- China

- /

- Auto Components

- /

- SZSE:300680

Global Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of optimism and caution, with U.S. equity indexes showing modest gains despite weaker-than-expected labor market data fueling speculation about potential interest rate cuts. As investors navigate these uncertain economic conditions, stocks with strong insider ownership can offer a compelling investment opportunity, as high insider confidence often signals alignment between management and shareholder interests in driving growth.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.9% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩12.07 trillion.

Operations: The company's revenue segments include Platform, generating ₩369.99 million, and Segment Adjustment, contributing ₩2.09 billion.

Insider Ownership: 32.6%

HYBE Co., Ltd. demonstrates potential as a growth company with high insider ownership, despite some challenges. Recent earnings reports show strong sales growth to KRW 705.65 billion for Q2 2025, with net income rising to KRW 18.06 million from the previous year. However, profit margins have decreased from last year and return on equity is forecasted to be low in three years' time. Yet, earnings are expected to grow significantly at 46.3% annually, outpacing the Korean market average of 23.4%.

- Delve into the full analysis future growth report here for a deeper understanding of HYBE.

- Our comprehensive valuation report raises the possibility that HYBE is priced higher than what may be justified by its financials.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd specializes in the manufacturing of auto parts in China, with a market cap of CN¥10.81 billion.

Operations: Wuxi Longsheng Technology Co., Ltd generates its revenue primarily from the manufacturing of auto parts in China.

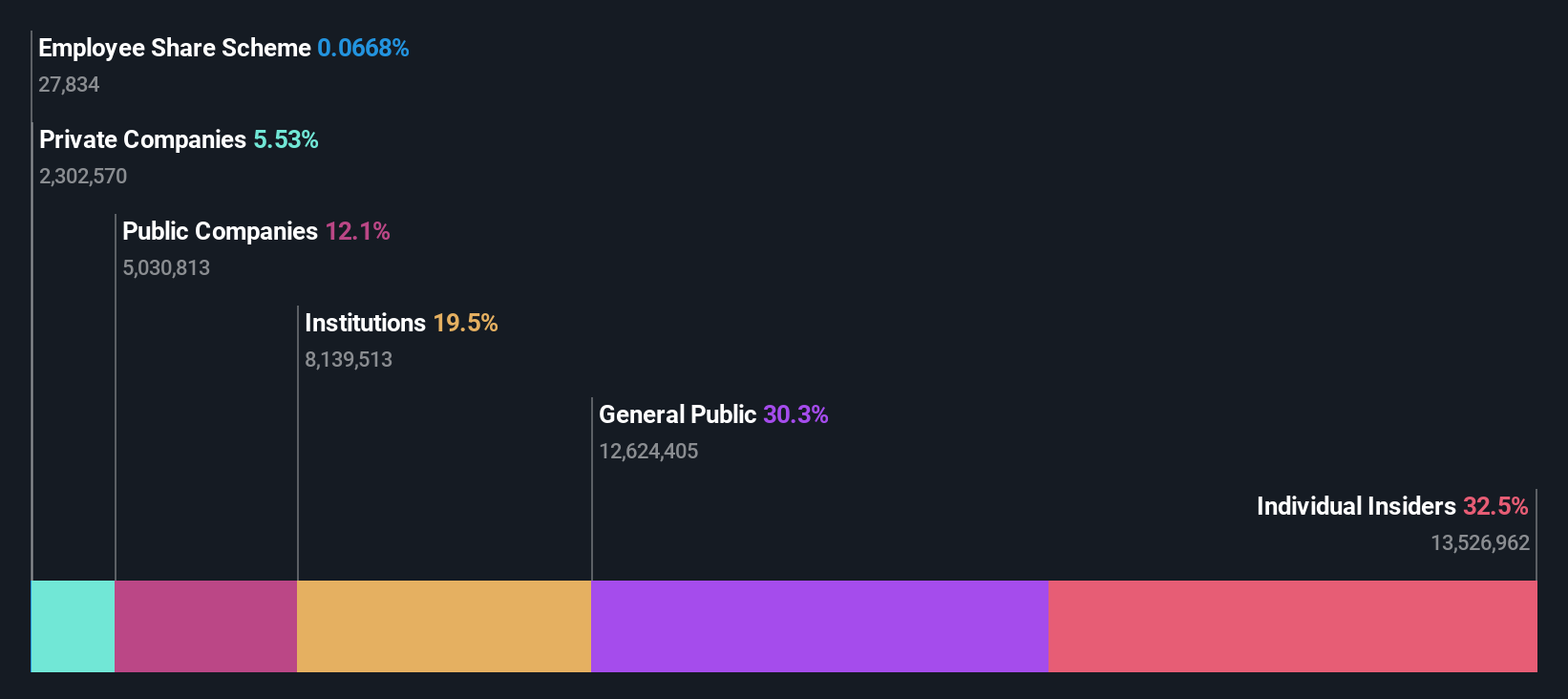

Insider Ownership: 34.9%

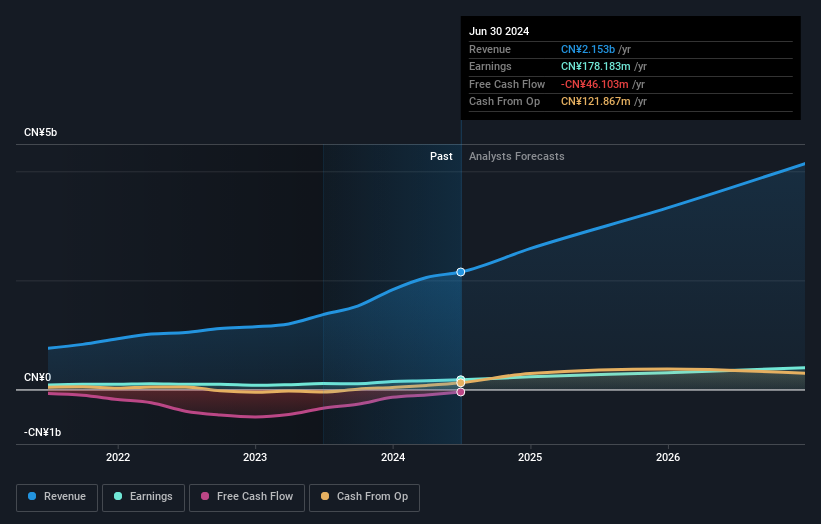

Wuxi Longsheng Technology Ltd. shows potential for growth, with earnings expected to grow significantly at 31.4% annually over the next three years, outpacing the Chinese market average. Revenue is also forecast to rise by 24.8% per year, surpassing market expectations. Recent earnings reveal sales of CNY 1.22 billion for the first half of 2025, a notable increase from last year, though net income growth was modest. The company completed a share buyback program worth CNY 111.12 million in July 2025.

- Dive into the specifics of Wuxi Longsheng TechnologyLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Wuxi Longsheng TechnologyLtd implies its share price may be too high.

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd focuses on the research, development, production, and sale of materials for lithium-ion batteries in China and has a market capitalization of CN¥11.34 billion.

Operations: Shenzhen Dynanonic Co., Ltd generates revenue through its involvement in the research, development, production, and sale of materials used in lithium-ion batteries within China.

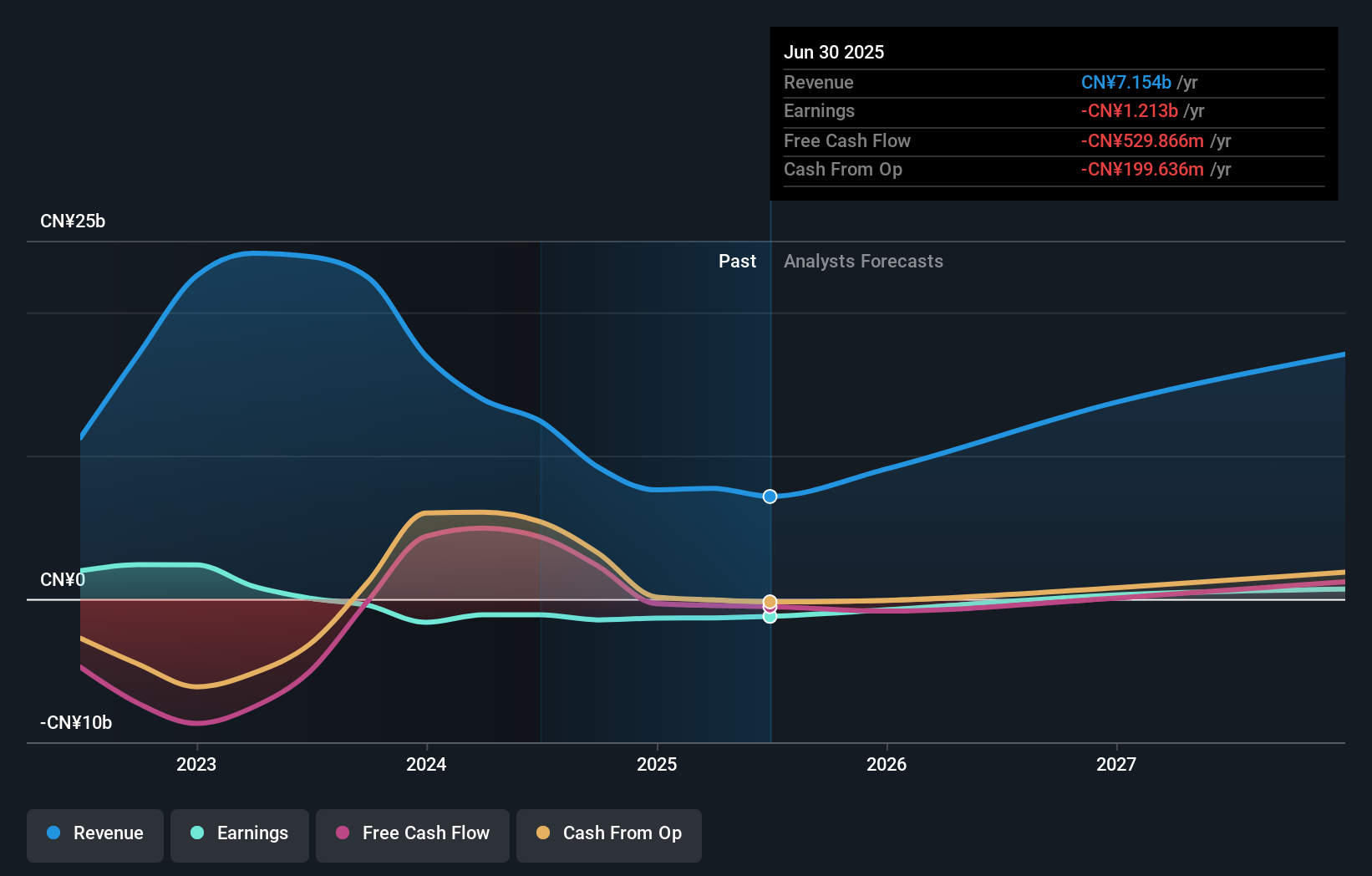

Insider Ownership: 29.3%

Shenzhen Dynanonic faces challenges with a recent net loss of CNY 390.77 million for the first half of 2025, though this is an improvement from the previous year. Despite being removed from major indices, revenue is projected to grow at 35.2% annually, outpacing the market average. The company has taken steps to amend its bylaws and implement an employee stock ownership plan, potentially aligning management interests with shareholders and fostering long-term growth despite current volatility.

- Click here to discover the nuances of Shenzhen Dynanonic with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Shenzhen Dynanonic's current price could be quite moderate.

Taking Advantage

- Click here to access our complete index of 841 Fast Growing Global Companies With High Insider Ownership.

- Ready For A Different Approach? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the manufacturing of auto parts in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives