Unearthing Hidden Gems with Strong Potential This January 2025

Reviewed by Simply Wall St

As global markets navigate a challenging start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly watching economic indicators and Federal Reserve policies that could influence future market dynamics. In this environment of uncertainty, identifying stocks with strong fundamentals and growth potential can be crucial for those looking to uncover hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Rimoni Industries | NA | 4.64% | 3.50% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Isracard | 69.54% | 9.35% | 3.37% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

China Foods (SEHK:506)

Simply Wall St Value Rating: ★★★★★★

Overview: China Foods Limited is an investment holding company that focuses on the manufacturing, distribution, marketing, and sales of Coca-Cola series products in the People’s Republic of China with a market cap of HK$6.99 billion.

Operations: China Foods generates revenue primarily from the processing, bottling, and distribution of sparkling and still beverages, totaling CN¥20.33 billion.

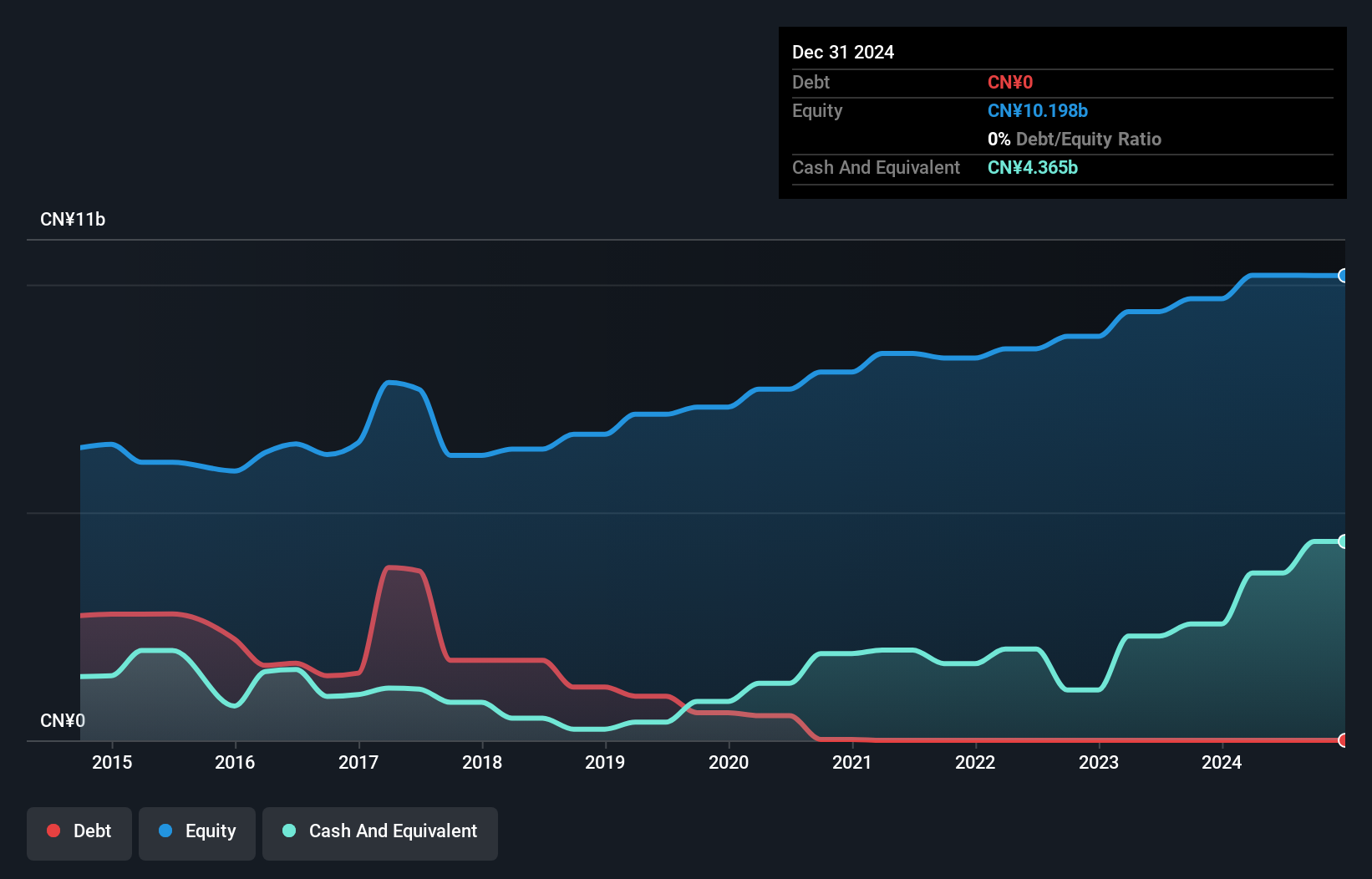

China Foods, a player in the beverage industry, seems to offer intriguing prospects. The company is trading at 93.9% below its estimated fair value, signaling potential undervaluation compared to peers. Over the past year, earnings grew by 2.3%, outpacing the industry's 0.2% growth rate and showcasing high-quality earnings with no debt burden since reducing its debt-to-equity ratio from 13.5% five years ago to zero today. Recent executive changes include Mr. Zhan Zaizhong stepping in as managing director, which may influence strategic direction positively given his extensive operational experience within COFCO Coca-Cola Beverages Limited.

- Click to explore a detailed breakdown of our findings in China Foods' health report.

Gain insights into China Foods' past trends and performance with our Past report.

Shanghai Aladdin Biochemical TechnologyLtd (SHSE:688179)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Aladdin Biochemical Technology Co., Ltd. operates in the biochemical industry, focusing on research and test development, with a market capitalization of CN¥3.89 billion.

Operations: The company generates revenue primarily from the research and test development industry, amounting to CN¥497.71 million.

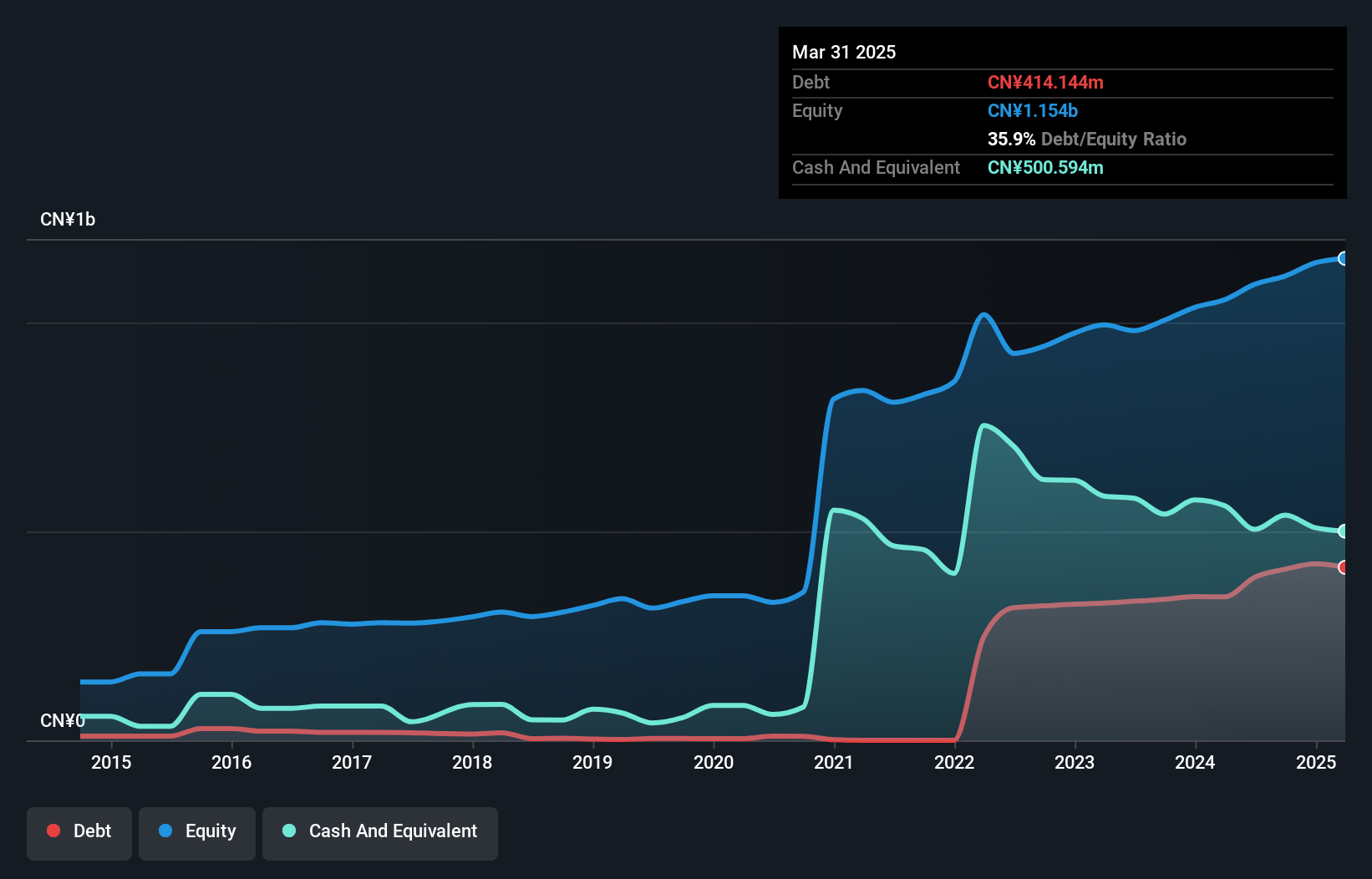

Shanghai Aladdin Biochemical Technology, a small player in the biochemical sector, has shown promising growth with its earnings surging 26.6% over the past year, well above the industry average of -4.7%. The company's revenue for the nine months ending September 2024 reached CNY 377.61 million, up from CNY 282.78 million in the previous year, while net income climbed to CNY 72.57 million from CNY 54.69 million. With a debt-to-equity ratio rising to 36.9% over five years but interest payments covered by EBIT at an impressive rate of 97 times, financial stability seems robust despite increased leverage.

Winstech Precision Holding (SZSE:001319)

Simply Wall St Value Rating: ★★★★★★

Overview: Winstech Precision Holding Co., LTD. specializes in the stamping, welding, and assembly of precision automobile stamping dies and auto parts for the automotive industry, with a market cap of CN¥3.35 billion.

Operations: Winstech derives its revenue primarily from the stamping, welding, and assembly of precision automobile stamping dies and auto parts. The company operates with a market cap of CN¥3.35 billion.

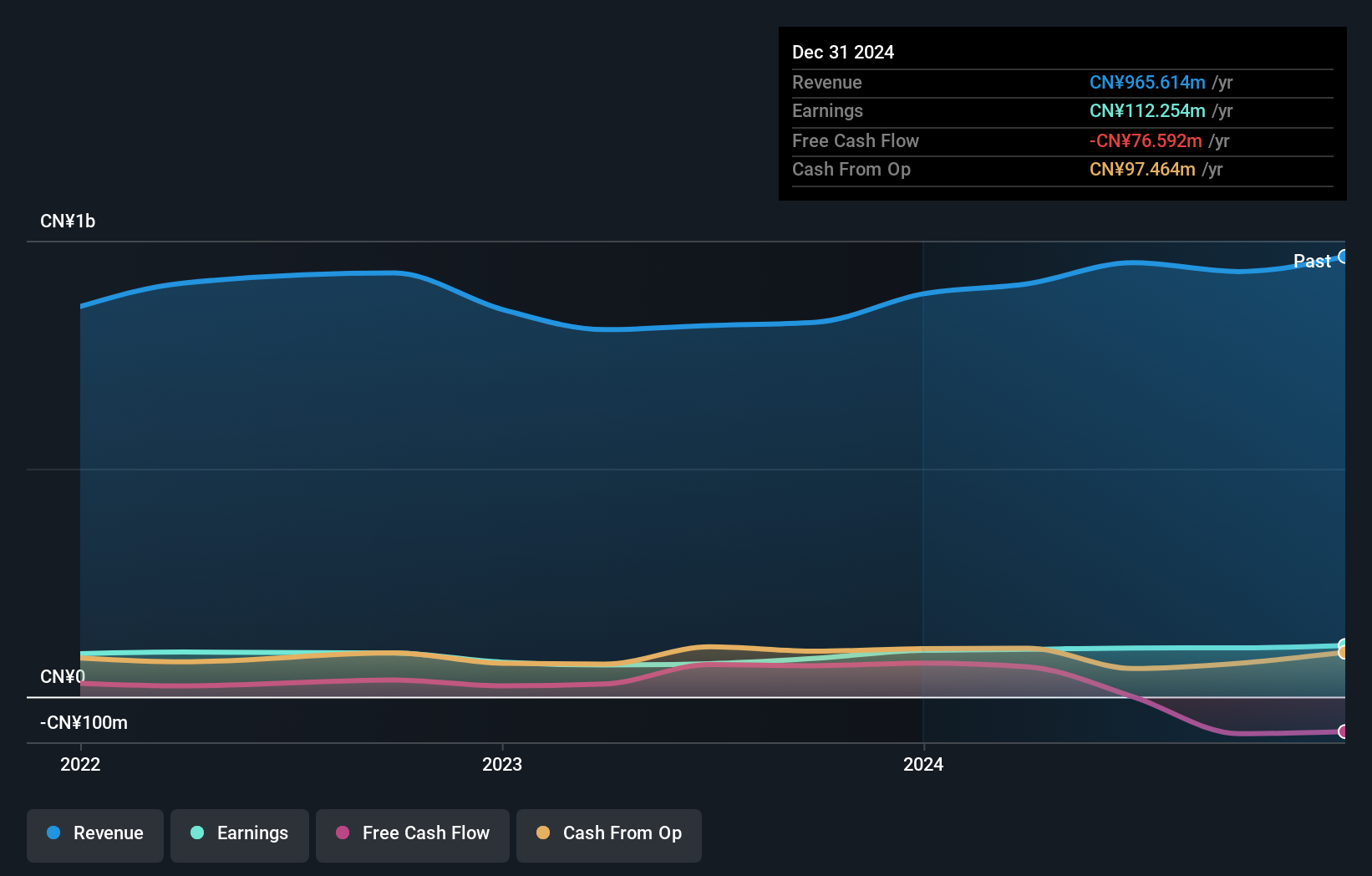

Winstech Precision Holding appears to be making strides with its recent earnings report showing sales of CNY 671.45 million, up from CNY 622.51 million the previous year, and net income rising to CNY 76.52 million from CNY 70.86 million. The company’s debt-to-equity ratio has impressively decreased from 14.4% to just 0.9% over five years, indicating a solid financial footing with more cash than total debt on hand. Despite a volatile share price recently and no positive free cash flow, Winstech's earnings growth outpaced the Auto Components industry by a significant margin last year at 27%.

Key Takeaways

- Explore the 4655 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688179

Shanghai Aladdin Biochemical TechnologyLtd

Shanghai Aladdin Biochemical Technology Co.,Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives