Subdued Growth No Barrier To Zhejiang Taotao Vehicles Co., Ltd. (SZSE:301345) With Shares Advancing 27%

Zhejiang Taotao Vehicles Co., Ltd. (SZSE:301345) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

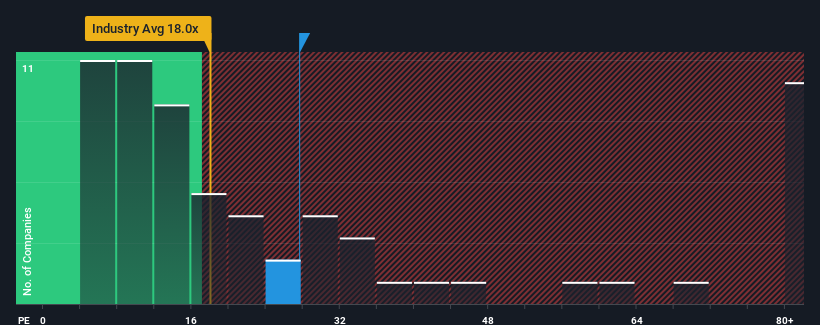

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Zhejiang Taotao Vehicles' P/E ratio of 27.6x, since the median price-to-earnings (or "P/E") ratio in China is also close to 29x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Zhejiang Taotao Vehicles as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Zhejiang Taotao Vehicles

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Zhejiang Taotao Vehicles' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.4% last year. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 26% as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 35% growth forecast for the broader market.

In light of this, it's curious that Zhejiang Taotao Vehicles' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Zhejiang Taotao Vehicles' P/E

Zhejiang Taotao Vehicles' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhejiang Taotao Vehicles' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhejiang Taotao Vehicles you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Taotao Vehicles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301345

Zhejiang Taotao Vehicles

Engages in the research and development, production, and sale of motorcycles, electric vehicles, and ATVs in China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.