- China

- /

- Auto Components

- /

- SZSE:300680

Wuxi Longsheng Technology Co.,Ltd's (SZSE:300680) P/E Is Still On The Mark Following 30% Share Price Bounce

Those holding Wuxi Longsheng Technology Co.,Ltd (SZSE:300680) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

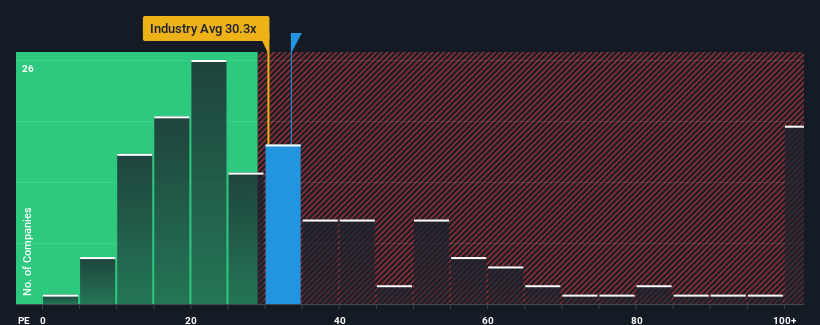

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Wuxi Longsheng TechnologyLtd as a stock to potentially avoid with its 33.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Wuxi Longsheng TechnologyLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Wuxi Longsheng TechnologyLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Wuxi Longsheng TechnologyLtd would need to produce impressive growth in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 135% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 104% as estimated by the three analysts watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Wuxi Longsheng TechnologyLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Wuxi Longsheng TechnologyLtd's P/E?

The large bounce in Wuxi Longsheng TechnologyLtd's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Wuxi Longsheng TechnologyLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Wuxi Longsheng TechnologyLtd (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on Wuxi Longsheng TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the research and development, production, sales, and service of automotive parts products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.