As global markets grapple with fluctuating consumer sentiment and economic uncertainties, Asia's stock markets present intriguing opportunities amid easing trade tensions and evolving market dynamics. In this environment, identifying stocks that exhibit strong fundamentals and resilience to broader market shifts can be particularly rewarding for investors seeking undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiamen Jihong | 17.57% | 6.86% | -18.83% | ★★★★★★ |

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| Gem-Year IndustrialLtd | NA | -3.47% | -34.40% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 7.79% | 10.01% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| Shanghai SK Automation TechnologyLtd | 26.22% | 27.36% | 28.69% | ★★★★★☆ |

| Xuelong GroupLtd | 0.98% | -6.79% | -22.33% | ★★★★★☆ |

| KinjiroLtd | 20.72% | 11.66% | 24.80% | ★★★★★☆ |

| Shenzhen LiantronicsLtd | 218.35% | -12.53% | 83.11% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sino-Platinum MetalsLtd (SHSE:600459)

Simply Wall St Value Rating: ★★★★★★

Overview: Sino-Platinum Metals Co., Ltd operates in the precious metal industrial materials manufacturing industry in China, with a market cap of CN¥13.11 billion.

Operations: Sino-Platinum Metals Co., Ltd generates revenue primarily from the manufacturing of precious metal industrial materials. The company has a market capitalization of CN¥13.11 billion.

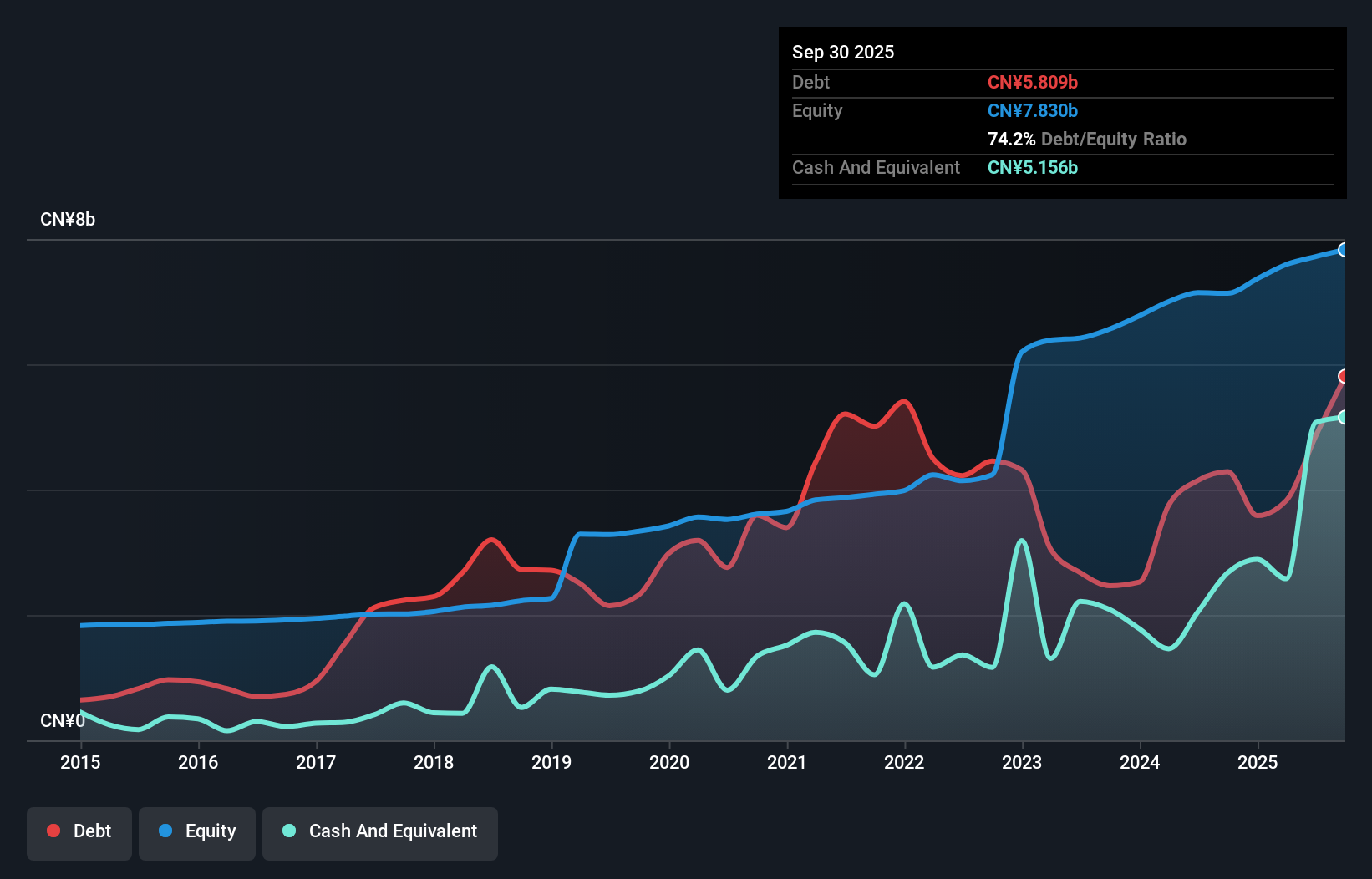

Sino-Platinum Metals Ltd, a relatively smaller player in the metals and mining sector, has shown notable performance with earnings growth of 23.9% over the past year, surpassing the industry average of 8.4%. Trading at a good value compared to peers and industry standards, its net debt to equity ratio stands at a satisfactory 8.3%. The company reported sales of CNY 45.18 billion for nine months ending September 2025, up from CNY 36.97 billion last year. Despite large one-off gains impacting recent results by CN¥201 million, it remains profitable with positive free cash flow trends observed recently.

Shanghai Xinpeng IndustryLtd (SZSE:002328)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Xinpeng Industry Co., Ltd. develops, manufactures, and sells metal electromechanical parts in China and internationally, with a market cap of CN¥5.79 billion.

Operations: Shanghai Xinpeng Industry Ltd. generates revenue primarily from the sale of metal electromechanical parts. The company's cost structure is significantly influenced by raw material expenses and manufacturing costs. Over recent periods, it has experienced fluctuations in its gross profit margin, reflecting variations in production efficiency and pricing strategies.

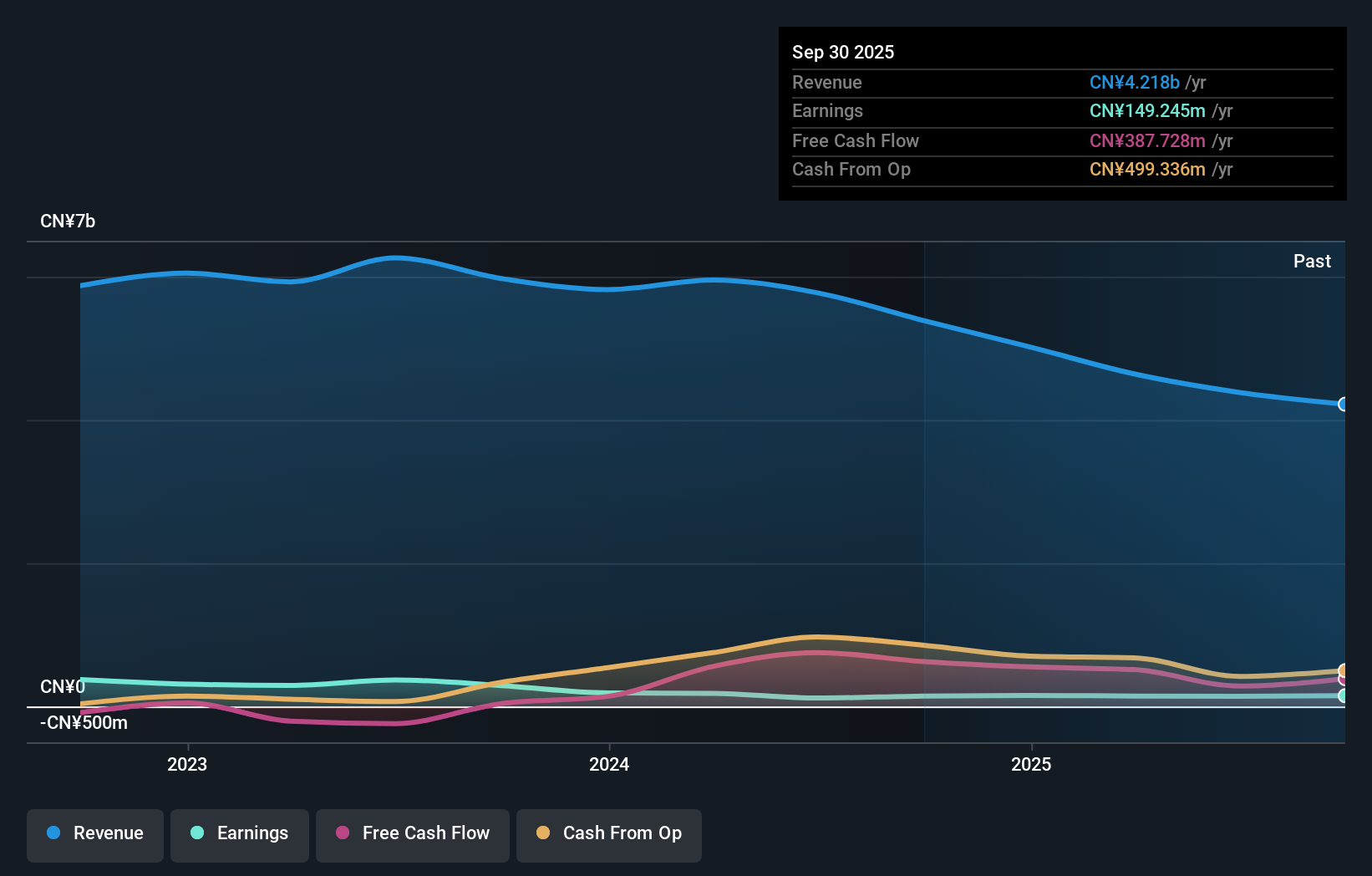

Xinpeng Industry, a smaller player in the auto components sector, has faced some challenges recently. Over the past five years, earnings have decreased by 9.1% annually, yet it manages to maintain high-quality earnings and free cash flow remains positive. The price-to-earnings ratio of 38.8x is attractively below the market average of 45x in China. Despite an increase in debt-to-equity from 2.4% to 9%, its cash position surpasses total debt, indicating financial stability. Recent results show sales at CNY 3 billion for nine months ending September compared to CNY 3.89 billion last year with net income slightly dipping to CNY 141 million from CNY 146 million previously.

- Navigate through the intricacies of Shanghai Xinpeng IndustryLtd with our comprehensive health report here.

Learn about Shanghai Xinpeng IndustryLtd's historical performance.

Longkou Union Chemical (SZSE:301209)

Simply Wall St Value Rating: ★★★★★★

Overview: Longkou Union Chemical Co., Ltd. specializes in the production and sale of organic pigments both domestically and internationally, with a market capitalization of CN¥11.39 billion.

Operations: Longkou Union Chemical generates revenue primarily from the sale of organic pigments in both domestic and international markets. The company has a market capitalization of CN¥11.39 billion.

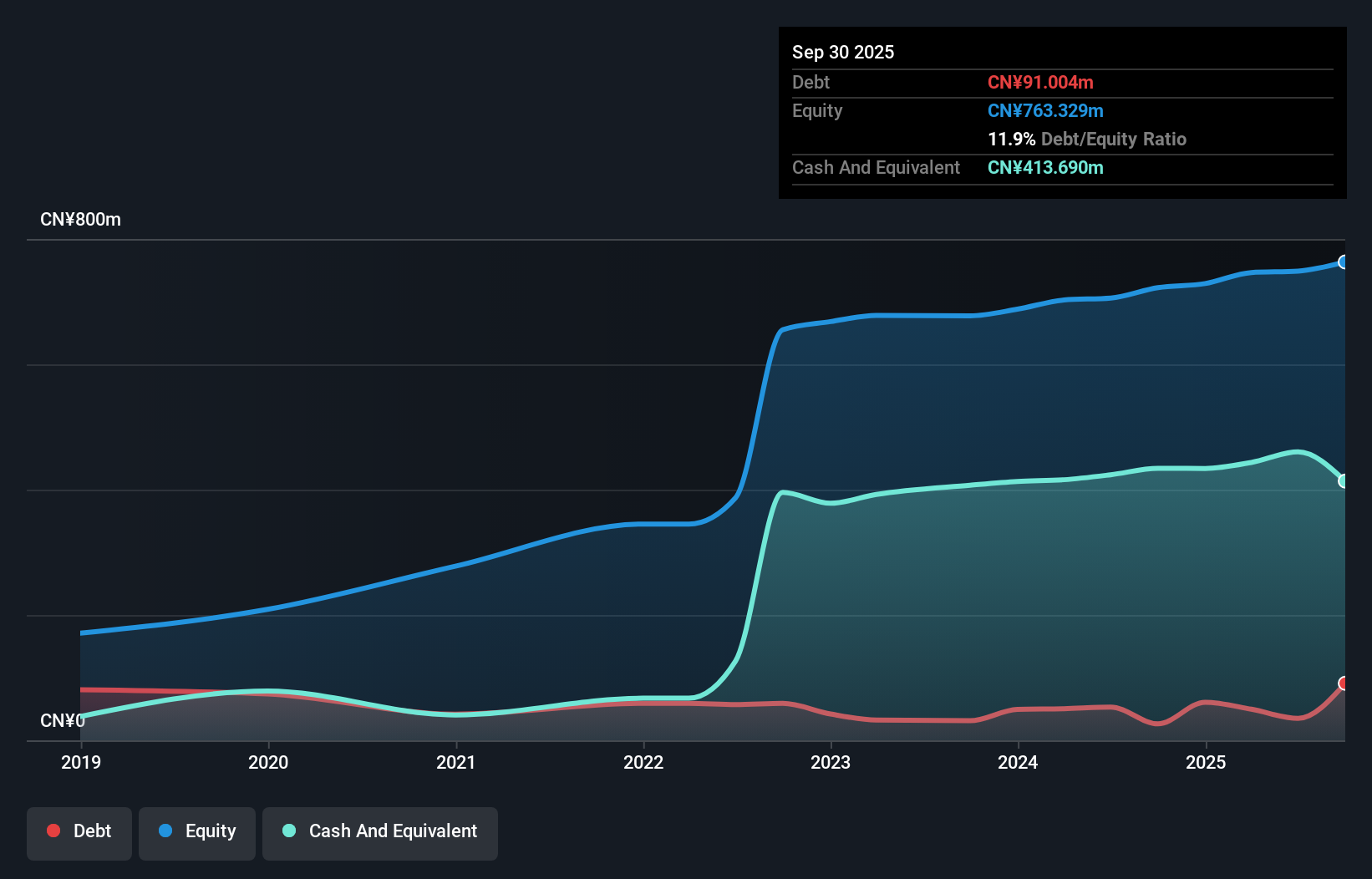

Longkou Union Chemical, a dynamic player in the chemicals sector, has shown resilience despite a volatile share price over the past three months. The company's earnings grew by 11% last year, outpacing the industry average of 6%. Over five years, its debt-to-equity ratio improved from 19% to 12%, reflecting prudent financial management. For the nine months ending September 2025, sales reached CNY 387.59 million with net income climbing to CNY 47.42 million from CNY 44.08 million previously. This growth is complemented by high-quality earnings and positive free cash flow, positioning Longkou Union favorably within its market niche.

Summing It All Up

- Gain an insight into the universe of 2435 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301209

Longkou Union Chemical

Engages in the production and sale of organic pigments in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives