- Taiwan

- /

- Semiconductors

- /

- TPEX:7734

Uncovering Streamax Technology And 2 Other Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of rising inflation and interest rate uncertainties, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing their value counterparts. Amid this backdrop, small-cap stocks have been lagging behind larger indices like the S&P 500, presenting potential opportunities for investors seeking undiscovered gems in a volatile market environment. In such conditions, identifying promising small-cap companies that exhibit strong fundamentals and innovative potential can be key to enhancing portfolio diversification and capturing future growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Li Ming Development Construction | 236.64% | 31.54% | 34.00% | ★★★★☆☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

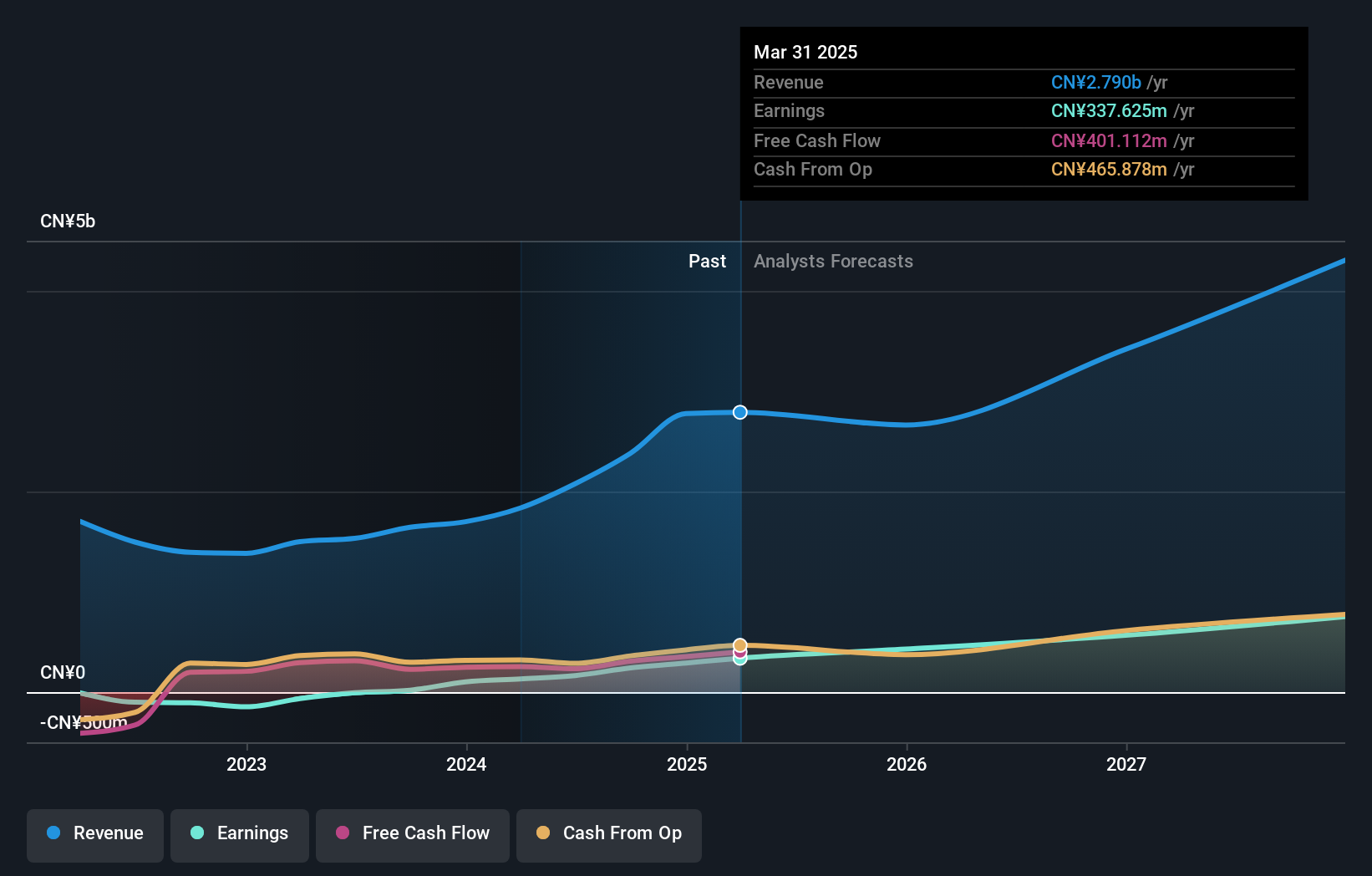

Streamax Technology (SZSE:002970)

Simply Wall St Value Rating: ★★★★★☆

Overview: Streamax Technology Co., Ltd. specializes in the research, development, manufacturing, and sale of AI-powered mobile safety and industrial management solutions for commercial vehicles both in China and internationally, with a market capitalization of CN¥8.84 billion.

Operations: Streamax Technology generates revenue primarily from the sale of AI-powered solutions for commercial vehicles. The company's cost structure includes expenses related to research and development, manufacturing, and sales operations. Its net profit margin is an important metric to consider when evaluating its financial performance.

Streamax Technology is making waves with its impressive earnings growth of 1145.4% over the past year, outpacing the Auto Components industry's 10.5%. The company seems to have a solid financial footing, holding more cash than its total debt and maintaining a reasonable price-to-earnings ratio of 36.8x compared to the CN market's 37.4x. While their debt-to-equity ratio has risen to 12.7% over five years, free cash flow remains positive, indicating robust operational efficiency. With earnings forecasted to grow by 32.91% annually, Streamax appears poised for continued expansion in its sector.

