion.

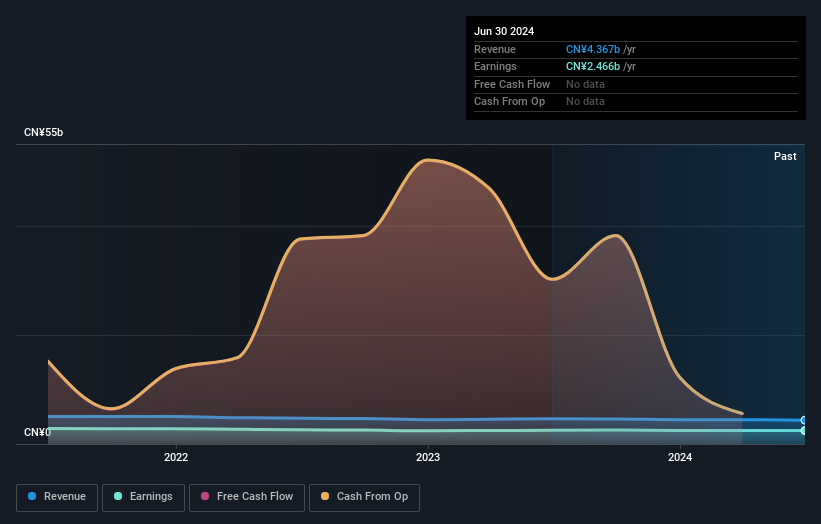

Operations: The company generates revenue primarily through its core operations which involve managing costs related to goods sold and operational expenses while focusing on increasing gross profit. Over recent periods, it has seen a notable trend in improving its gross profit margin, reaching as high as 39.83% by the end of 2024 from earlier figures around 33.49% in late 2017.

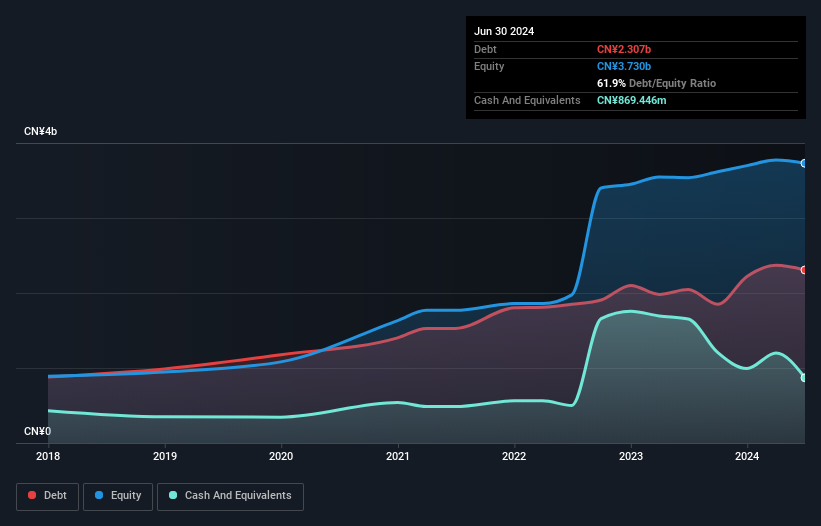

Beijing China Sciences Runyu Environmental Technology Co., Ltd. stands out with its robust earnings growth of 25.8% this past year, surpassing the Commercial Services sector's decline by 5%. This performance is supported by a significant reduction in debt-to-equity from 106% to 63% over five years, enhancing financial stability. The company's Price-To-Earnings ratio at 23.6x, below the market average of 27.5x, suggests a potential undervaluation. Recent governance enhancements further solidify its strategic position, promising for investors seeking untapped potential in China's environmental sector.

Turning Ideas Into Actions

- Click this link to deep-dive into the 997 companies within our Chinese Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing China Sciences Runyu Environmental Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301175

Beijing China Sciences Runyu Environmental Technology

Beijing China Sciences Runyu Environmental Technology Co., Ltd.

Solid track record with adequate balance sheet.