- China

- /

- Auto Components

- /

- SZSE:002406

Xuchang Yuandong Drive ShaftLtd (SZSE:002406) Has Affirmed Its Dividend Of CN¥0.10

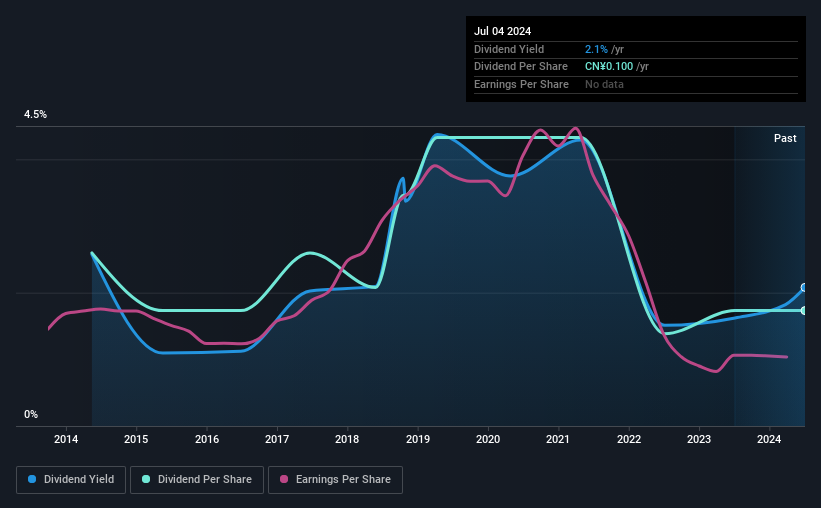

Xuchang Yuandong Drive Shaft Co.Ltd (SZSE:002406) has announced that it will pay a dividend of CN¥0.10 per share on the 9th of July. Based on this payment, the dividend yield will be 2.1%, which is fairly typical for the industry.

See our latest analysis for Xuchang Yuandong Drive ShaftLtd

Xuchang Yuandong Drive ShaftLtd's Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Before making this announcement, Xuchang Yuandong Drive ShaftLtd was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. This is a pretty unsustainable practice, and could be risky if continued for the long term.

If the company can't turn things around, EPS could fall by 23.1% over the next year. However, if the dividend continues along recent trends, we estimate the payout ratio could reach 93%, meaning that most of the company's earnings is being paid out to shareholders.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of CN¥0.15 in 2014 to the most recent total annual payment of CN¥0.10. This works out to be a decline of approximately 4.0% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been sinking by 23% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

An additional note is that the company has been raising capital by issuing stock equal to 17% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 4 warning signs for Xuchang Yuandong Drive ShaftLtd (1 is concerning!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002406

Xuchang Yuandong Drive ShaftLtd

Engages in the research, development, production, and sale of transmission drive shafts and related components in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives