- China

- /

- Auto Components

- /

- SZSE:002863

Why Investors Shouldn't Be Surprised By Zhejiang Jinfei Kaida Wheel Co.,Ltd.'s (SZSE:002863) Low P/E

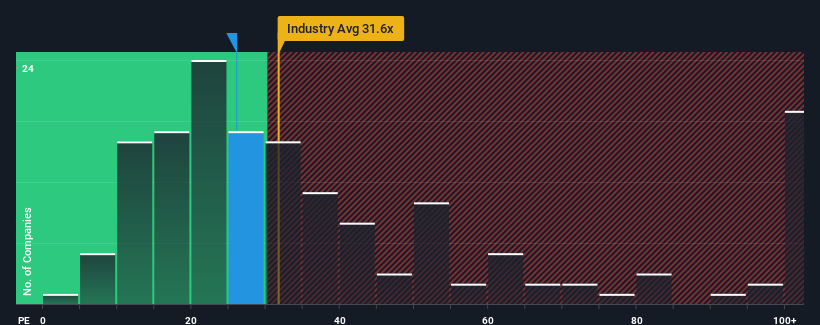

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may consider Zhejiang Jinfei Kaida Wheel Co.,Ltd. (SZSE:002863) as an attractive investment with its 26x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Zhejiang Jinfei Kaida WheelLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Zhejiang Jinfei Kaida WheelLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Zhejiang Jinfei Kaida WheelLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Zhejiang Jinfei Kaida WheelLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhejiang Jinfei Kaida WheelLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Zhejiang Jinfei Kaida WheelLtd (1 shouldn't be ignored!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jinfei Kaida WheelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002863

Zhejiang Jinfei Kaida WheelLtd

Engages in the research, development, manufacture, and sale of aluminum alloy wheels in China.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.