Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by record highs for major indices, including the S&P 600 for small-cap stocks, global markets have shown resilience despite geopolitical tensions and tariff concerns. With U.S. small-caps joining their larger peers in reaching new heights, investors are increasingly attentive to the potential of lesser-known companies that could thrive amid economic shifts and policy changes. In this context, identifying promising small-cap stocks involves looking at those with strong fundamentals and growth potential that can capitalize on current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Grupo Herdez. de (BMV:HERDEZ *)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grupo Herdez, S.A.B. de C.V. is a food company involved in the manufacture, purchase, distribution, and marketing of canned and packed food products both in Mexico and internationally, with a market cap of MX$16.90 billion.

Operations: The company's revenue streams include exports at MX$3.21 billion, momentum products at MX$5.07 billion, and canned food at MX$29.06 billion. The canned food segment is the largest contributor to revenue among these segments.

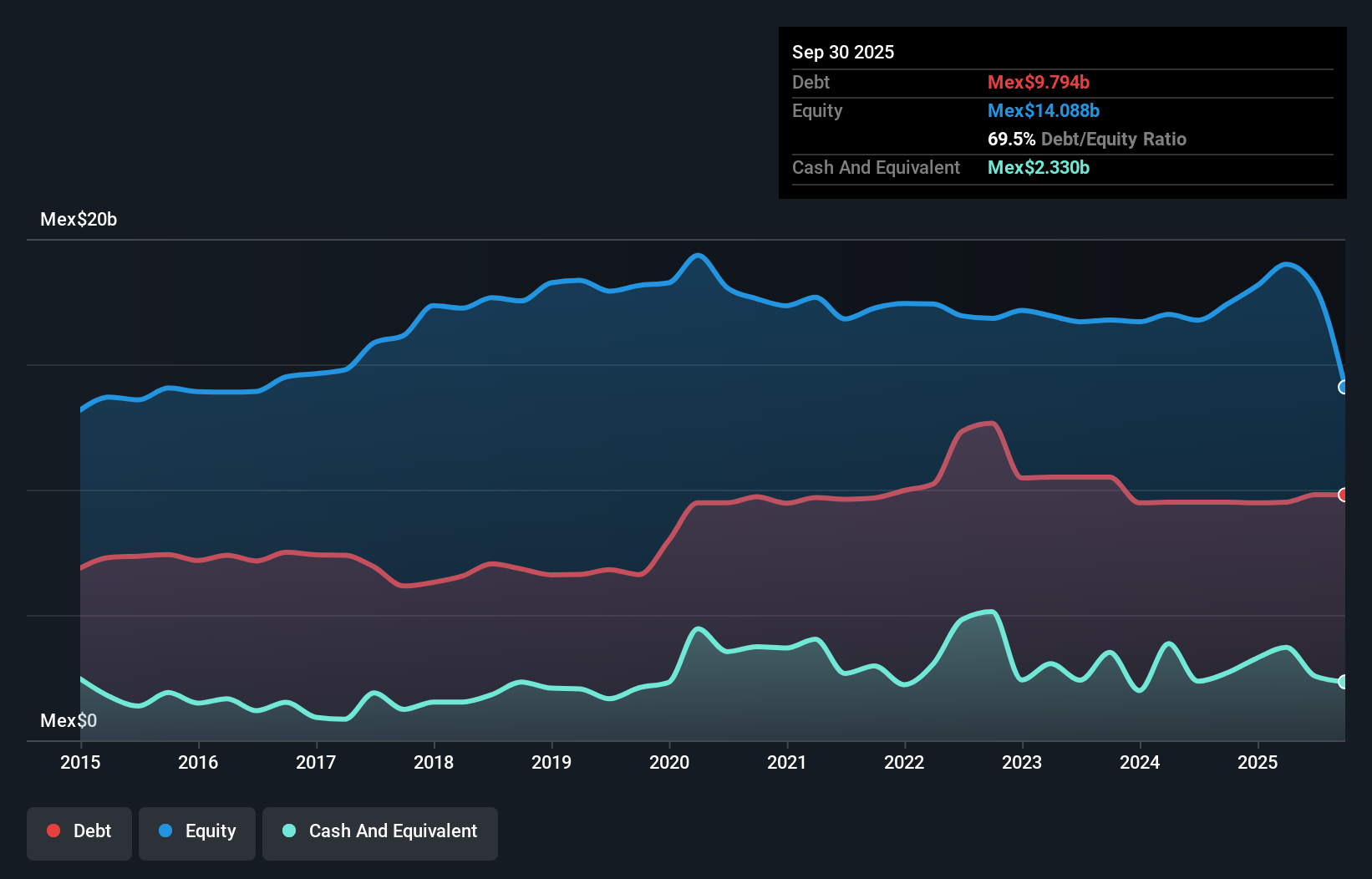

Grupo Herdez has been making strides with its earnings growing by 6% over the past year, surpassing the food industry's growth. Despite an increase in its debt to equity ratio from 36% to 55% over five years, it maintains a satisfactory net debt to equity ratio of 39%. The company's interest payments are well covered by EBIT at 7.8 times coverage. Recent earnings for Q3 show sales at MXN9.35 billion, up from MXN9.02 billion last year, although net income dipped slightly to MXN294 million from MXN336 million. With plans for M&A and a focus on the U.S., future growth seems promising.

- Click to explore a detailed breakdown of our findings in Grupo Herdez. de's health report.

Understand Grupo Herdez. de's track record by examining our Past report.

Shanghai Sinotec (SHSE:603121)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Sinotec Co., Ltd. develops, produces, and sells auto parts in China with a market capitalization of CN¥3.35 billion.

Operations: Shanghai Sinotec generates revenue primarily from the sale of auto parts in China. The company has a market capitalization of CN¥3.35 billion, reflecting its financial stature in the industry.

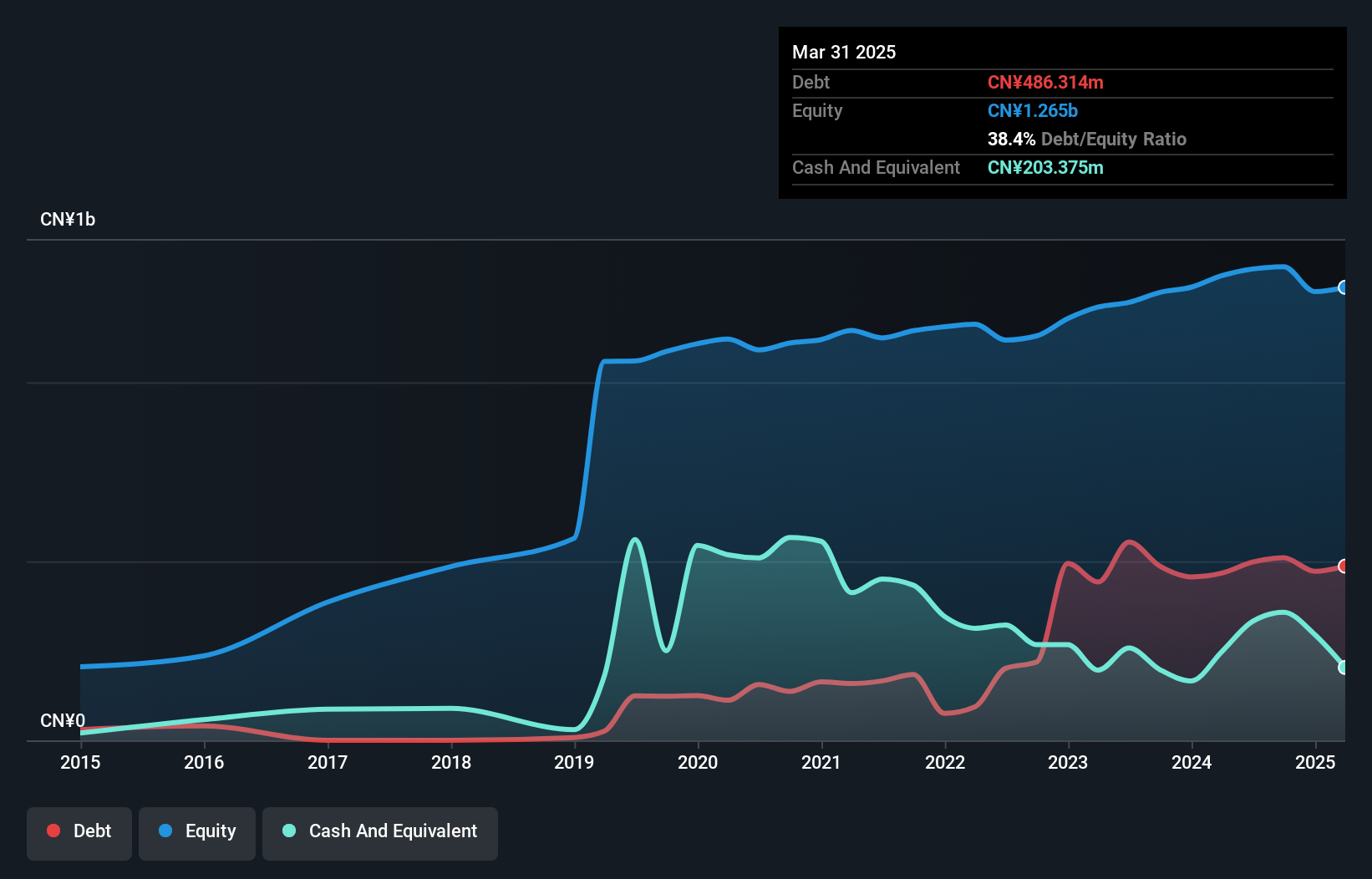

Shanghai Sinotec, a smaller player in the auto components industry, has demonstrated notable earnings growth of 17.4% over the past year, outpacing the industry average of 10.5%. Despite a rise in its debt to equity ratio from 11.4% to 38.5% over five years, its net debt to equity remains satisfactory at 11.5%. The company reported sales of CNY 941.87 million for nine months ending September 2024, with net income decreasing to CNY 71.24 million from CNY 96.53 million a year prior, indicating some financial headwinds despite trading at an attractive valuation below estimated fair value by about one-third.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Chuanhuan Technology Co., Ltd. focuses on the research, development, production, and sale of automotive rubber hose series products in China, with a market capitalization of CN¥4.37 billion.

Operations: The primary revenue stream for Sichuan Chuanhuan Technology Co., Ltd. comes from its Non-Tire Rubber Products segment, generating CN¥1.30 billion. The company's financial performance can be analyzed through its gross profit margin or net profit margin trends over time, though specific percentages are not provided here.

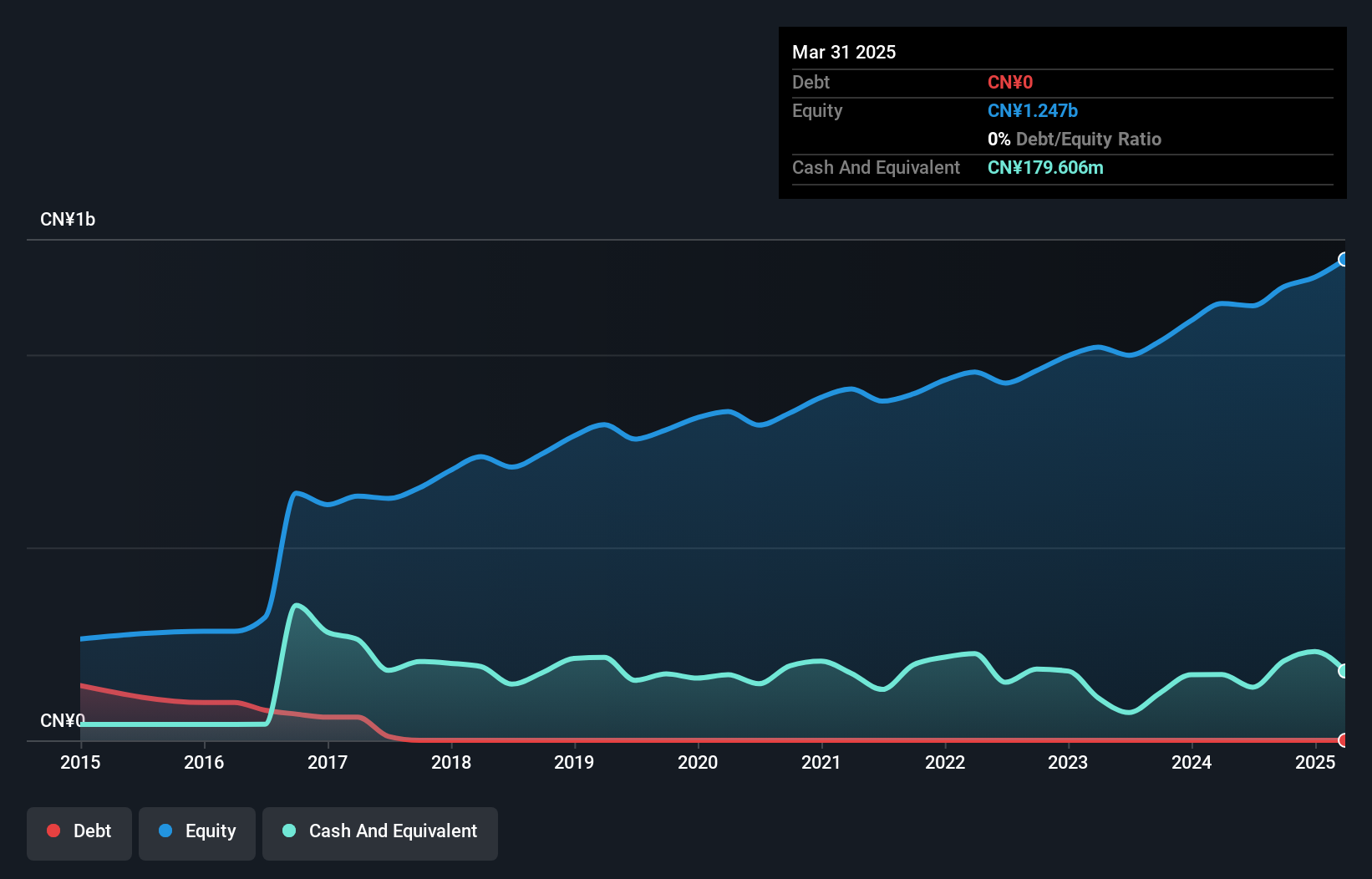

Sichuan Chuanhuan Technology, a nimble player in the auto components sector, showcases robust financial health with no debt on its books over the past five years. The company reported earnings growth of 37.1% last year, outpacing the industry average of 10.5%, reflecting its competitive edge. Its price-to-earnings ratio stands at 21.8x, notably lower than the CN market average of 36.9x, indicating potential undervaluation. Despite recent shareholder dilution and share price volatility over three months, it remains free cash flow positive and profitable with a forecasted earnings growth rate of 21.45% annually, suggesting promising prospects ahead.

Summing It All Up

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4642 more companies for you to explore.Click here to unveil our expertly curated list of 4645 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:HERDEZ *

Grupo Herdez. de

A food company, engages in the manufacture, purchase, distribution, and marketing of canned and packed food products in Mexico and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives