- China

- /

- Auto Components

- /

- SZSE:002863

Zhejiang Jinfei Kaida WheelLtd's (SZSE:002863) Sluggish Earnings Might Be Just The Beginning Of Its Problems

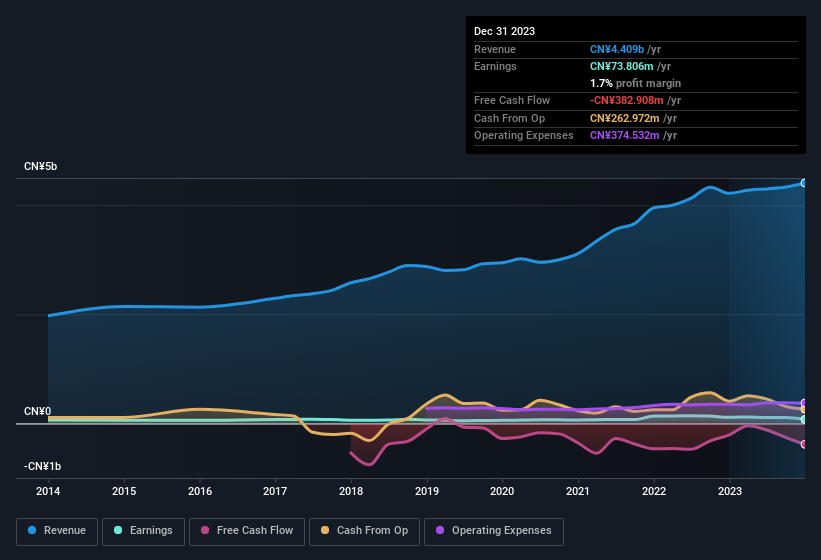

The subdued market reaction suggests that Zhejiang Jinfei Kaida Wheel Co.,Ltd.'s (SZSE:002863) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for Zhejiang Jinfei Kaida WheelLtd

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Zhejiang Jinfei Kaida WheelLtd expanded the number of shares on issue by 20% over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Zhejiang Jinfei Kaida WheelLtd's EPS by clicking here.

A Look At The Impact Of Zhejiang Jinfei Kaida WheelLtd's Dilution On Its Earnings Per Share (EPS)

As you can see above, Zhejiang Jinfei Kaida WheelLtd has been growing its net income over the last few years, with an annualized gain of 14% over three years. In contrast, earnings per share were actually down by 12% per year, in the exact same period. Net income was down 35% over the last twelve months. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 34%. So you can see that the dilution has had a bit of an impact on shareholders.

If Zhejiang Jinfei Kaida WheelLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Zhejiang Jinfei Kaida WheelLtd.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Zhejiang Jinfei Kaida WheelLtd's profit was boosted by unusual items worth CN¥30m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Zhejiang Jinfei Kaida WheelLtd's Profit Performance

To sum it all up, Zhejiang Jinfei Kaida WheelLtd got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue Zhejiang Jinfei Kaida WheelLtd's profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 4 warning signs for Zhejiang Jinfei Kaida WheelLtd you should be mindful of and 1 of them is potentially serious.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jinfei Kaida WheelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002863

Zhejiang Jinfei Kaida WheelLtd

Engages in the research, development, manufacture, and sale of aluminum alloy wheels in China.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.