- China

- /

- Auto Components

- /

- SZSE:300547

Three Undiscovered Gems in China with Strong Potential

Reviewed by Simply Wall St

The Chinese market has recently seen mixed signals, with a modest rise in consumer prices countered by ongoing concerns about deflationary pressures and uneven economic growth. Despite these challenges, the potential for small-cap stocks remains promising as investors seek opportunities in underexplored sectors. Identifying a good stock often involves looking for companies with strong fundamentals, innovative business models, and resilience amid broader market volatility. In this article, we will explore three lesser-known Chinese stocks that exhibit these qualities and hold significant promise for future growth.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shanghai Xujiahui Commercial | NA | -34.49% | -34.61% | ★★★★★★ |

| Hefei Lifeon Pharmaceutical | 1.62% | -2.13% | 17.48% | ★★★★★★ |

| Xuelong GroupLtd | NA | -2.44% | -13.80% | ★★★★★★ |

| CHTC Helon | NA | 8.72% | 37.40% | ★★★★★★ |

| Changsha Tongcheng HoldingsLtd | 8.57% | -13.35% | -5.14% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 17.27% | -7.57% | -9.09% | ★★★★★☆ |

| Tianjin Lisheng PharmaceuticalLtd | 1.12% | -7.51% | 12.08% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 27.43% | 9.01% | -4.77% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 28.44% | 9.39% | -1.94% | ★★★★★☆ |

| Huaiji Dengyun Auto-parts (Holding)Ltd | 51.23% | 12.10% | -46.35% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Xinjiang Torch Gas (SHSE:603080)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xinjiang Torch Gas Co., Ltd operates as a gas service company in China with a market cap of CN¥1.96 billion.

Operations: Xinjiang Torch Gas generates revenue primarily from its gas services in China. The company has a market cap of CN¥1.96 billion.

Xinjiang Torch Gas has shown impressive growth, with earnings increasing by 69.8% over the past year, far surpassing the Gas Utilities industry's 13.5%. The company's debt to equity ratio has improved from 16.2% to 4.7% in five years, indicating stronger financial health. Additionally, its Price-To-Earnings ratio of 13.5x is notably lower than the CN market average of 27.4x, suggesting it may be undervalued relative to peers in China’s market.

- Dive into the specifics of Xinjiang Torch Gas here with our thorough health report.

Gain insights into Xinjiang Torch Gas' past trends and performance with our Past report.

Bank of Lanzhou (SZSE:001227)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank of Lanzhou Co., Ltd. provides a range of banking products and services in China and has a market cap of CN¥12.76 billion.

Operations: Bank of Lanzhou generates revenue primarily through its banking products and services in China. The company has a market cap of CN¥12.76 billion.

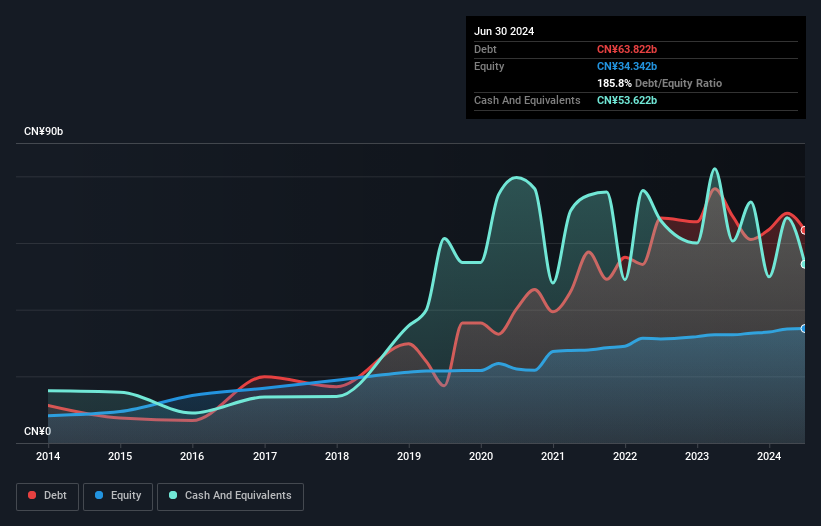

Bank of Lanzhou, with total assets of CN¥462.8B and equity of CN¥34.2B, has a net interest margin of 1.5%. Total deposits stand at CN¥357.1B while loans are at CN¥288.6B. The bank's allowance for bad loans is sufficient at 1.6% of total loans, reflecting its low-risk funding structure where 83% liabilities are customer deposits. Despite earnings declining by 0.8% annually over five years, it trades below estimated fair value by 7%.

- Take a closer look at Bank of Lanzhou's potential here in our health report.

Examine Bank of Lanzhou's past performance report to understand how it has performed in the past.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Chuanhuan Technology Co., Ltd. engages in the research, development, production, and sale of automotive rubber hose series products in China with a market cap of CN¥3.08 billion.

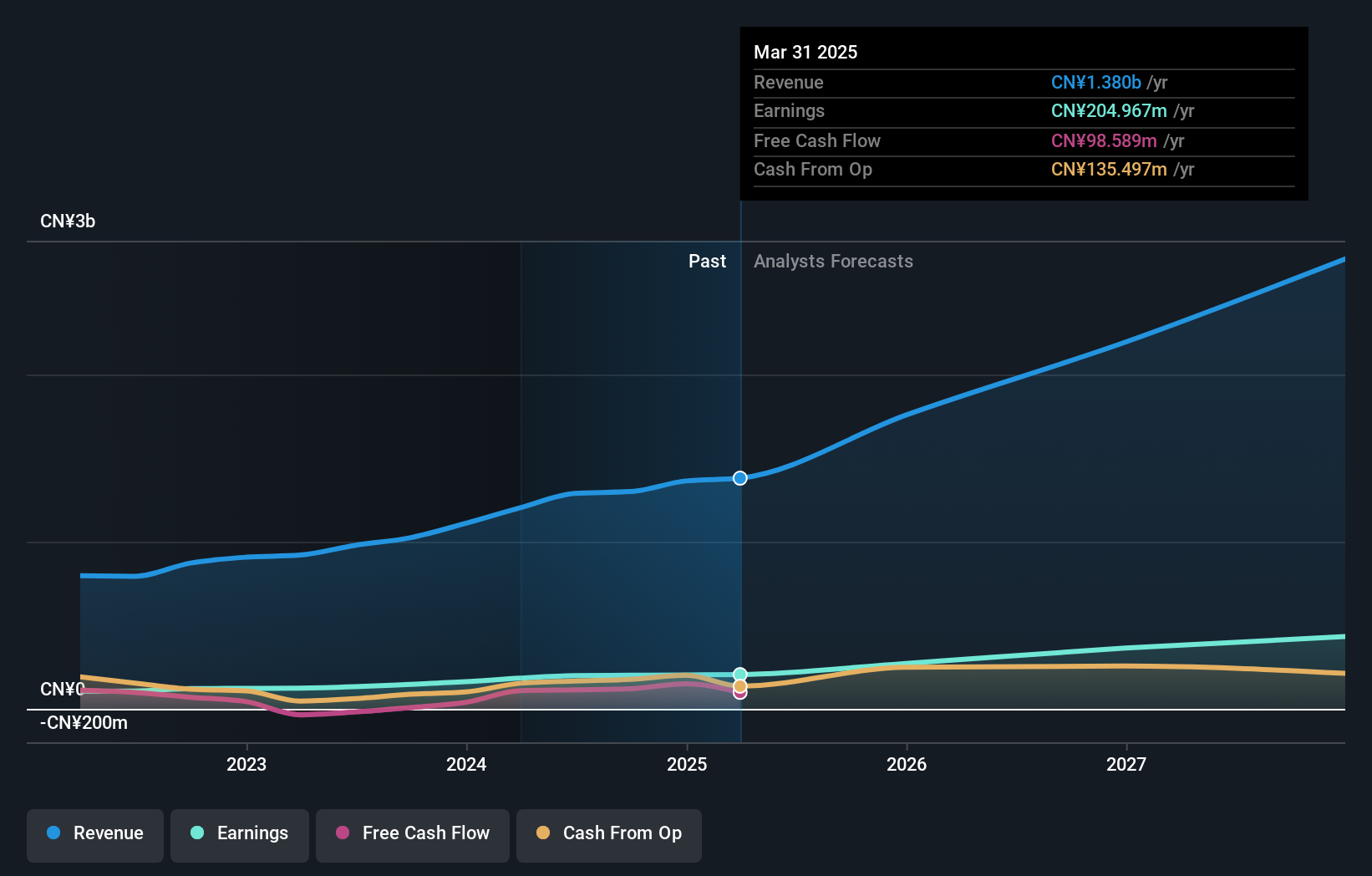

Operations: The company's primary revenue stream is derived from non-tire rubber products, generating CN¥1.20 billion.

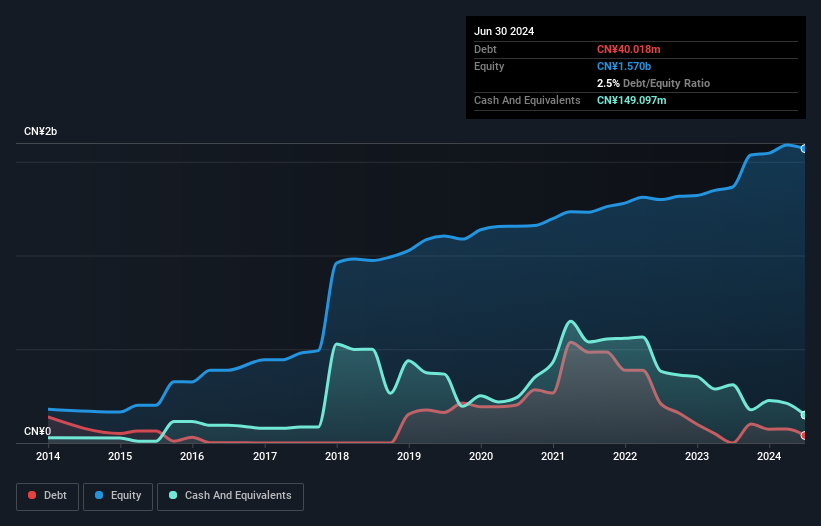

Sichuan Chuanhuan Technology Ltd. has shown remarkable performance, with earnings growing 48.3% over the past year, surpassing the Auto Components industry’s 27.9%. The company trades at a favorable P/E ratio of 16.8x compared to the CN market's 27.4x and is debt-free, reflecting strong financial health and no interest payment concerns. Additionally, it announced a cash dividend of CNY 2.77 per share for its A shares in June 2024, underscoring its profitability and shareholder value focus.

- Click to explore a detailed breakdown of our findings in Sichuan Chuanhuan TechnologyLtd's health report.

Understand Sichuan Chuanhuan TechnologyLtd's track record by examining our Past report.

Where To Now?

- Delve into our full catalog of 1006 Chinese Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300547

Sichuan Chuanhuan TechnologyLtd

Engages in the research, development, production, and sale of automotive rubber hose series products in China.

Exceptional growth potential with flawless balance sheet.