- China

- /

- Auto Components

- /

- SZSE:000901

Is Aerospace Hi-Tech Holding Group (SZSE:000901) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Aerospace Hi-Tech Holding Group Co., Ltd. (SZSE:000901) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Aerospace Hi-Tech Holding Group

What Is Aerospace Hi-Tech Holding Group's Debt?

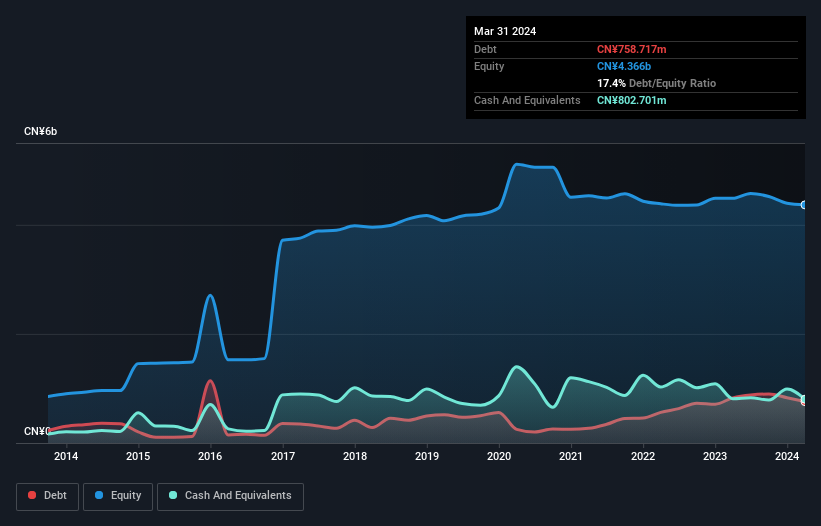

As you can see below, Aerospace Hi-Tech Holding Group had CN¥758.7m of debt at March 2024, down from CN¥828.1m a year prior. However, it does have CN¥802.7m in cash offsetting this, leading to net cash of CN¥44.0m.

A Look At Aerospace Hi-Tech Holding Group's Liabilities

According to the last reported balance sheet, Aerospace Hi-Tech Holding Group had liabilities of CN¥2.81b due within 12 months, and liabilities of CN¥1.41b due beyond 12 months. On the other hand, it had cash of CN¥802.7m and CN¥2.07b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥1.34b.

Given Aerospace Hi-Tech Holding Group has a market capitalization of CN¥7.12b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Aerospace Hi-Tech Holding Group also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Aerospace Hi-Tech Holding Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Aerospace Hi-Tech Holding Group wasn't profitable at an EBIT level, but managed to grow its revenue by 18%, to CN¥6.9b. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Aerospace Hi-Tech Holding Group?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Aerospace Hi-Tech Holding Group lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CN¥8.6m of cash and made a loss of CN¥140m. With only CN¥44.0m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Aerospace Hi-Tech Holding Group that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000901

Aerospace Hi-Tech Holding Group

Aerospace Hi-Tech Holding Group Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.