- China

- /

- Auto Components

- /

- SZSE:300680

If EPS Growth Is Important To You, Wuxi Longsheng TechnologyLtd (SZSE:300680) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Wuxi Longsheng TechnologyLtd (SZSE:300680). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Wuxi Longsheng TechnologyLtd with the means to add long-term value to shareholders.

View our latest analysis for Wuxi Longsheng TechnologyLtd

How Fast Is Wuxi Longsheng TechnologyLtd Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Wuxi Longsheng TechnologyLtd's EPS has grown 21% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

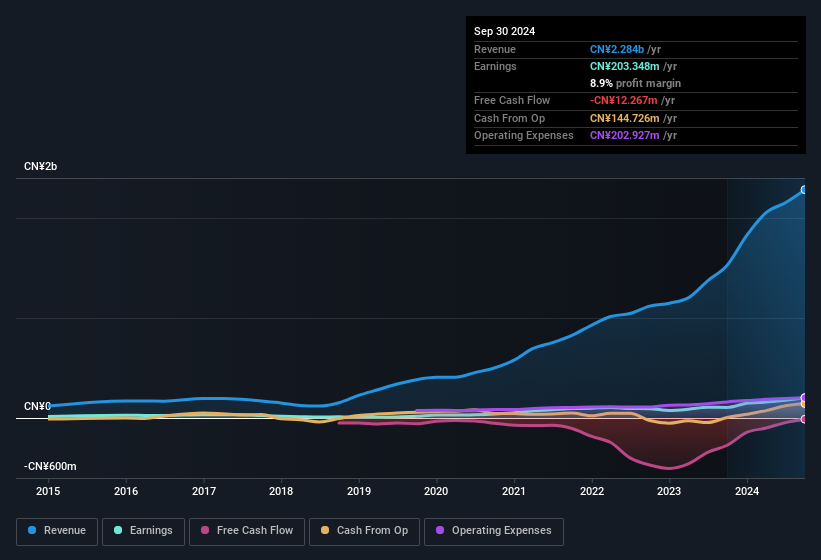

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Wuxi Longsheng TechnologyLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Wuxi Longsheng TechnologyLtd shareholders can take confidence from the fact that EBIT margins are up from 7.1% to 9.7%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Wuxi Longsheng TechnologyLtd's forecast profits?

Are Wuxi Longsheng TechnologyLtd Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Wuxi Longsheng TechnologyLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 35% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. This is an incredible endorsement from them.

Is Wuxi Longsheng TechnologyLtd Worth Keeping An Eye On?

For growth investors, Wuxi Longsheng TechnologyLtd's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Wuxi Longsheng TechnologyLtd's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Wuxi Longsheng TechnologyLtd that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the research and development, production, sales, and service of automotive parts products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.