- China

- /

- Auto Components

- /

- SHSE:603202

Three Undiscovered Gems In Asia With Promising Potential

Reviewed by Simply Wall St

In recent weeks, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown resilience amidst a mixed performance in major stock markets, highlighting the potential opportunities within this segment. As global trade tensions and economic uncertainties persist, investors may find value in identifying stocks that demonstrate strong fundamentals and adaptability to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 2.62% | 7.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 10.55% | 4.93% | 13.28% | ★★★★★★ |

| Pro-Hawk | 17.03% | -6.66% | -2.75% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Hangzhou Xili Intelligent TechnologyLtd | NA | 9.72% | 7.37% | ★★★★★★ |

| AIC | NA | 25.92% | 57.48% | ★★★★★★ |

| Xinjiang Torch Gas | 1.49% | 16.01% | 12.79% | ★★★★★☆ |

| Dura Tek | 4.98% | 42.18% | 94.37% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 3.78% | 17.22% | -2.01% | ★★★★★☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Heilongjiang Tianyouwei Electronics (SHSE:603202)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heilongjiang Tianyouwei Electronics Co., Ltd. is a company engaged in the electronics industry with a market cap of approximately CN¥11.22 billion.

Operations: The company's revenue streams and cost breakdowns are not explicitly detailed in the provided text. However, it is noted that Heilongjiang Tianyouwei Electronics has a market capitalization of approximately CN¥11.22 billion.

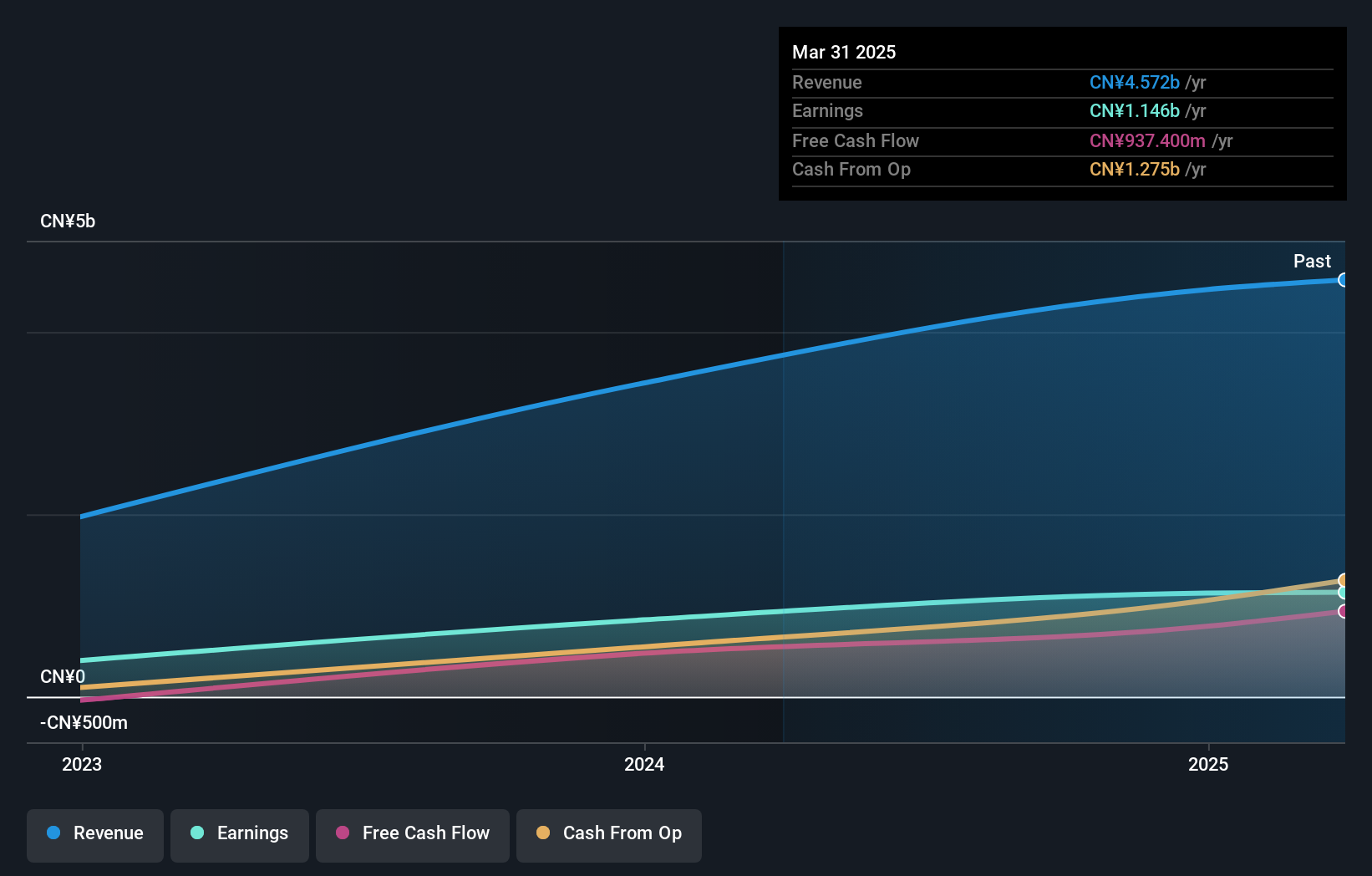

Heilongjiang Tianyouwei Electronics recently completed an IPO, raising CNY 3.74 billion, which signifies strong market interest. The company reported a net income of CNY 1.14 billion for the year ending December 2024, with basic earnings per share at CNY 9.47. Its earnings growth of 35% outpaced the Auto Components industry average of 7.8%, highlighting robust performance in a competitive sector. With shares trading at about 80% below estimated fair value and more cash than total debt, it seems well-positioned financially despite its highly illiquid shares and high non-cash earnings level.

China Leadshine Technology (SZSE:002979)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Leadshine Technology Co., Ltd. specializes in designing, manufacturing, and selling motion control equipment and components in China with a market cap of CN¥13.96 billion.

Operations: Leadshine generates revenue primarily from the sale of motion control equipment and components. The company's net profit margin stands at 18.5%, reflecting its ability to manage costs effectively within its operational framework.

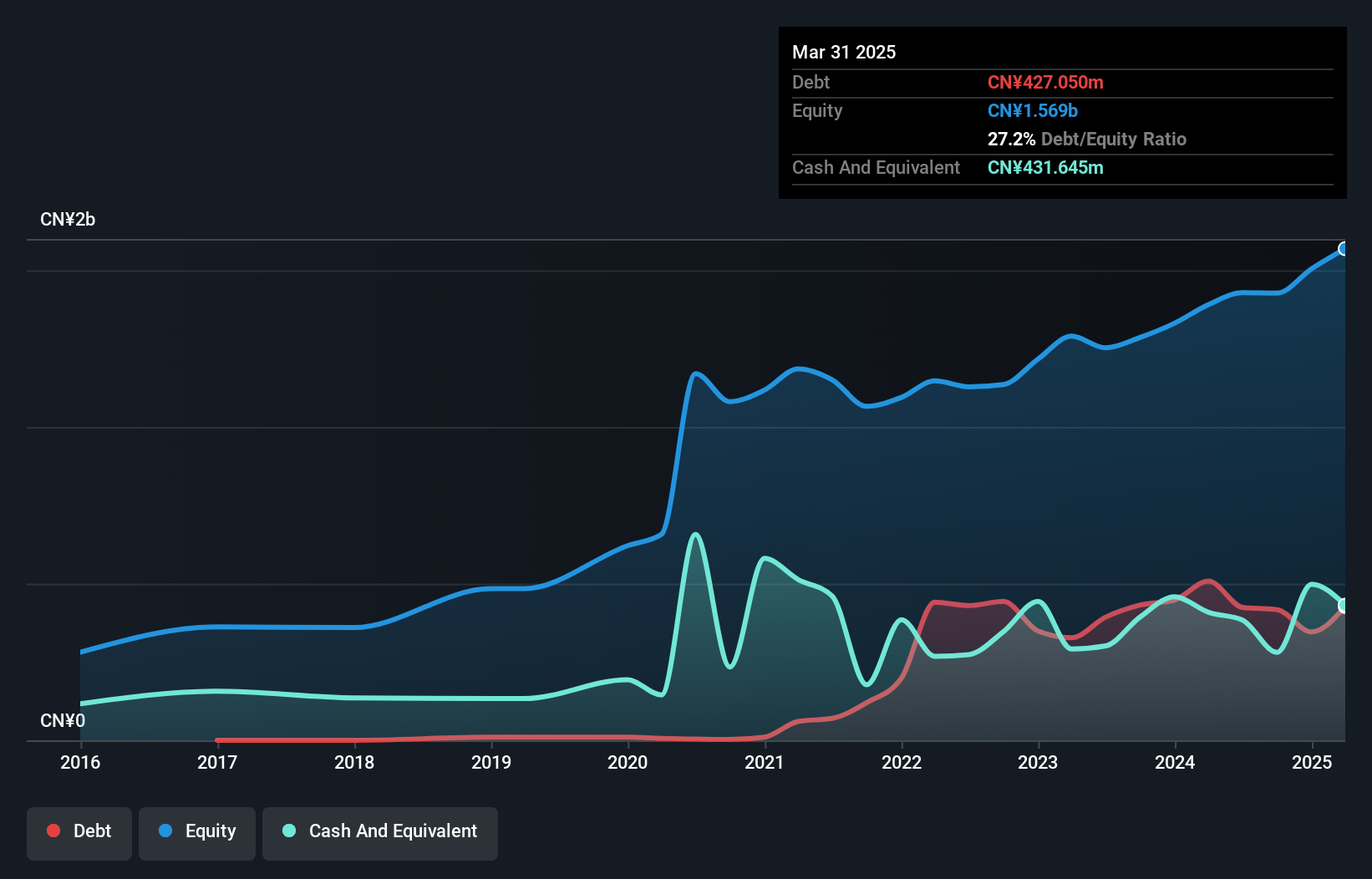

Leadshine Technology, a nimble player in the electronics sector, has seen its earnings surge by 84% over the past year, outpacing the broader industry growth of 7%. Its debt to equity ratio rose from 1.7% to 29.2% over five years, yet remains satisfactory with net debt at just 9.6%. Despite recent share price volatility, Leadshine maintains high-quality earnings and positive free cash flow. The company also completed a buyback of approximately 1.7 million shares for CNY28.8 million under its February buyback program, reflecting confidence in its market position and future prospects.

- Take a closer look at China Leadshine Technology's potential here in our health report.

Learn about China Leadshine Technology's historical performance.

Hengbo HoldingsLtd (SZSE:301225)

Simply Wall St Value Rating: ★★★★★★

Overview: Hengbo Holdings Co., Ltd. specializes in the research, development, production, and sale of internal combustion engine air intake systems for automobiles, motorcycles, and general machinery with a market capitalization of CN¥5.24 billion.

Operations: Hengbo Holdings generates revenue primarily from the sale of air intake systems for internal combustion engines used in automobiles, motorcycles, and general machinery. The company's cost structure includes expenses related to research, development, production, and sales operations. It has a market capitalization of CN¥5.24 billion.

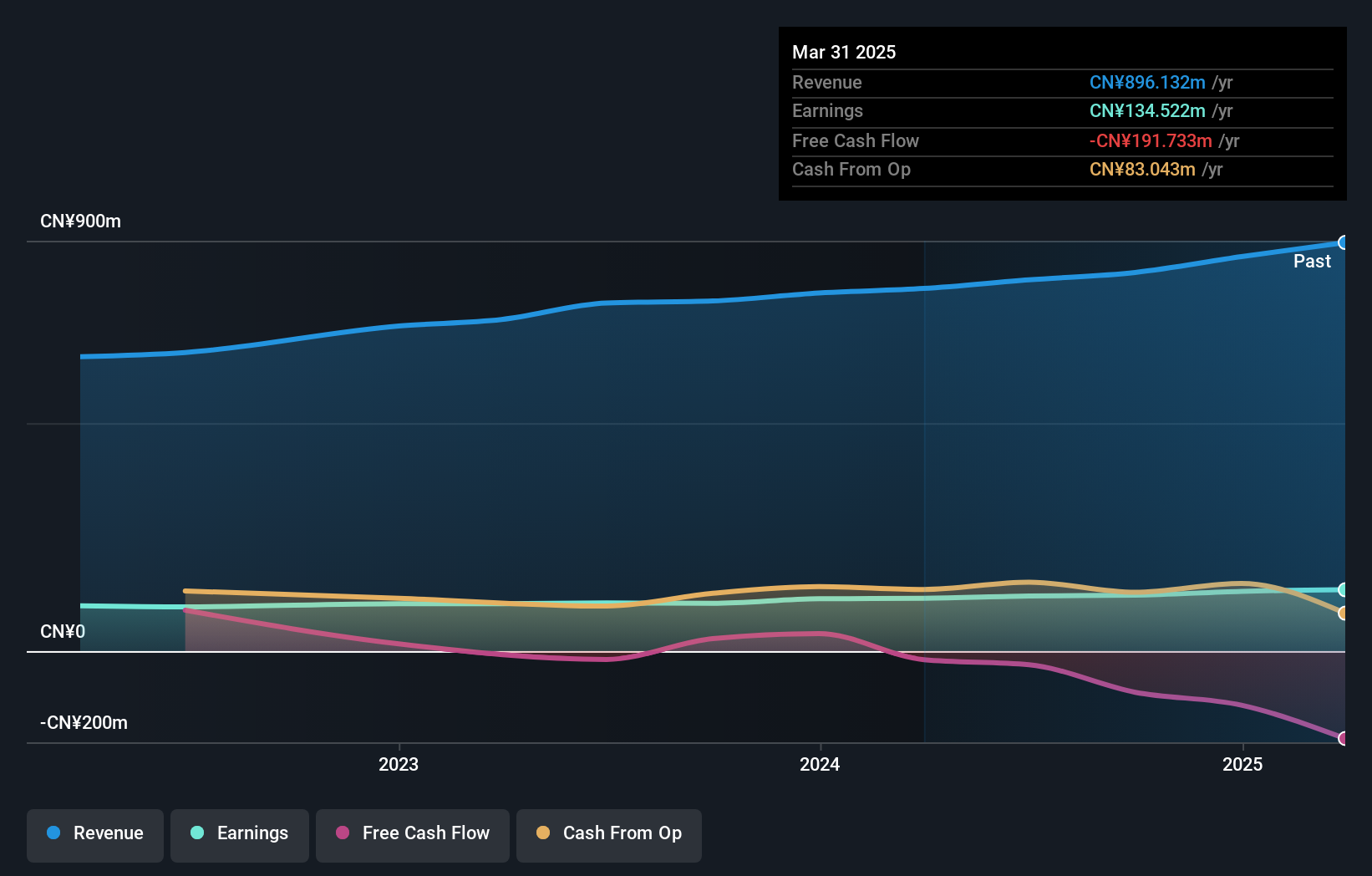

Hengbo Holdings, a smaller player in the Auto Components sector, has shown promising growth with earnings surging 14.2% last year, outpacing the industry average of 7.8%. The company boasts a robust debt profile, having reduced its debt-to-equity ratio from 88.9% to just 0.7% over five years while generating CNY 865 million in sales and CNY 131 million net income for 2024. Although its share price has been volatile recently, Hengbo offers stability through high-quality non-cash earnings and recent dividend increases of CNY 4.20 per ten shares, reflecting confidence in future profitability despite not being free cash flow positive yet.

- Unlock comprehensive insights into our analysis of Hengbo HoldingsLtd stock in this health report.

Explore historical data to track Hengbo HoldingsLtd's performance over time in our Past section.

Taking Advantage

- Explore the 2646 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heilongjiang Tianyouwei Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603202

Heilongjiang Tianyouwei Electronics

Heilongjiang Tianyouwei Electronics Co., Ltd.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives