- China

- /

- Auto Components

- /

- SZSE:002662

Beijing WKW Automotive Parts Co.,Ltd. (SZSE:002662) Surges 26% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Beijing WKW Automotive Parts Co.,Ltd. (SZSE:002662) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 6.9% isn't as attractive.

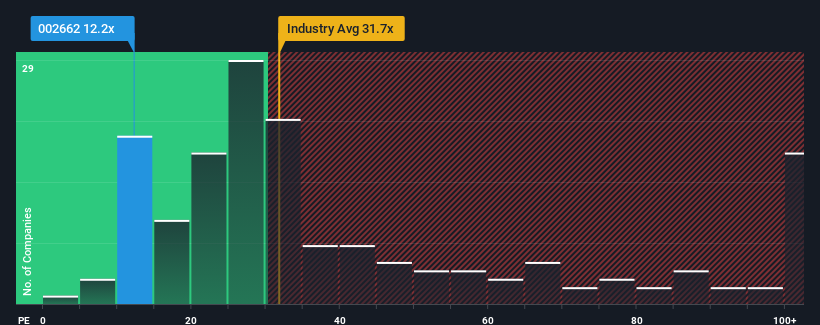

In spite of the firm bounce in price, Beijing WKW Automotive PartsLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.2x, since almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 73x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Beijing WKW Automotive PartsLtd has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Beijing WKW Automotive PartsLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Beijing WKW Automotive PartsLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.9% last year. Pleasingly, EPS has also lifted 119% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Beijing WKW Automotive PartsLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Beijing WKW Automotive PartsLtd's P/E

Shares in Beijing WKW Automotive PartsLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Beijing WKW Automotive PartsLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Beijing WKW Automotive PartsLtd is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Beijing WKW Automotive PartsLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fengjing Automotive Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002662

Beijing Fengjing Automotive Parts

Researches, develops, manufactures, and sells interior and exterior trim systems for passenger cars in China and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives