Little Excitement Around Chongqing Jianshe Vehicle System Co., Ltd.'s (SZSE:200054) Revenues As Shares Take 51% Pounding

To the annoyance of some shareholders, Chongqing Jianshe Vehicle System Co., Ltd. (SZSE:200054) shares are down a considerable 51% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

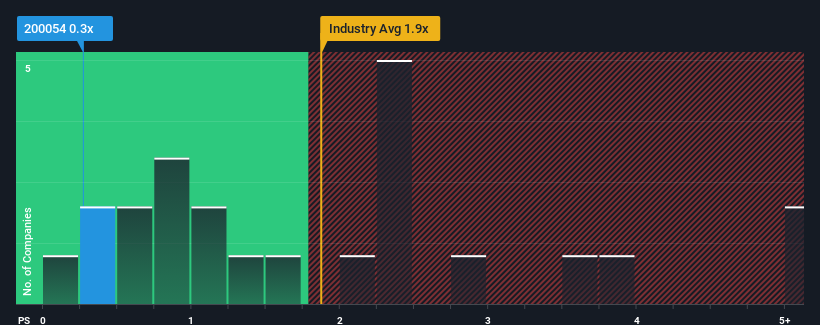

Since its price has dipped substantially, it would be understandable if you think Chongqing Jianshe Vehicle System is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in China's Auto industry have P/S ratios above 1.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Chongqing Jianshe Vehicle System

What Does Chongqing Jianshe Vehicle System's P/S Mean For Shareholders?

Chongqing Jianshe Vehicle System has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chongqing Jianshe Vehicle System will help you shine a light on its historical performance.How Is Chongqing Jianshe Vehicle System's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Chongqing Jianshe Vehicle System's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 40% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 53% shows it's an unpleasant look.

With this in mind, we understand why Chongqing Jianshe Vehicle System's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Chongqing Jianshe Vehicle System's P/S?

The southerly movements of Chongqing Jianshe Vehicle System's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Chongqing Jianshe Vehicle System confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Chongqing Jianshe Vehicle System is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:200054

Chongqing Jianshe Vehicle System

Chongqing Jianshe Vehicle System Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026