- China

- /

- Semiconductors

- /

- SZSE:300111

November 2024 Penny Stocks With Growth Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in U.S. indexes and broad-based gains, investors are keenly observing the implications of geopolitical tensions and economic policies. In this context, penny stocks—though an outdated term—remain relevant as they represent smaller or newer companies that can offer significant growth opportunities. By focusing on those with strong financial health, these stocks can present valuable prospects for investors looking for under-the-radar companies with potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.205 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.59 | £67.89M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.44 | SGD310.8M | ★★★★★☆ |

Click here to see the full list of 5,778 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aotecar New Energy Technology Co., Ltd. specializes in the research, design, manufacture, and sale of automotive AC compressors and HVAC systems, with a market cap of CN¥8.18 billion.

Operations: The company generates revenue of CN¥7.51 billion from its Thermal Management Components Manufacturing segment.

Market Cap: CN¥8.18B

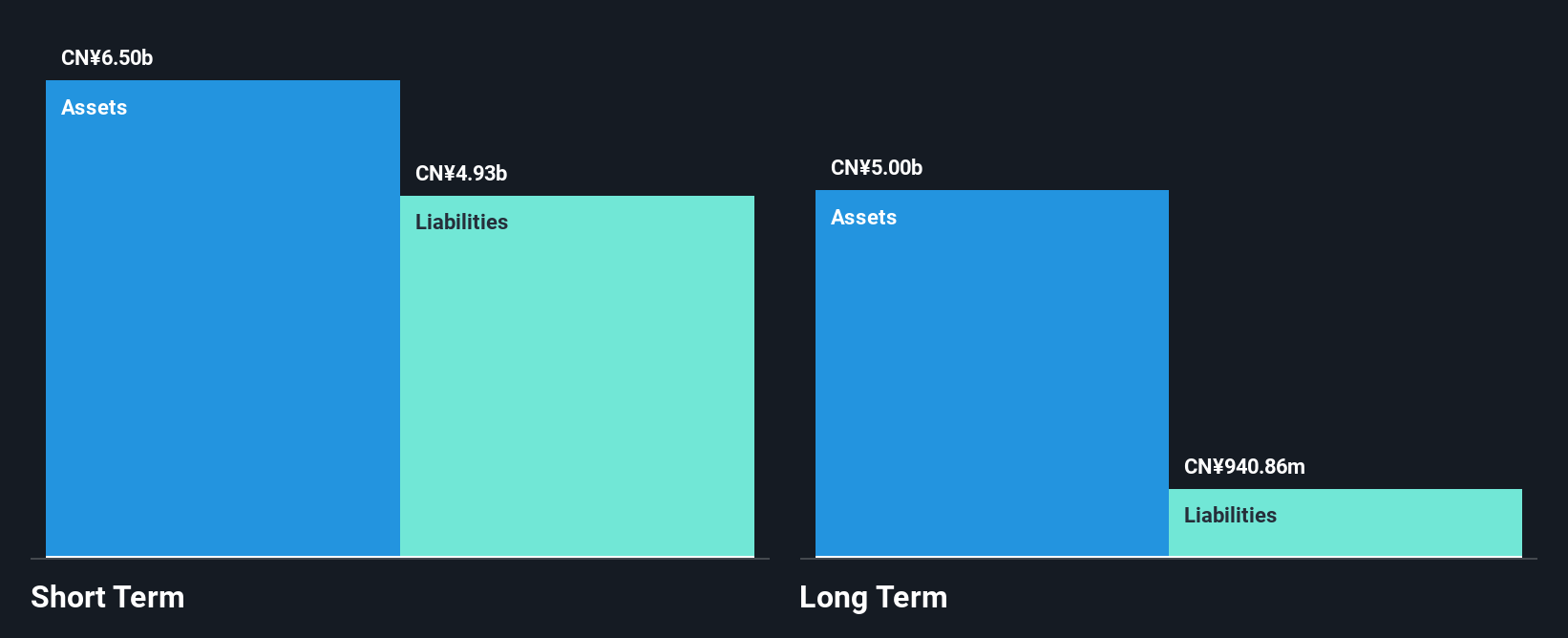

Aotecar New Energy Technology has demonstrated growth in its revenue, reporting CN¥5.63 billion for the nine months ending September 2024, up from CN¥4.97 billion a year earlier, with net income rising to CN¥91.96 million from CN¥63.1 million. Despite this positive trend, the company faces challenges such as negative earnings growth over the past year and low return on equity at 1.7%. However, short-term assets exceed both short-term and long-term liabilities significantly, indicating solid liquidity management. The absence of shareholder dilution over the past year is another favorable aspect for investors considering this stock.

- Unlock comprehensive insights into our analysis of Aotecar New Energy Technology stock in this financial health report.

- Review our historical performance report to gain insights into Aotecar New Energy Technology's track record.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. operates in the aquaculture industry, focusing on the production and processing of seafood products, with a market cap of CN¥4.81 billion.

Operations: No specific revenue segments are reported for Zhanjiang Guolian Aquatic Products Co., Ltd.

Market Cap: CN¥4.81B

Zhanjiang Guolian Aquatic Products Co., Ltd. has shown a reduction in net loss over the past year, with a reported net loss of CN¥79.56 million for the nine months ending September 2024, compared to CN¥235.16 million in the previous year. Despite being unprofitable, the company benefits from strong liquidity, with short-term assets of CN¥3.5 billion surpassing both short and long-term liabilities significantly. While its share price remains highly volatile and debt levels are relatively high with a net debt to equity ratio of 42.1%, it is trading at nearly half its estimated fair value, offering potential value for investors mindful of risks associated with penny stocks.

- Click to explore a detailed breakdown of our findings in Zhanjiang Guolian Aquatic Products' financial health report.

- Learn about Zhanjiang Guolian Aquatic Products' historical performance here.

Zhejiang Sunflower Great Health (SZSE:300111)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Sunflower Great Health Co., Ltd. operates in the health industry and has a market capitalization of CN¥4.03 billion.

Operations: The company generates revenue of CN¥330.25 million from its pharmaceutical industry segment.

Market Cap: CN¥4.03B

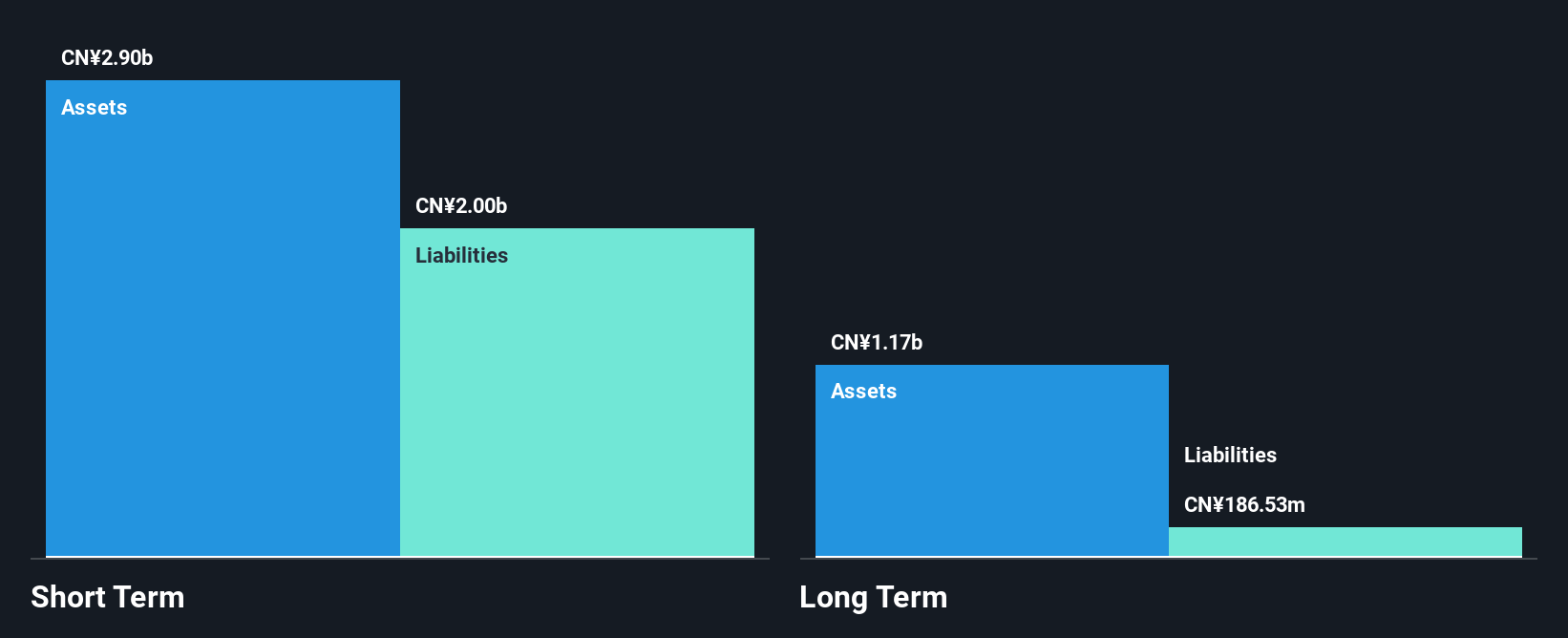

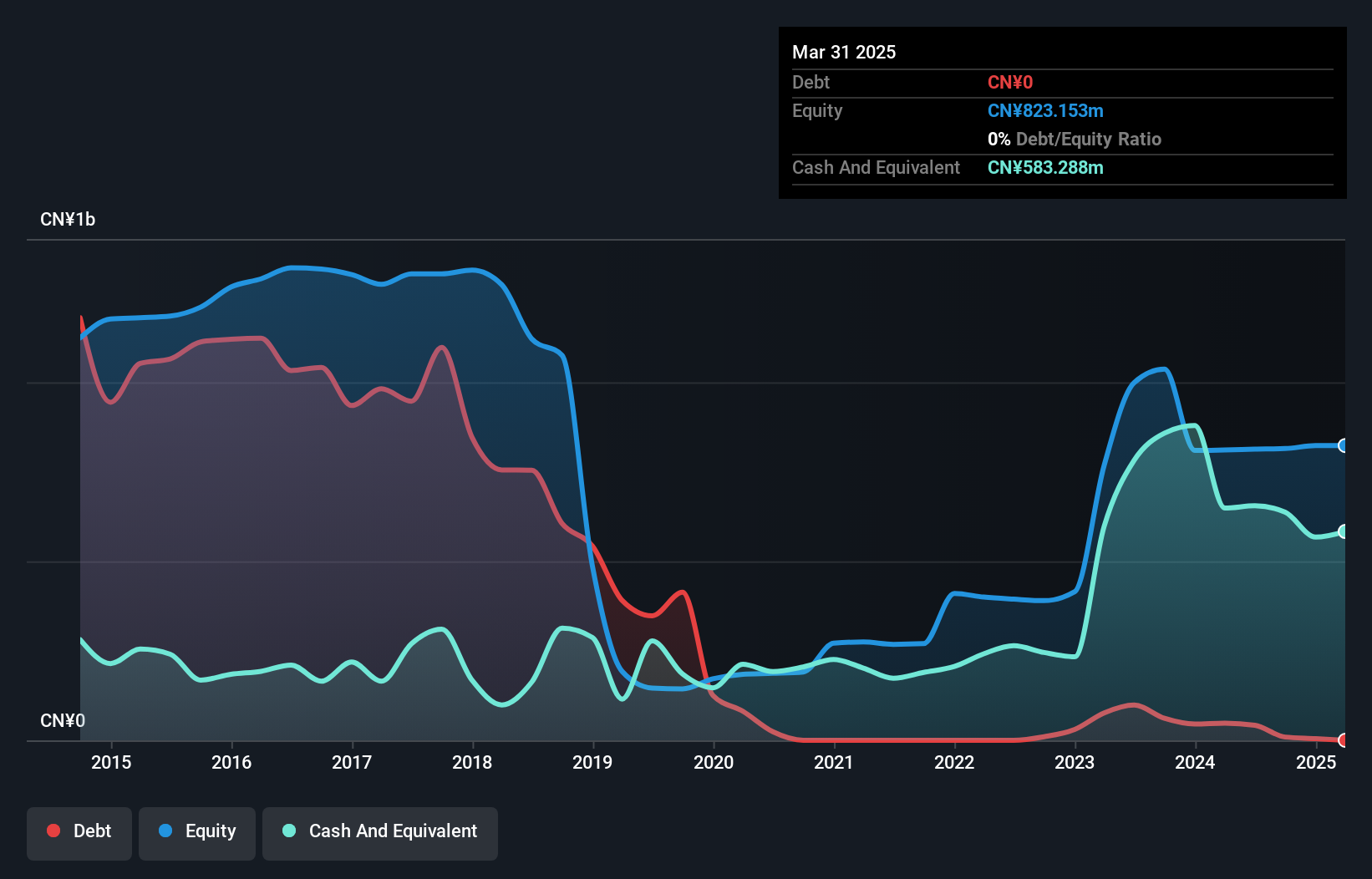

Zhejiang Sunflower Great Health Co., Ltd. operates with a market capitalization of CN¥4.03 billion and recently reported nine-month revenues of CN¥226.98 million, showing a slight decrease from the previous year. Despite negative earnings growth and reduced profit margins, the company maintains strong liquidity with short-term assets significantly exceeding liabilities, and its debt is well covered by operating cash flow. The board's average tenure suggests experienced governance amidst recent independent director elections. However, high share price volatility presents challenges for investors considering this stock within the penny stock landscape.

- Dive into the specifics of Zhejiang Sunflower Great Health here with our thorough balance sheet health report.

- Gain insights into Zhejiang Sunflower Great Health's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Jump into our full catalog of 5,778 Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sunflower Great Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300111

Zhejiang Sunflower Great Health

Zhejiang Sunflower Great Health Co., Ltd.

Excellent balance sheet with questionable track record.