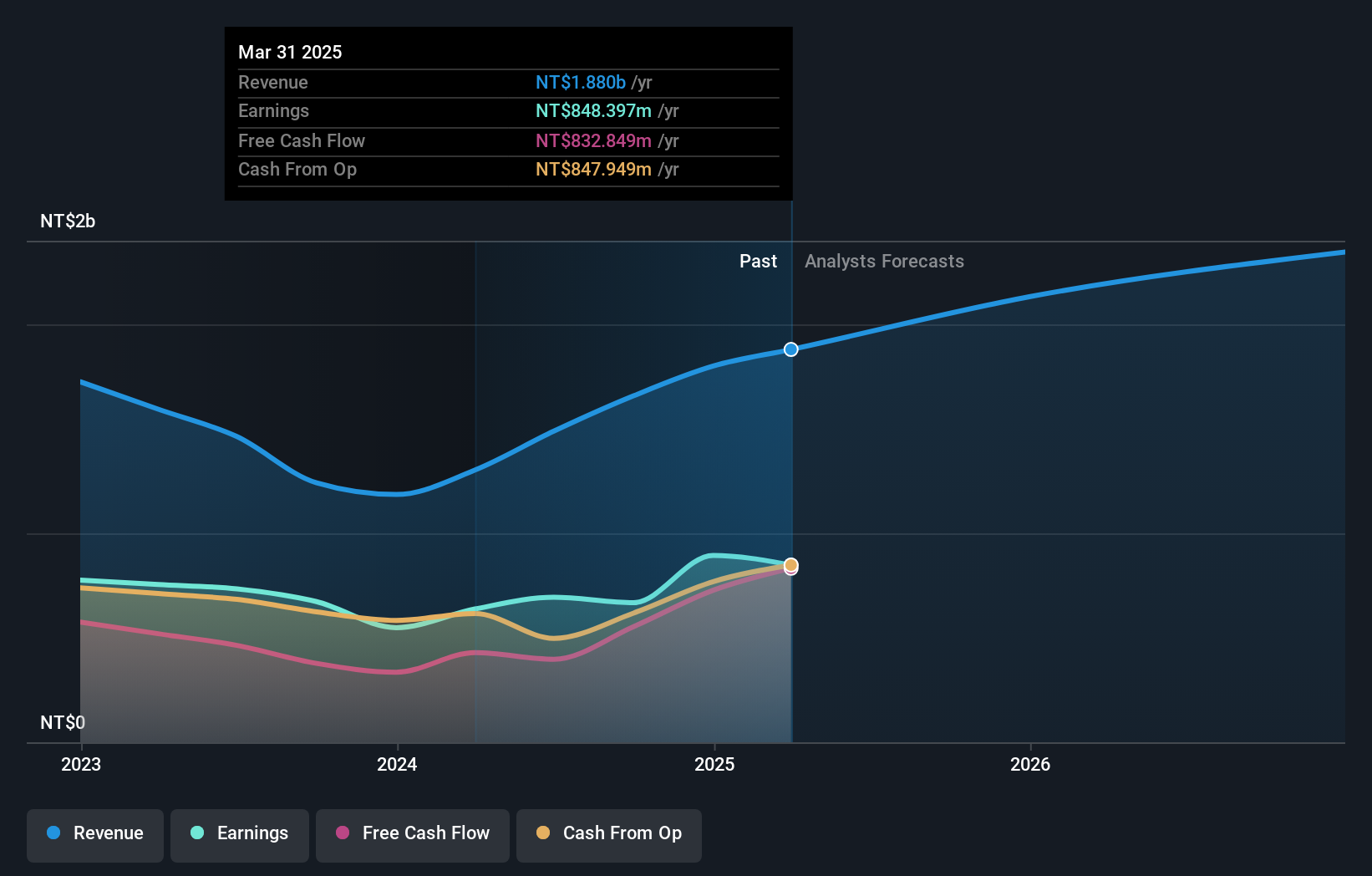

AblePrint Technology (TPEX:7734)

Simply Wall St Value Rating: ★★★★★☆

Overview: AblePrint Technology Co., Ltd. is a process solution provider addressing process issues across various industries in Taiwan and internationally, with a market capitalization of NT$33.54 billion.

Operations: AblePrint generates revenue primarily from Pneumatic and Thermal Process Solutions, contributing NT$1.24 billion, followed by Automation System Solutions at NT$287.92 million. The company's gross profit margin is a notable aspect of its financial performance.

AblePrint Technology, a small cap player in the tech space, showcases a blend of strengths and challenges. Over the past three years, its levered free cash flow has seen an upward trajectory from US$208 million in 2020 to US$553 million by late 2024. Despite this growth, earnings dipped by 0.7% last year against an industry average of 5.9%. The company is profitable with more cash than debt and forecasts suggest a revenue growth rate of 15.16% annually. Recent activity includes a follow-on equity offering worth TWD3.15 billion to bolster its financial position further.

- Get an in-depth perspective on AblePrint Technology's performance by reading our health report here.

Understand AblePrint Technology's track record by examining our Past report.

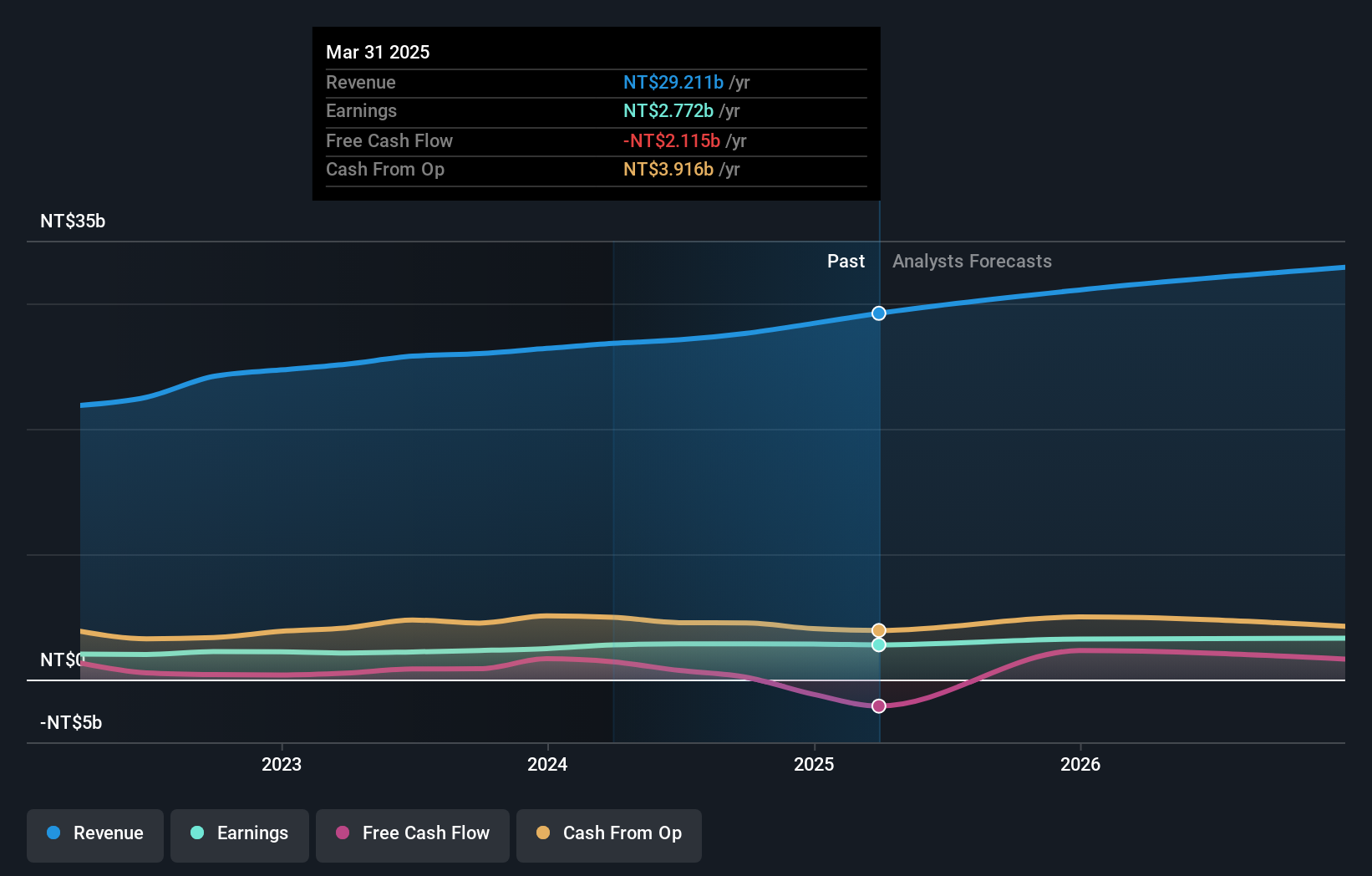

Taiwan Hon Chuan Enterprise (TWSE:9939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Hon Chuan Enterprise Co., Ltd. manufactures and sells various packaging materials for the food and beverage industries in Taiwan, Mainland China, Southeast Asia, and internationally, with a market cap of NT$47.33 billion.

Operations: The company's revenue is primarily derived from overseas markets, contributing NT$17.65 billion, while domestic sales account for NT$10.09 billion.

Taiwan Hon Chuan Enterprise, a niche player in the packaging industry, shows promise with its high-quality earnings and free cash flow positivity. Despite trading at 68.4% below its estimated fair value, it faces challenges such as a high net debt to equity ratio of 77.9%. Over the past five years, earnings have grown annually by 14.7%, though recent growth at 23.3% lags behind the industry's 42.7%. Interest payments are comfortably covered by EBIT at an impressive 18.5x coverage, yet debt remains a concern despite reducing from 115.3% to 108.6% over five years, highlighting financial resilience amidst industry pressures.

Key Takeaways

- Click here to access our complete index of 4711 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:7734

AblePrint Technology

Operates as a process solution provider for reducing process issues for various industries in Taiwan and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives