As global markets react to recent political shifts and economic policy changes, major indices like the S&P 500 have reached record highs, buoyed by optimism around growth and tax reforms. Amidst these dynamic conditions, dividend stocks stand out as a compelling option for investors seeking stability and income, offering potential resilience against market volatility while providing regular cash flow.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.15% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Aygaz (IBSE:AYGAZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aygaz A.S. is involved in purchasing liquid petroleum gas (LPG) for distribution to retailers in Turkey, with a market cap of TRY35.01 billion.

Operations: Aygaz A.S. generates revenue primarily through the sale of liquid petroleum gas (LPG) to retailers within Turkey.

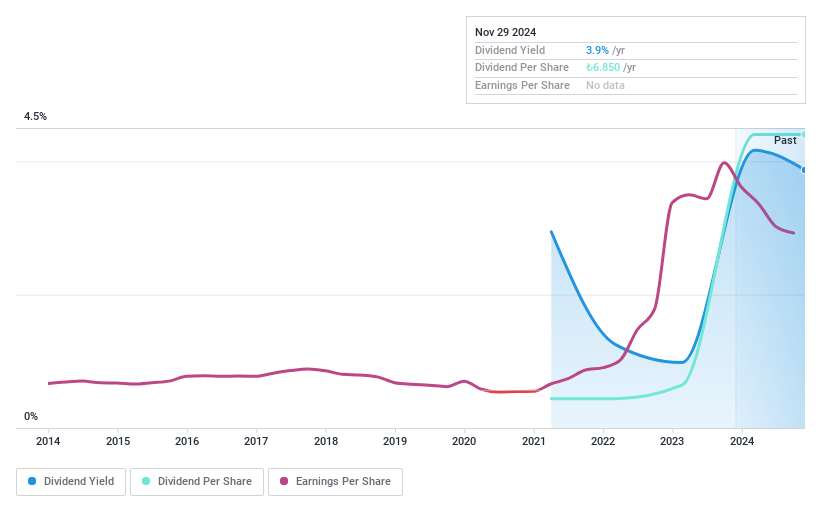

Dividend Yield: 4.3%

Aygaz has shown a reliable dividend pattern, with payments growing steadily over the past four years. Its payout ratio of 30.8% indicates dividends are well-covered by earnings, while a cash payout ratio of 70.7% suggests reasonable coverage by cash flows. Despite its short dividend history, Aygaz offers a competitive yield in Turkey's market and trades at good value compared to peers. Recent earnings show decreased sales and net income, which could impact future payouts.

- Get an in-depth perspective on Aygaz's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Aygaz's share price might be too pessimistic.

Emperor Watch & Jewellery (SEHK:887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emperor Watch & Jewellery Limited is an investment holding company involved in the sale of watches and jewelry products, with a market cap of HK$1.25 billion.

Operations: The company generates revenue of HK$5.09 billion from its watch and jewelry sales.

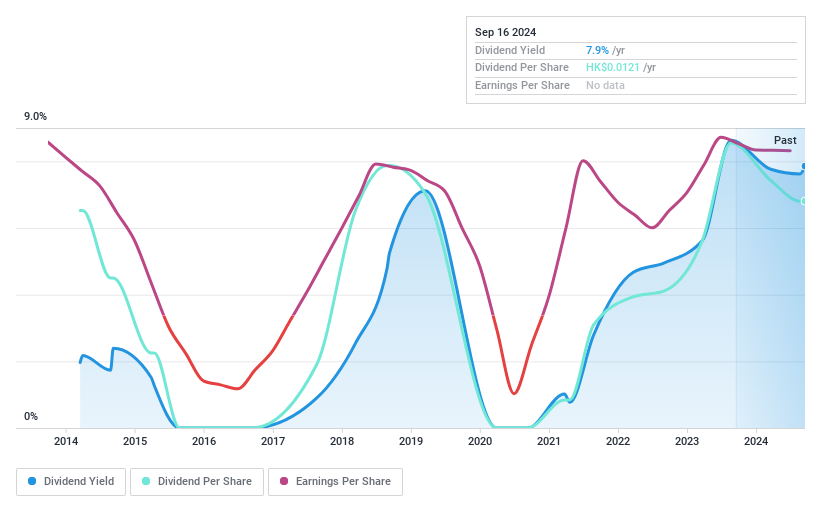

Dividend Yield: 6.5%

Emperor Watch & Jewellery's dividend yield of 6.54% is below the top 25% of Hong Kong dividend payers. Despite a low payout ratio (27.5%) and cash payout ratio (32.2%), indicating strong coverage, its dividends have been volatile over the past decade, recently decreasing to HKD 0.65 cent per share for H1 2024 from HKD 0.76 cent in H1 2023, reflecting an unstable dividend track record despite solid earnings coverage.

- Take a closer look at Emperor Watch & Jewellery's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Emperor Watch & Jewellery is priced lower than what may be justified by its financials.

Zhejiang Qianjiang Motorcycle (SZSE:000913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Qianjiang Motorcycle Co., Ltd. engages in the research, development, manufacturing, and sale of motorcycles, engines, and components in China with a market cap of CN¥9.33 billion.

Operations: Zhejiang Qianjiang Motorcycle Co., Ltd.'s revenue is primarily derived from its operations in the motorcycle, engine, and component sectors within China.

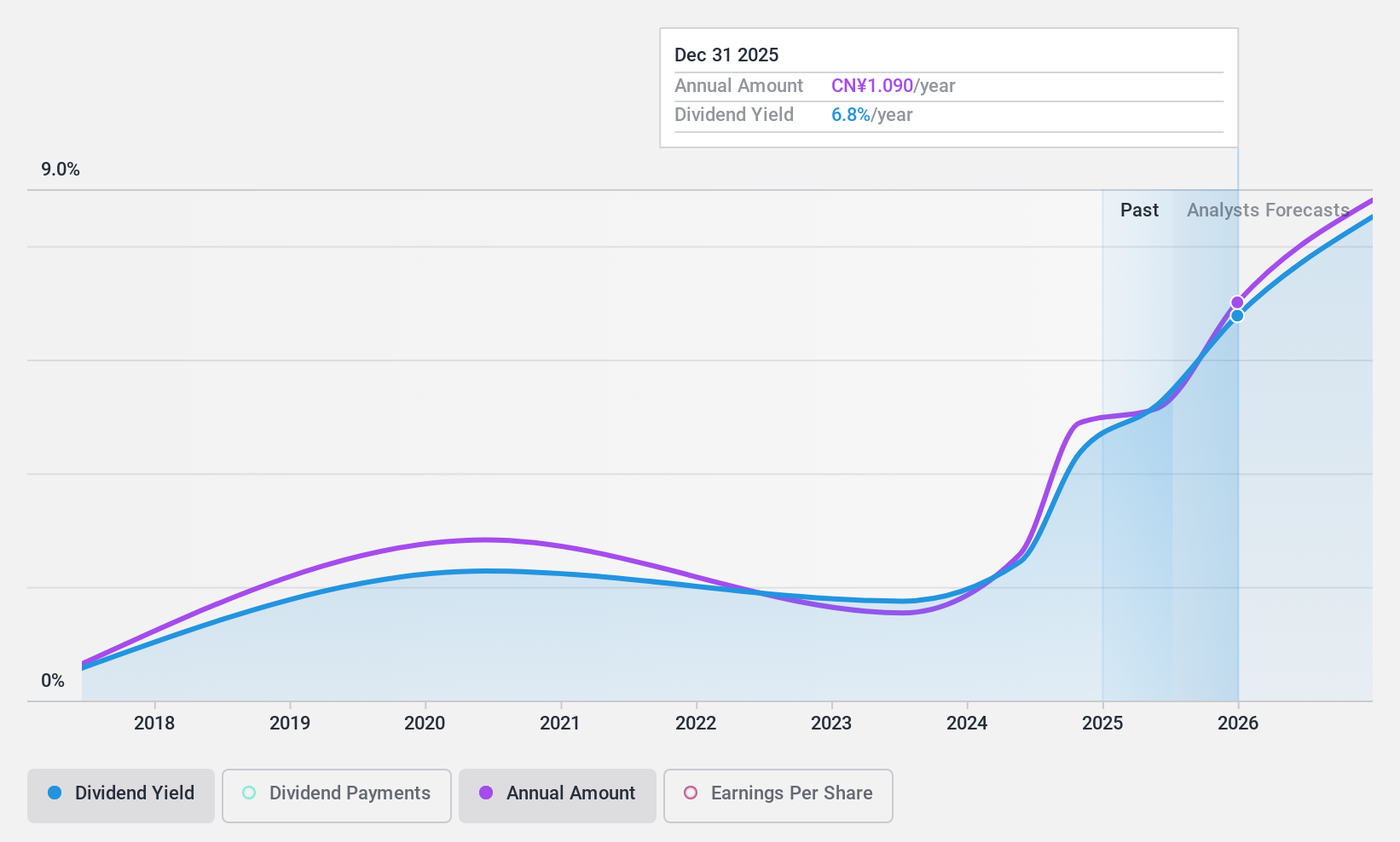

Dividend Yield: 4.3%

Zhejiang Qianjiang Motorcycle offers a dividend yield of 4.29%, placing it among the top 25% of dividend payers in China. The company's dividends are supported by an earnings payout ratio of 80.4% and a cash flow payout ratio of 62.7%. However, its seven-year dividend history has been marked by volatility, with payments not consistently growing. Recent earnings growth and interim cash dividends suggest potential stability, yet past fluctuations may concern some investors seeking reliability.

- Click to explore a detailed breakdown of our findings in Zhejiang Qianjiang Motorcycle's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zhejiang Qianjiang Motorcycle shares in the market.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1937 more companies for you to explore.Click here to unveil our expertly curated list of 1940 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Qianjiang Motorcycle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000913

Zhejiang Qianjiang Motorcycle

Researches and develops, manufactures, and sells motorcycles, engines, and components in China.

Solid track record with excellent balance sheet and pays a dividend.