Global markets have started the year with mixed signals, as U.S. equities faced declines amid inflation concerns and political uncertainties, while European markets showed resilience with gains in major indices. In such a fluctuating market landscape, identifying stocks that combine strong fundamentals with growth potential becomes crucial for investors seeking opportunities. Though the term "penny stock" might seem outdated, it still signifies a segment of smaller or newer companies that can offer substantial returns when backed by solid financials. This article explores several promising penny stocks that stand out due to their robust balance sheets and potential for significant appreciation.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$39.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £5.00 | £478.61M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £744.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.715 | MYR423.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £178.93M | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.54 | THB1.97B | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

Click here to see the full list of 5,712 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Jiangsu Hongdou IndustrialLTD (SHSE:600400)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Hongdou Industrial Co., LTD manufactures and sells clothing products with a market cap of CN¥5.62 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥5.62B

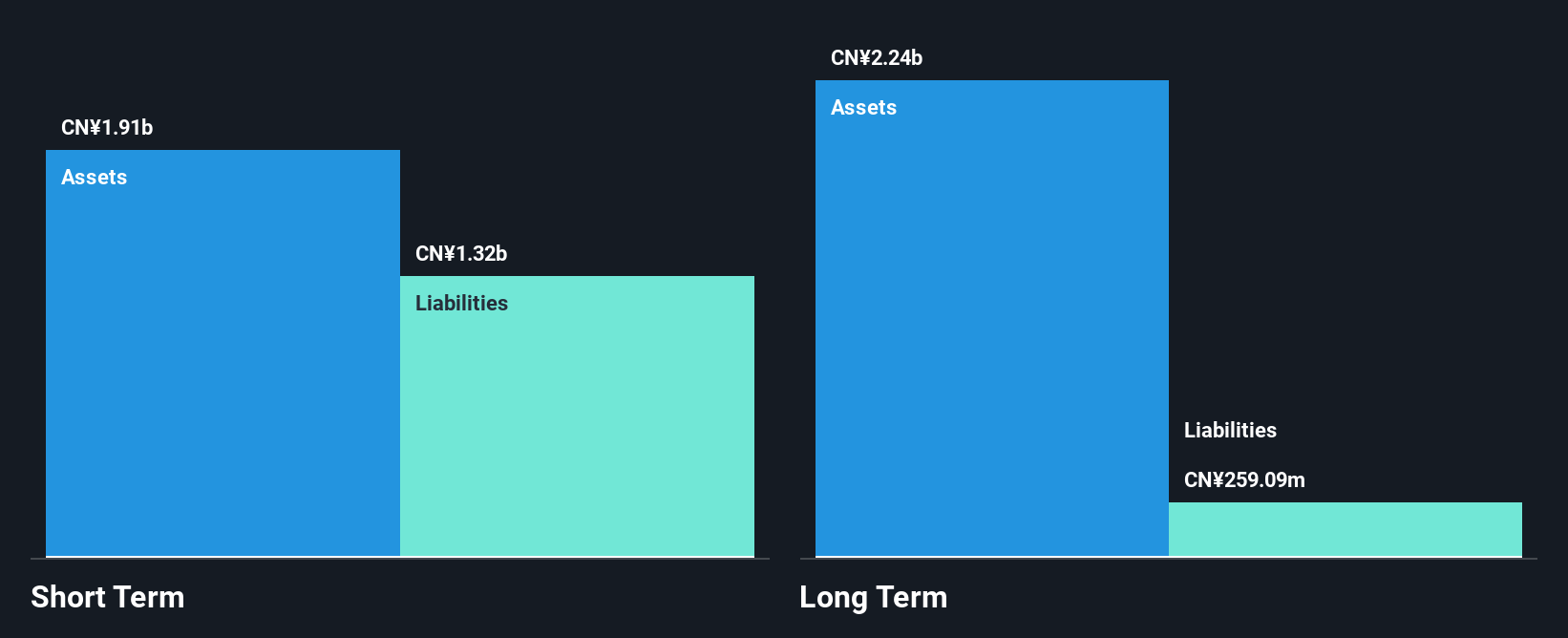

Jiangsu Hongdou Industrial Co., LTD, with a market cap of CN¥5.62 billion, has seen its short-term assets (CN¥2.3 billion) comfortably exceed both its long-term liabilities (CN¥286.2 million) and short-term liabilities (CN¥1.4 billion), indicating strong liquidity management. However, it remains unprofitable with increasing losses over the past five years at a rate of 48.6% per year and declining net income from CN¥39.2 million to CN¥3.29 million year-over-year for the nine months ended September 2024, reflecting operational challenges despite stable weekly volatility and no significant shareholder dilution recently observed through share buybacks.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Hongdou IndustrialLTD.

- Examine Jiangsu Hongdou IndustrialLTD's past performance report to understand how it has performed in prior years.

Harbin VITI Electronics (SHSE:603023)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harbin VITI Electronics Co., Ltd. focuses on the research, development, manufacturing, and sale of automobile electronic products for cars and buses in China with a market cap of approximately CN¥1.57 billion.

Operations: The company's revenue primarily comes from its Computer Communications and Other Electronic Equipment Manufacturing segment, generating CN¥54.23 million.

Market Cap: CN¥1.57B

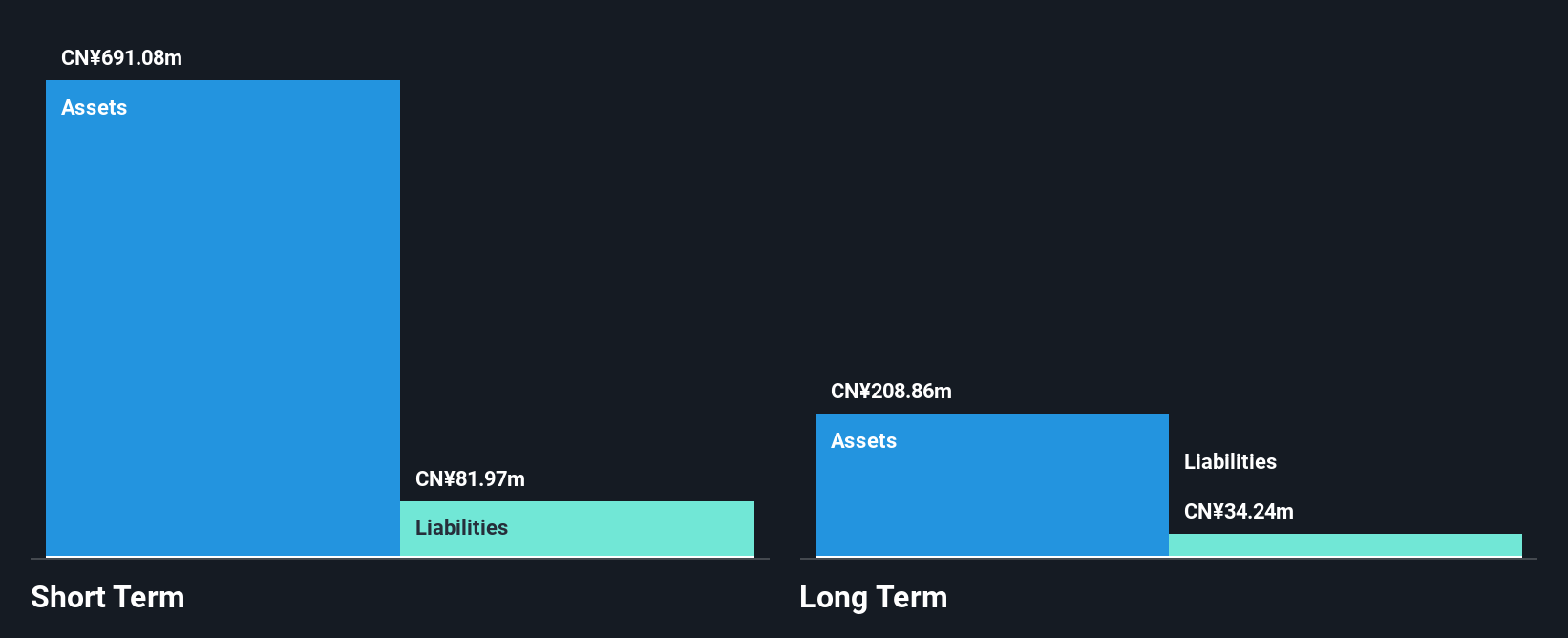

Harbin VITI Electronics Co., Ltd., with a market cap of CN¥1.57 billion, operates without debt, which simplifies financial management. The company reported sales of CN¥46.21 million for the nine months ending September 2024, showing slight growth from the previous year. Despite being unprofitable with a negative return on equity of -1.81%, it has undertaken share buybacks totaling 3,962,400 shares worth CN¥9.99 million as of January 2025, indicating confidence in its valuation and potential future performance while maintaining stable weekly volatility and experienced management and board teams.

- Dive into the specifics of Harbin VITI Electronics here with our thorough balance sheet health report.

- Evaluate Harbin VITI Electronics' historical performance by accessing our past performance report.

Nanning Baling Technology (SZSE:002592)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanning Baling Technology Co., Ltd. focuses on the research, development, production, and sale of automotive parts in Mainland China with a market cap of CN¥1.31 billion.

Operations: Currently, there are no specific revenue segments reported for this company.

