- China

- /

- Auto Components

- /

- SZSE:300694

Why Investors Shouldn't Be Surprised By Wuxi Lihu Corporation Limited.'s (SZSE:300694) 33% Share Price Surge

Wuxi Lihu Corporation Limited. (SZSE:300694) shares have continued their recent momentum with a 33% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.3% over the last year.

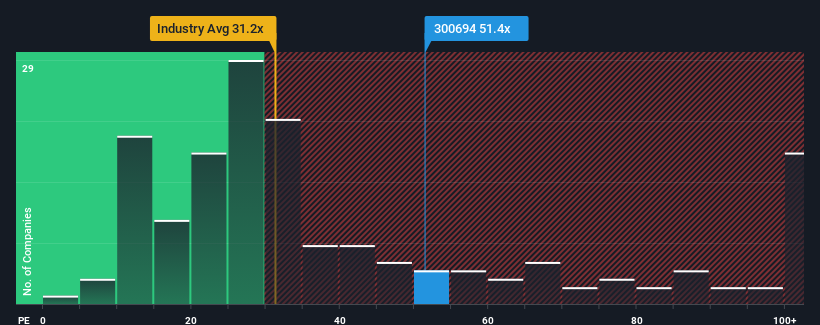

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 36x, you may consider Wuxi Lihu as a stock to potentially avoid with its 51.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

As an illustration, earnings have deteriorated at Wuxi Lihu over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Wuxi Lihu

How Is Wuxi Lihu's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Wuxi Lihu's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Still, the latest three year period has seen an excellent 1,534% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is only predicted to deliver 41% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Wuxi Lihu is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Wuxi Lihu's P/E

Wuxi Lihu's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Wuxi Lihu revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Wuxi Lihu (1 is a bit unpleasant!) that you should be aware of before investing here.

If you're unsure about the strength of Wuxi Lihu's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Lihu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300694

Wuxi Lihu

Engages in the research and development, manufacture, and sale of turbocharger components in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives