- China

- /

- Aerospace & Defense

- /

- SZSE:300722

Uncovering Hidden Potential With Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts, buoyed by a strong labor market and optimistic economic indicators. As investors navigate this landscape of broad-based gains and geopolitical uncertainties, identifying stocks with hidden potential can be a strategic way to enhance portfolio diversity and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

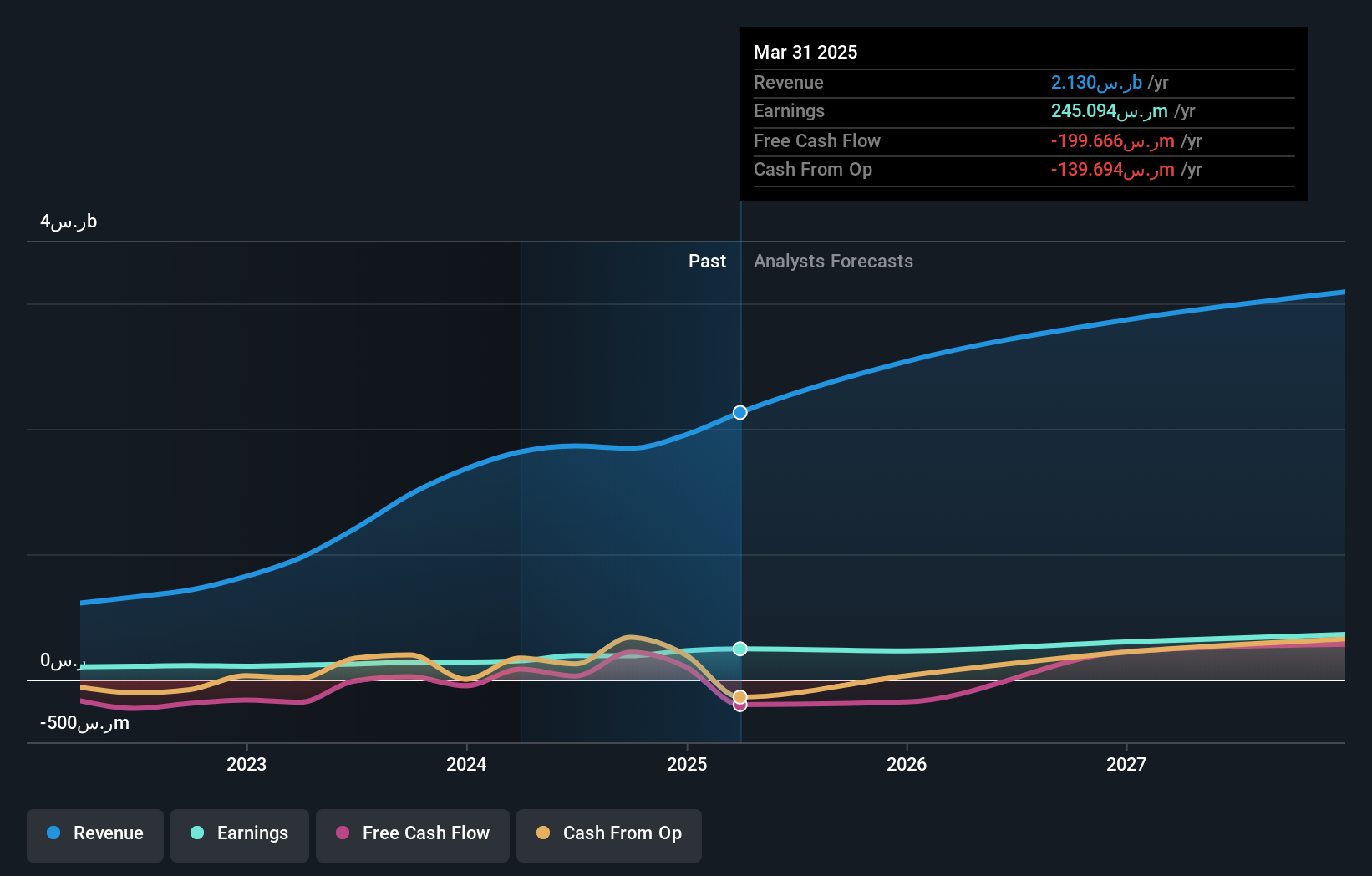

Alkhorayef Water and Power Technologies (SASE:2081)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alkhorayef Water and Power Technologies Company specializes in designing, constructing, operating, maintaining, and managing water and wastewater projects in Saudi Arabia, with a market cap of SAR4.99 billion.

Operations: The company generates revenue primarily from designing, constructing, operating, and managing water and wastewater projects in Saudi Arabia. With a market cap of SAR4.99 billion, its financial performance is influenced by project-based income streams.

Alkhorayef Water and Power Technologies, a smaller player in the water utilities sector, has demonstrated impressive earnings growth of 37.5% over the past year, outpacing the industry average of -2.6%. The company seems to be managing its finances effectively with free cash flow in positive territory and interest payments well covered by EBIT at 8 times. However, it carries a significant net debt to equity ratio of 68.3%, which is considered high compared to typical benchmarks. Despite this leverage, it's trading at an attractive valuation—67.4% below estimated fair value—indicating potential for future upside as earnings are forecasted to grow annually by 21.75%.

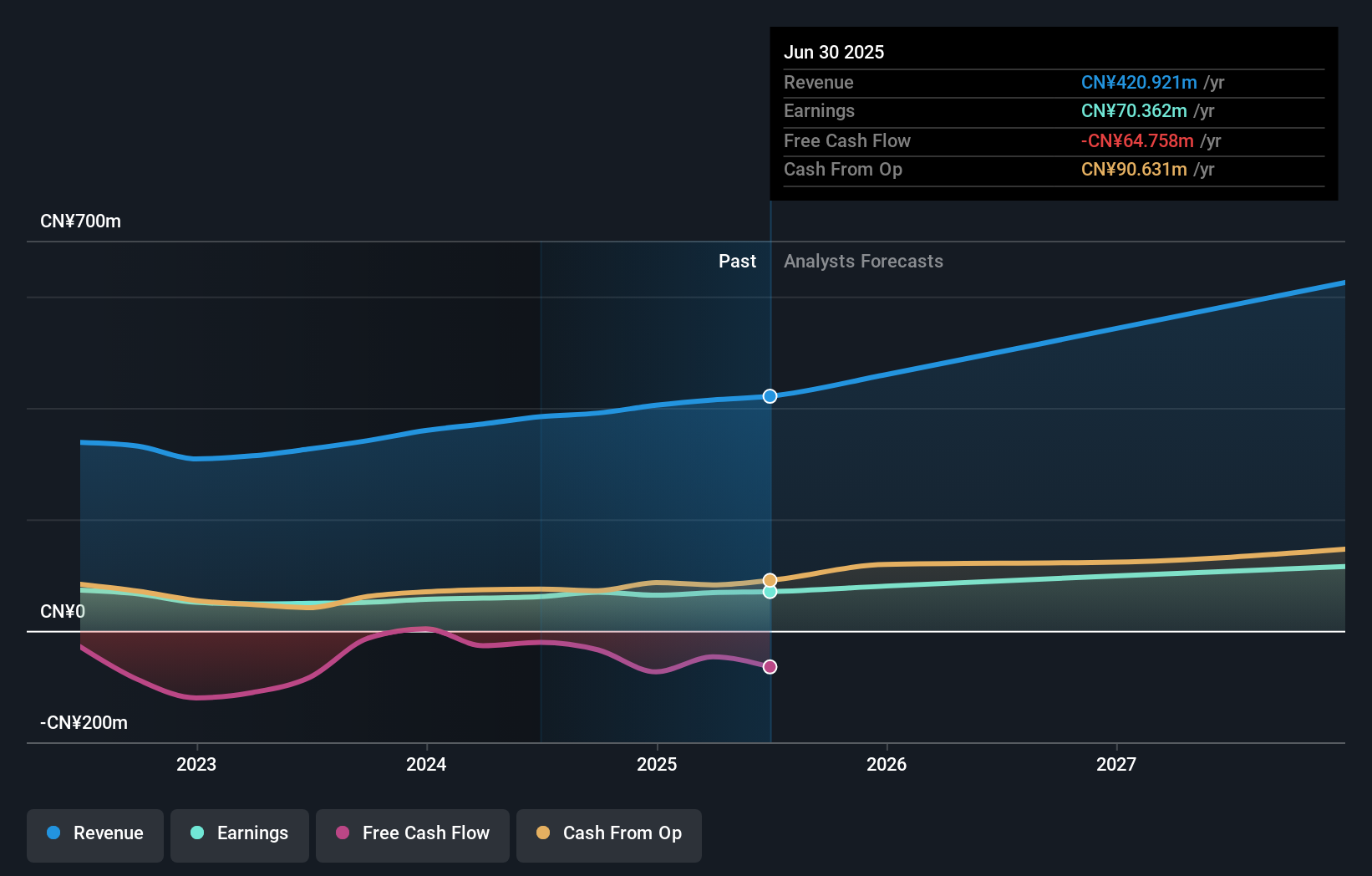

Qingdao Richen FoodLtd (SHSE:603755)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingdao Richen Food Co., Ltd. focuses on the research, development, production, and sale of compound seasoning and condiments for food processing and catering companies in China, with a market cap of approximately CN¥2.55 billion.

Operations: Qingdao Richen Food Co., Ltd. generates revenue primarily through the sale of compound seasonings and condiments to food processing and catering companies in China. The company's financial performance includes a market capitalization of approximately CN¥2.55 billion, reflecting its position within the industry.

Qingdao Richen Food Co.,Ltd. showcases promising growth, with earnings surging by 35% over the past year, outpacing the broader food industry's -5.8%. Their net income for the nine months ending September 2024 reached CNY 54.43 million, up from CNY 41.59 million a year prior, reflecting high-quality earnings and effective interest coverage. Despite a debt to equity ratio increase to 22% over five years, they hold more cash than total debt, suggesting financial stability. However, free cash flow remains negative due to significant capital expenditures like CNY -106 million in recent quarters which could impact liquidity management strategies moving forward.

- Unlock comprehensive insights into our analysis of Qingdao Richen FoodLtd stock in this health report.

Learn about Qingdao Richen FoodLtd's historical performance.

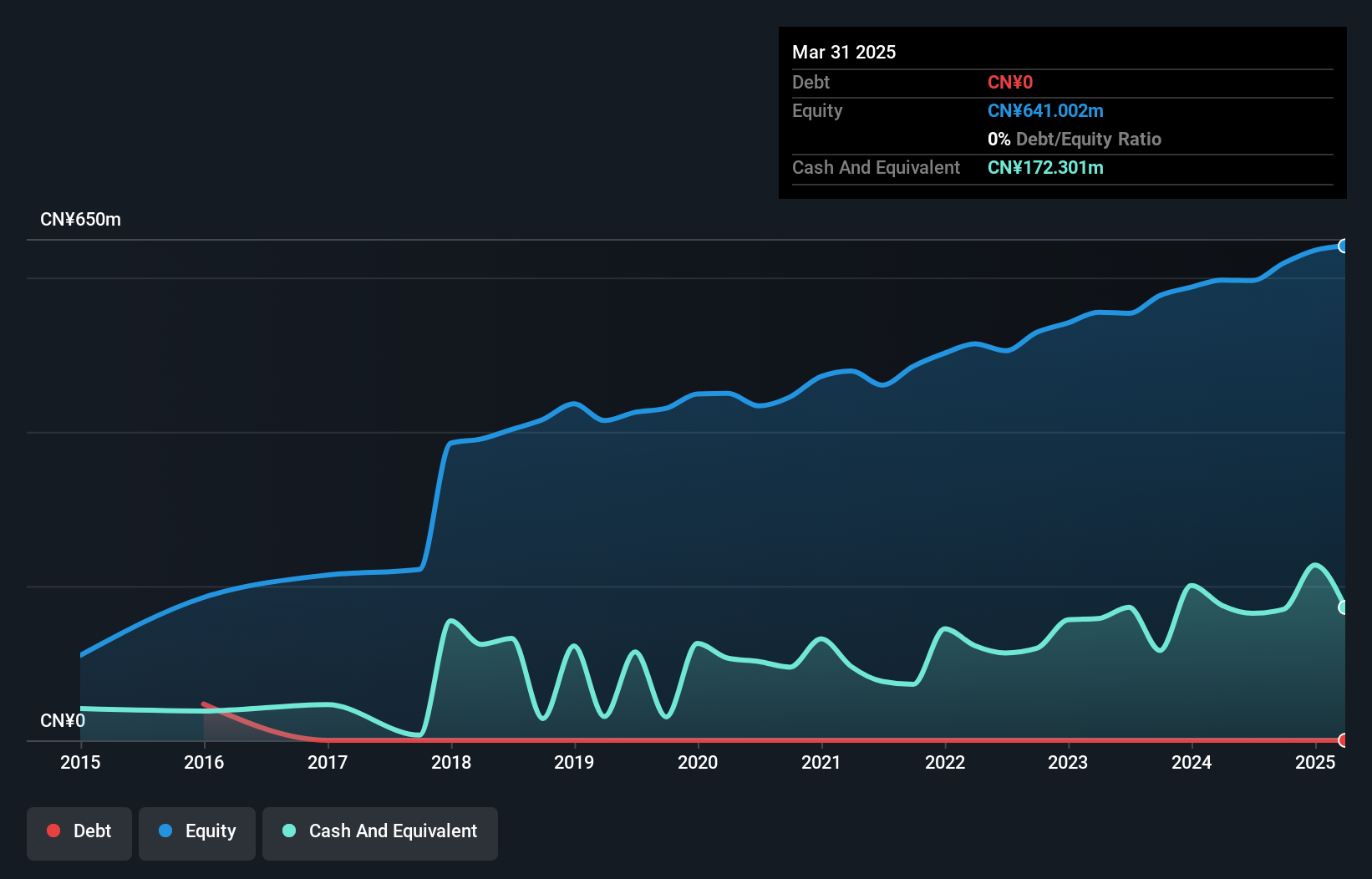

Jiangxi Xinyu Guoke Technology (SZSE:300722)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Xinyu Guoke Technology Co., Ltd specializes in the manufacturing and sale of military products, with a market cap of CN¥7.99 billion.

Operations: Xinyu Guoke Technology generates its revenue primarily from the manufacturing and sale of military products. The company's market cap stands at CN¥7.99 billion, reflecting its scale in the industry.

Jiangxi Xinyu Guoke Technology, a nimble player in the tech sector, has shown resilience with earnings growth of 7% over the past year, outpacing its industry peers. The company reported sales of CNY 318.54 million for the first nine months of 2024, up from CNY 269.77 million last year, while net income rose to CNY 65.75 million from CNY 62.04 million. Despite a highly volatile share price recently, this debt-free firm boasts high-quality earnings and positive free cash flow at CNY 91.02 million as of September-end 2024, highlighting its robust financial health amidst market fluctuations.

Taking Advantage

- Navigate through the entire inventory of 4638 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300722

Flawless balance sheet with acceptable track record.