- China

- /

- Electrical

- /

- SZSE:300660

Uncovering Three Hidden Gems with Strong Potential

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced mixed results, with small-cap stocks showing resilience compared to their larger counterparts. As the broader market navigates these turbulent waters, investors may find opportunities in lesser-known companies that demonstrate strong fundamentals and potential for growth. In this environment, identifying hidden gems requires focusing on stocks with solid financial health, innovative business models, and the ability to adapt to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Winstech Precision Holding (SZSE:001319)

Simply Wall St Value Rating: ★★★★★★

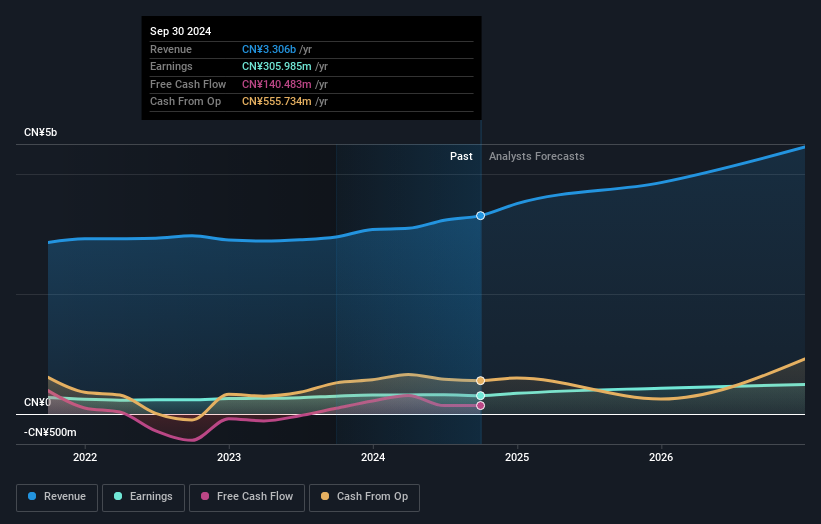

Overview: Winstech Precision Holding Co., LTD. specializes in the stamping, welding, and assembly of precision automobile stamping dies and auto parts for the automotive industry, with a market cap of CN¥3.58 billion.

Operations: Winstech generates revenue primarily from the production and assembly of precision automobile stamping dies and auto parts. The company's financial performance includes a focus on maintaining cost efficiencies in its operations. Notably, Winstech's gross profit margin has shown variability over recent periods, reflecting changes in production costs and pricing strategies.

Winstech Precision Holding, a nimble player in its field, has demonstrated notable financial resilience. Over the past five years, it significantly reduced its debt to equity ratio from 14.4 to 0.9, reflecting prudent financial management. The company reported earnings growth of 27% last year, outpacing the Auto Components industry's average of 10%. Recent earnings for nine months ending September 2024 showed sales of CNY 671 million and net income of CNY 76 million. Despite not being free cash flow positive currently, Winstech's price-to-earnings ratio at 33x remains competitive within the market landscape.

Jiangsu Leili Motor (SZSE:300660)

Simply Wall St Value Rating: ★★★★★☆

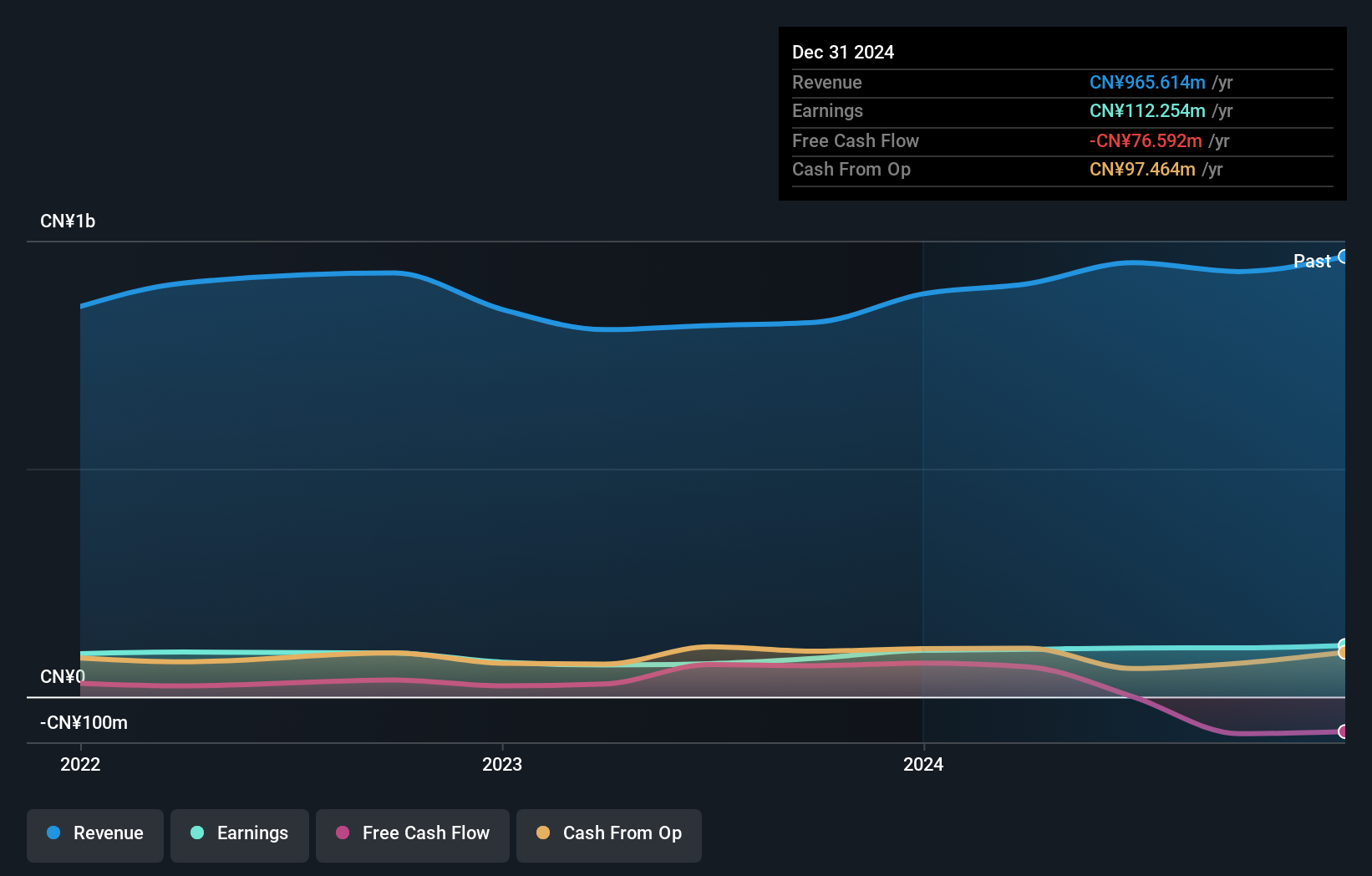

Overview: Jiangsu Leili Motor Co., Ltd is involved in the research, development, production, and sale of household appliances, micro motors, and intelligent components both in China and internationally with a market cap of CN¥9.83 billion.

Operations: Jiangsu Leili Motor generates revenue primarily from the sale of household appliances, micro motors, and intelligent components. The company's cost structure includes expenses related to research and development, production, and sales operations. Notably, its net profit margin has shown variability over recent periods.

Jiangsu Leili Motor, a modestly sized player in the electrical industry, showcases promising attributes with its earnings growth of 2.8% over the past year outpacing the industry's 0.3%. The company holds a favorable position with high-quality earnings and more cash than total debt, suggesting financial stability. Its price-to-earnings ratio of 32.1 is slightly below the CN market average of 33.6, indicating potential value for investors seeking opportunities in this sector. Recent earnings reported sales at CNY 2.48 billion for nine months ending September 2024, although net income dipped to CNY 240.88 million from CNY 252.02 million last year, reflecting some challenges amidst growth prospects.

Elite Advanced Laser (TWSE:3450)

Simply Wall St Value Rating: ★★★★★★

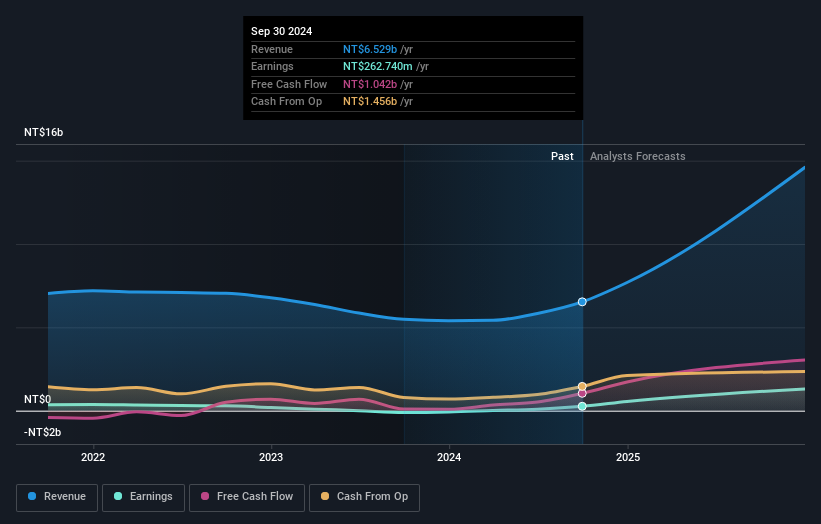

Overview: Elite Advanced Laser Corporation offers electronic manufacturing services in Taiwan with a market capitalization of approximately NT$34.09 billion.

Operations: Elite Advanced Laser Corporation generates revenue primarily from its semiconductor segment, contributing NT$4.51 billion, and the optoelectronics industry sector, adding NT$1.32 billion.

Elite Advanced Laser, a promising player in its field, has shown remarkable earnings growth of 4540% over the past year, outpacing the semiconductor industry. The company's debt to equity ratio improved from 4.3 to 3.8 over five years, indicating prudent financial management. Recent reports reveal a significant turnaround with net income reaching TWD 69 million compared to a loss of TWD 13 million last year for Q2. Revenue climbed to TWD 1,704 million from TWD 1,291 million previously. Despite recent volatility in share price, Elite's high-quality earnings and positive free cash flow suggest robust potential moving forward.

Seize The Opportunity

- Get an in-depth perspective on all 4735 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300660

Jiangsu Leili Motor

Engages in the research and development, production, and sale of household appliances, micro motors, and intelligent components in China and internationally.

Excellent balance sheet with acceptable track record.