- China

- /

- Auto Components

- /

- SZSE:002284

Discovering None's Hidden Gems Three Small Caps with Solid Potential

Reviewed by Simply Wall St

In a choppy start to the year, global markets have been grappling with inflation concerns and political uncertainty, leading to a notable underperformance of small-cap stocks as the Russell 2000 Index dipped into correction territory. Amidst this backdrop, identifying promising small-cap opportunities involves looking for companies with strong fundamentals and resilience in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Asia-Pacific Mechanical & ElectronicLtd (SZSE:002284)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Asia-Pacific Mechanical & Electronic Co., Ltd is involved in the development, manufacture, and sale of automotive parts across China and various international markets, with a market cap of CN¥5.65 billion.

Operations: Asia-Pacific Mechanical & Electronic generates revenue primarily from the sale of automotive parts, amounting to CN¥4.16 billion. The company's financial performance can be analyzed through its gross profit margin trends over time.

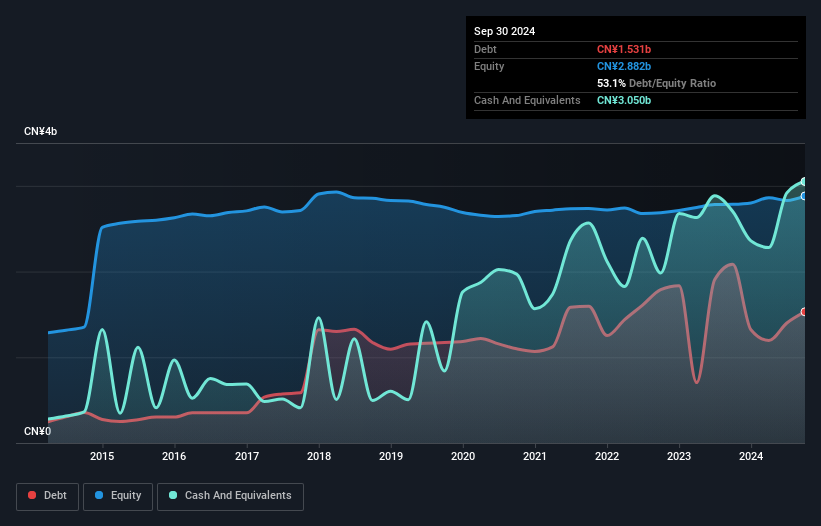

Zhejiang Asia-Pacific Mechanical & Electronic, a nimble player in the auto components sector, has shown impressive earnings growth of 25.8% over the past year, outpacing the industry average of 10.5%. This performance is supported by robust EBIT coverage of interest payments at 17.4 times, indicating strong financial health. Despite an increase in debt to equity from 42.7% to 53.1% over five years, the company remains well-positioned with more cash than total debt and high-quality earnings. Recent results show revenue climbing to CNY 3 billion and net income reaching CNY 157 million for nine months ending September 2024, reflecting solid profitability improvements.

Japan Wool Textile (TSE:3201)

Simply Wall St Value Rating: ★★★★★★

Overview: The Japan Wool Textile Co., Ltd. operates in the textile industry in Japan and has a market cap of ¥92.68 billion.

Operations: The company generates revenue primarily from its textile operations. It has a market cap of ¥92.68 billion, indicating its significant presence in the industry.

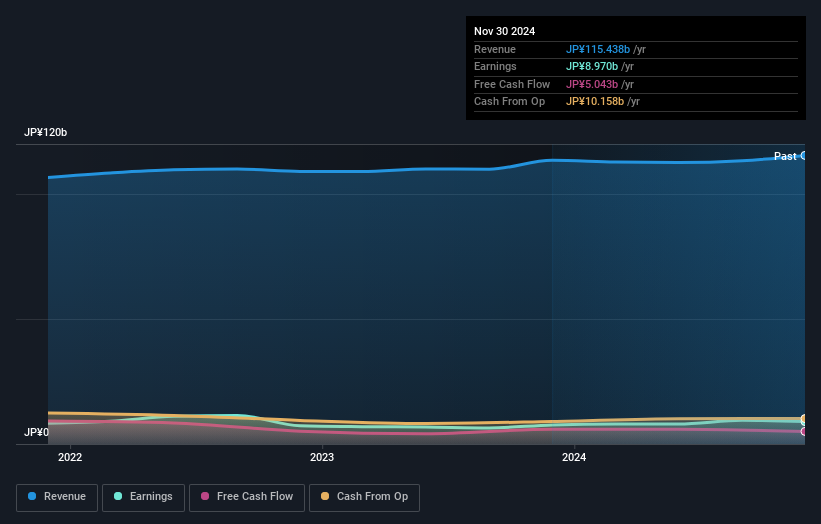

Japan Wool Textile, a niche player in its sector, has shown promising financial health. Over the past five years, its debt to equity ratio improved from 18.7% to 10.6%, indicating better leverage management. The company’s earnings growth of 17% last year surpassed the luxury industry average of 11%, showcasing robust performance. Recent guidance suggests net sales of ¥128 billion and an operating profit of ¥12 billion for fiscal year-end November 2025. Additionally, dividends have increased from ¥19 to ¥24 per share for fiscal year-end November 2024, with expectations set at ¥25 per share for full-year 2025 dividends.

- Click here to discover the nuances of Japan Wool Textile with our detailed analytical health report.

Evaluate Japan Wool Textile's historical performance by accessing our past performance report.

WakitaLTD (TSE:8125)

Simply Wall St Value Rating: ★★★★★★

Overview: Wakita & Co., LTD. operates in the construction equipment, trading, and real estate sectors in Japan with a market cap of ¥87.20 billion.

Operations: Wakita generates revenue through its construction equipment, trading, and real estate segments. The company's net profit margin has shown notable fluctuations over recent periods.

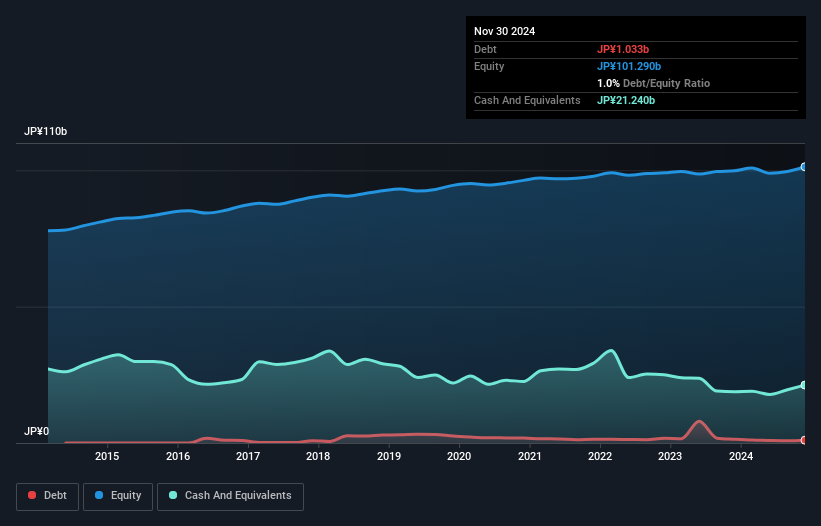

WakitaLTD shines as a potential gem with its debt to equity ratio improving from 2.7% to 1% over five years, signaling prudent financial management. Trading at a significant discount of 54.4% below estimated fair value, it offers an attractive entry point for investors. The company boasts impressive earnings growth of 13%, outpacing the Trade Distributors industry average of 1.6%. With more cash than total debt and interest payments covered by EBIT at a robust multiple of 129.5x, WakitaLTD's financial health seems solid, suggesting resilience and potential for future growth in its sector.

- Unlock comprehensive insights into our analysis of WakitaLTD stock in this health report.

Gain insights into WakitaLTD's historical performance by reviewing our past performance report.

Seize The Opportunity

- Discover the full array of 4618 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Asia-Pacific Mechanical & ElectronicLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002284

Zhejiang Asia-Pacific Mechanical & ElectronicLtd

Engages in the development, production, and sale of automotive parts and components in China and internationally.

Undervalued with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)