Market Cap: CN¥1.31B

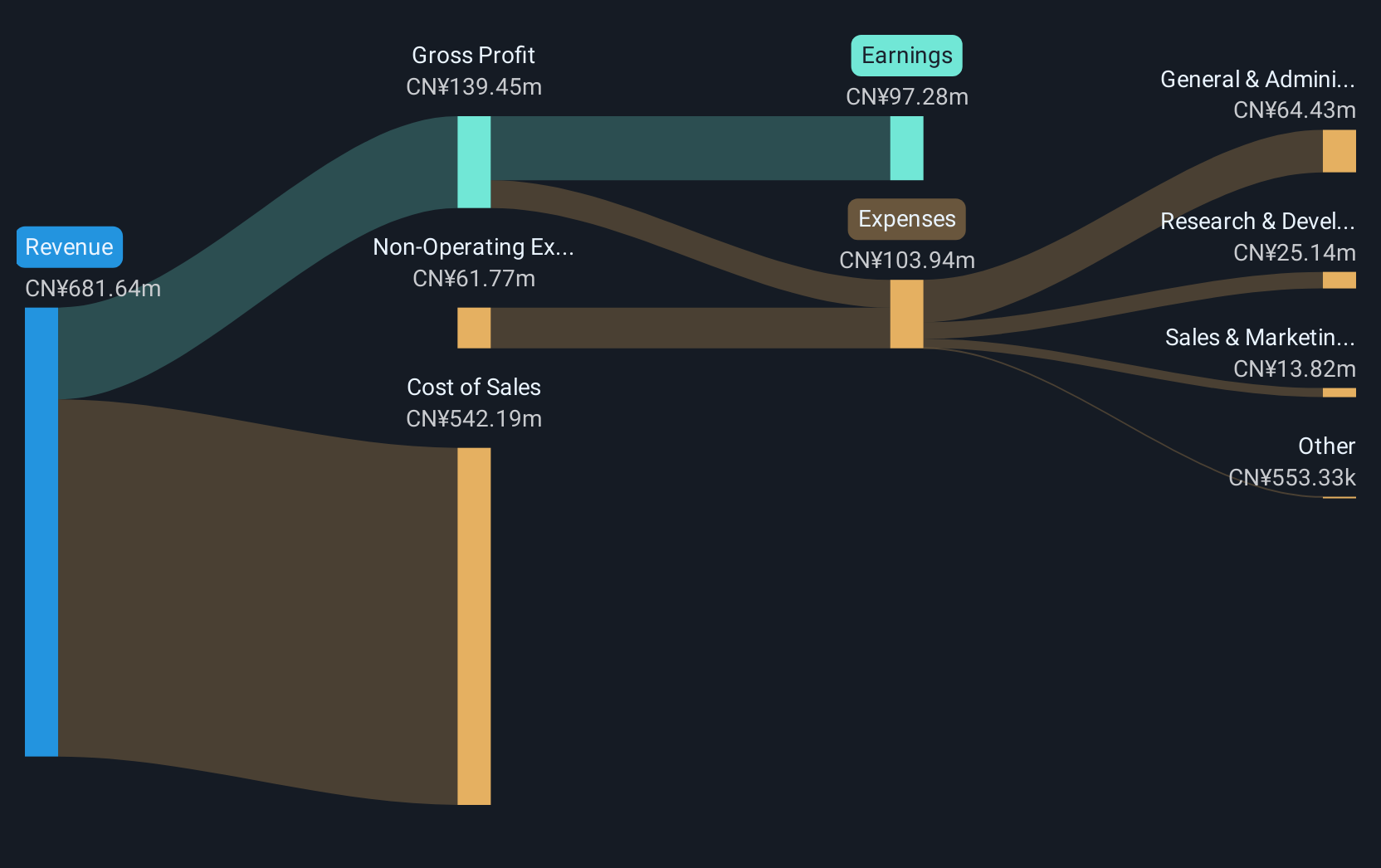

Nanning Baling Technology Co., Ltd., with a market cap of CN¥1.31 billion, operates without debt, providing financial flexibility. For the nine months ending September 2024, it reported sales of CN¥430.12 million but experienced a significant drop in net income to CN¥51.13 million from the previous year’s CN¥132.43 million due to large one-off losses impacting results. The company plans a private placement worth up to CN¥380 million, pending regulatory approvals, which could influence its capital structure and shareholder returns despite current low return on equity and declining profit margins compared to last year.

- Click here to discover the nuances of Nanning Baling Technology with our detailed analytical financial health report.

- Gain insights into Nanning Baling Technology's past trends and performance with our report on the company's historical track record.

Make It Happen

- Jump into our full catalog of 5,712 Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600400

Mediocre balance sheet minimal.

Market Insights

Community Narratives