- China

- /

- Auto Components

- /

- SZSE:001282

Wuhu Sanlian Forging Co., Ltd. (SZSE:001282) Held Back By Insufficient Growth Even After Shares Climb 30%

Wuhu Sanlian Forging Co., Ltd. (SZSE:001282) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

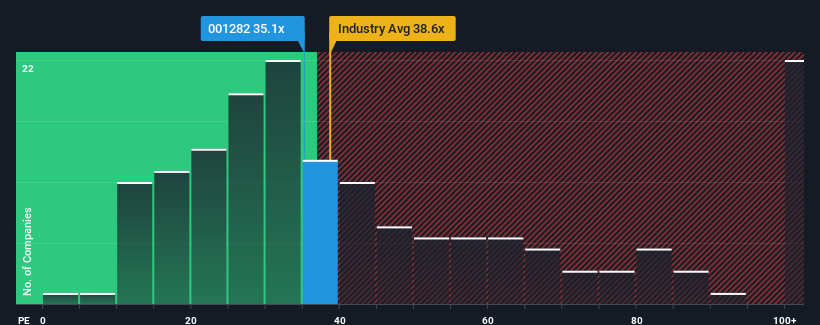

Although its price has surged higher, Wuhu Sanlian Forging may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 35.1x, since almost half of all companies in China have P/E ratios greater than 40x and even P/E's higher than 78x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen at a steady rate over the last year for Wuhu Sanlian Forging, which is generally not a bad outcome. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Wuhu Sanlian Forging

Is There Any Growth For Wuhu Sanlian Forging?

There's an inherent assumption that a company should underperform the market for P/E ratios like Wuhu Sanlian Forging's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 4.4%. Pleasingly, EPS has also lifted 41% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Wuhu Sanlian Forging's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Wuhu Sanlian Forging's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Wuhu Sanlian Forging maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Wuhu Sanlian Forging (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

You might be able to find a better investment than Wuhu Sanlian Forging. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wuhu Sanlian Forging might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001282

Wuhu Sanlian Forging

Engages in the research and development, production, distribution, and sale of automotive forging parts for use in automotive power systems, transmission systems, suspension support systems, and steering systems in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.