As global markets navigate the complexities of trade policies and economic indicators, Asia's small-cap sector presents intriguing opportunities amid shifting consumer confidence and inflation dynamics. In this environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 34.20% | 17.05% | 40.91% | ★★★★★★ |

| Woori Technology Investment | NA | 19.59% | -2.63% | ★★★★★★ |

| Great China Metal Ind | NA | 2.37% | -4.87% | ★★★★★★ |

| Bonraybio | NA | 46.87% | 491.11% | ★★★★★★ |

| Creative & Innovative System | 0.66% | 56.48% | 79.21% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Chin Hsin Environ Engineering | 2.92% | 45.36% | 41.71% | ★★★★★☆ |

| iMarketKorea | 30.54% | 4.27% | 0.27% | ★★★★★☆ |

| KC | 2.19% | 8.76% | -0.47% | ★★★★★☆ |

| Iljin DiamondLtd | 2.55% | -3.23% | 0.91% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

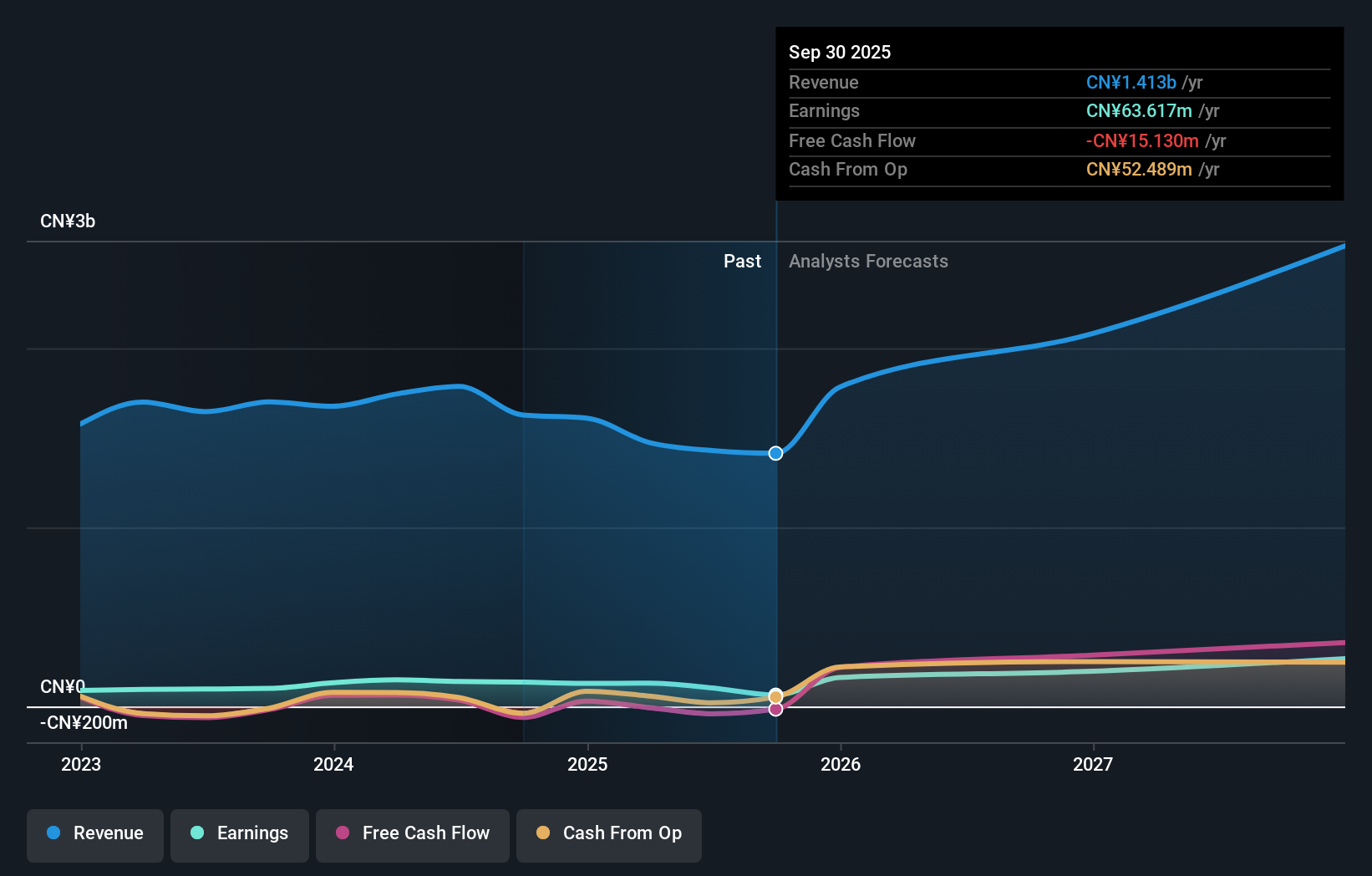

Nanjing LES Information Technology (SHSE:688631)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing LES Information Technology Co., Ltd. is a company with a market cap of CN¥13.89 billion, focused on providing technology solutions and services.

Operations: Nanjing LES Information Technology generates revenue primarily through its technology solutions and services. The company has a market cap of CN¥13.89 billion.

Nanjing LES Information Technology, a smaller player in its field, has been navigating some choppy waters. Over the past year, it reported negative earnings growth of 12.4%, mirroring the Aerospace & Defense industry average. Despite this setback, it's trading at 16% below its estimated fair value and remains debt-free—an attractive feature for potential investors. The company anticipates earnings to grow by 26% annually, suggesting brighter days ahead. However, recent quarterly results showed a net loss of CNY 14.93 million on sales of CNY 108.87 million compared to CNY 244.81 million last year, indicating challenges remain in boosting revenue streams effectively.

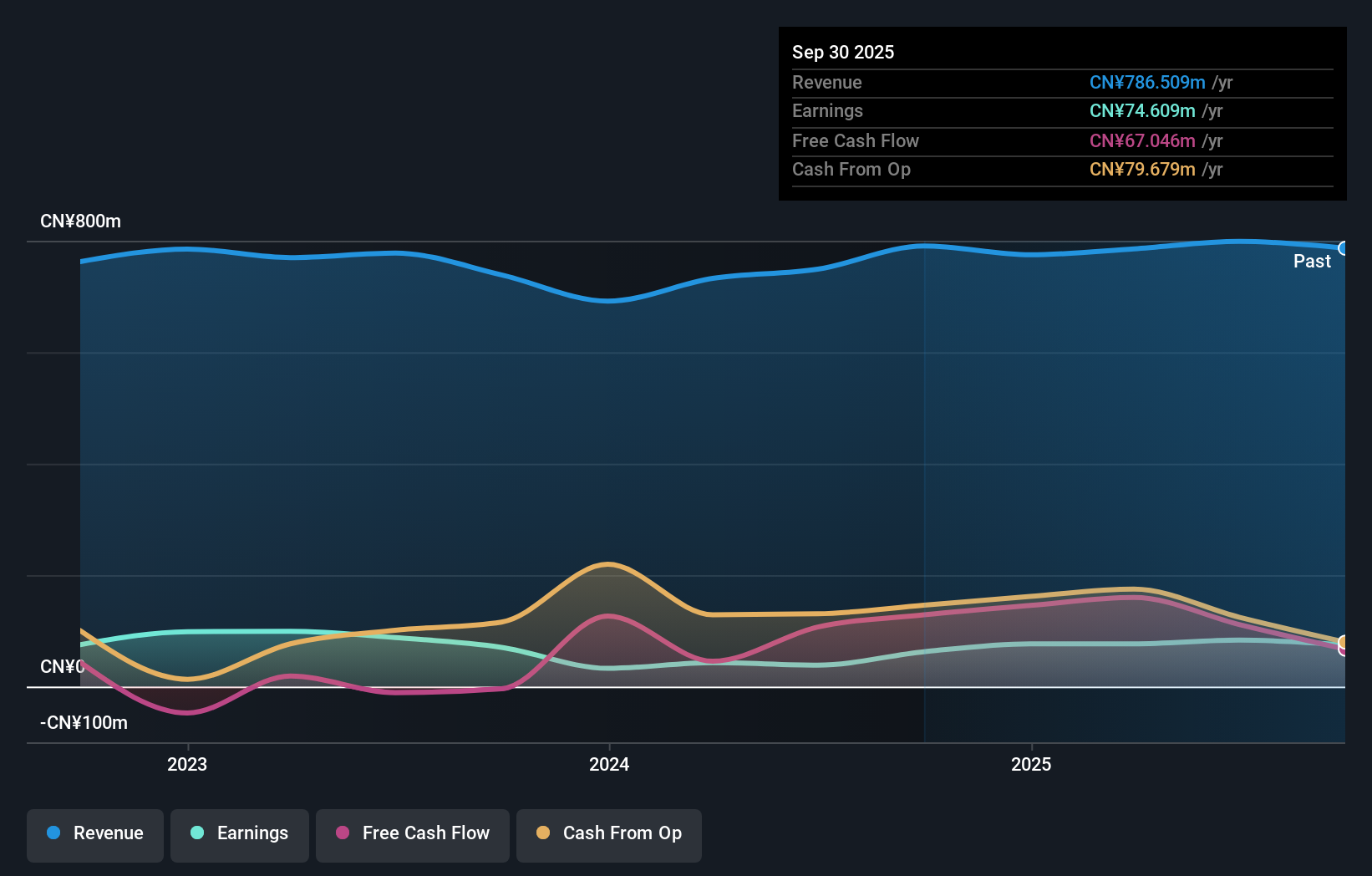

Chongqing Pharscin Pharmaceutical (SZSE:002907)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Pharscin Pharmaceutical Co., Ltd. is a company engaged in the research, development, production, and sale of pharmaceutical products with a market cap of CN¥9.13 billion.

Operations: The company generates revenue primarily from the sale of pharmaceutical products. It focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on maintaining efficient production processes. The net profit margin has shown variability across different reporting periods.

Chongqing Pharscin, a pharmaceutical player in Asia, has shown impressive earnings growth of 79% over the past year, outpacing the industry average. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 21%. Despite this strong performance, its earnings have decreased by an average of 20% annually over the past five years. Recent financials reveal net income at CN¥40 million for Q1 2025, unchanged from last year. Additionally, a one-off gain of CN¥22.6 million impacted recent results, highlighting potential volatility in earnings quality.

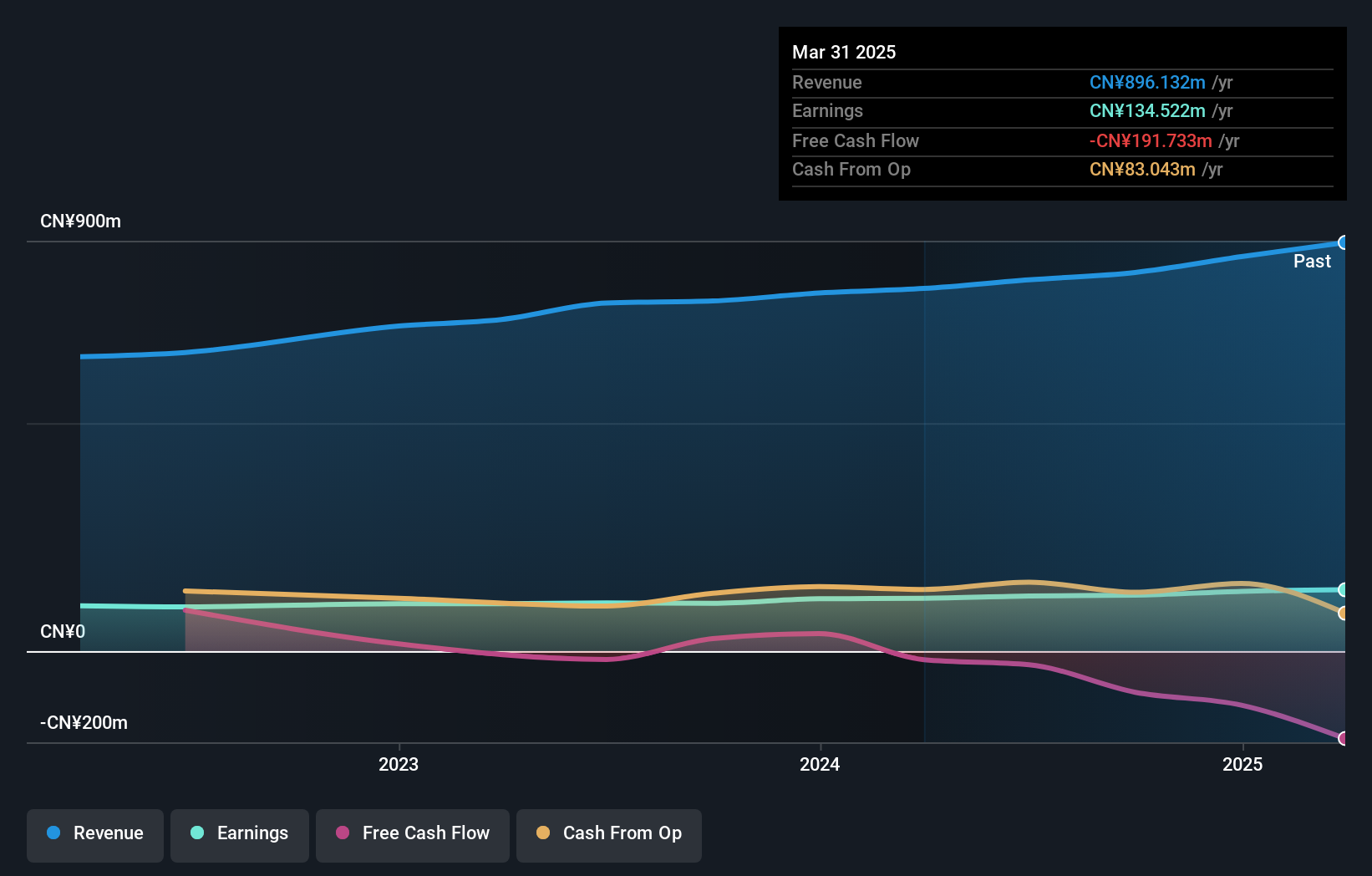

Hengbo HoldingsLtd (SZSE:301225)

Simply Wall St Value Rating: ★★★★★★

Overview: Hengbo Holdings Co., Ltd. focuses on the research, development, production, and sale of internal combustion engine air intake systems for automobiles, motorcycles, and general machinery with a market cap of approximately CN¥8.41 billion.

Operations: Hengbo Holdings Co., Ltd. generates revenue primarily from its Auto Parts & Accessories segment, amounting to approximately CN¥896.13 million.

Hengbo Holdings, a promising player in the auto components sector, has recently demonstrated notable financial resilience. With earnings growth of 16.2% over the past year, it outpaced the industry's 4.3% increase. The company is debt-free now compared to a debt-to-equity ratio of 67.8% five years ago, highlighting significant financial improvement. Despite its volatile share price in recent months, Hengbo reported first-quarter sales of CNY 215.54 million and net income of CNY 33.06 million for 2025, up from last year's figures of CNY 184.52 million and CNY 29.58 million respectively, reflecting steady progress amidst market challenges.

- Click to explore a detailed breakdown of our findings in Hengbo HoldingsLtd's health report.

Assess Hengbo HoldingsLtd's past performance with our detailed historical performance reports.

Next Steps

- Click here to access our complete index of 2599 Asian Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002907

Chongqing Pharscin Pharmaceutical

Chongqing Pharscin Pharmaceutical Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives