Market Participants Recognise IAT Automobile Technology Co., Ltd.'s (SZSE:300825) Revenues

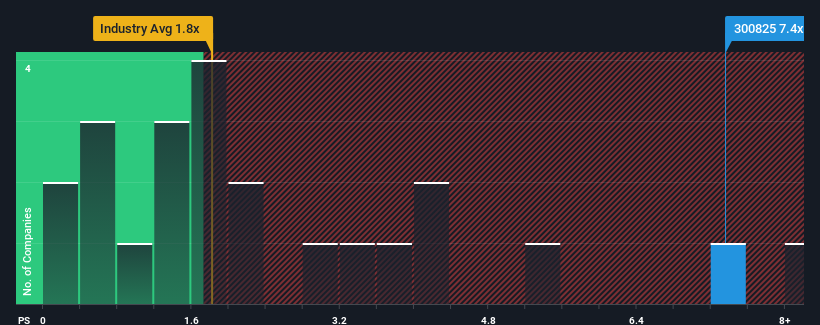

When close to half the companies in the Auto industry in China have price-to-sales ratios (or "P/S") below 1.8x, you may consider IAT Automobile Technology Co., Ltd. (SZSE:300825) as a stock to avoid entirely with its 7.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for IAT Automobile Technology

What Does IAT Automobile Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, IAT Automobile Technology's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IAT Automobile Technology.How Is IAT Automobile Technology's Revenue Growth Trending?

In order to justify its P/S ratio, IAT Automobile Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 26% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 43% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 31%, the company is positioned for a stronger revenue result.

With this information, we can see why IAT Automobile Technology is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does IAT Automobile Technology's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of IAT Automobile Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - IAT Automobile Technology has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300825

IAT Automobile Technology

Engages in design, manufacture, development, and research of automobiles, auto-parts, and development of new energy vehicles in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives