Top Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are navigating a complex landscape marked by fluctuating consumer confidence and shifts in major indices, with the Nasdaq Composite and Russell 1000 Growth Index experiencing notable movements. In this environment, identifying growth companies with high insider ownership can be particularly appealing, as such stocks often indicate strong internal confidence in the business's future prospects and resilience amid market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Intsig Information (SHSE:688615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IntSig Information Co., Ltd. offers optical character recognition solutions to corporate clients and individuals globally, with a market cap of CN¥20.24 billion.

Operations: IntSig Information Co., Ltd. generates its revenue from providing optical character recognition solutions to both corporate clients and individual users around the world.

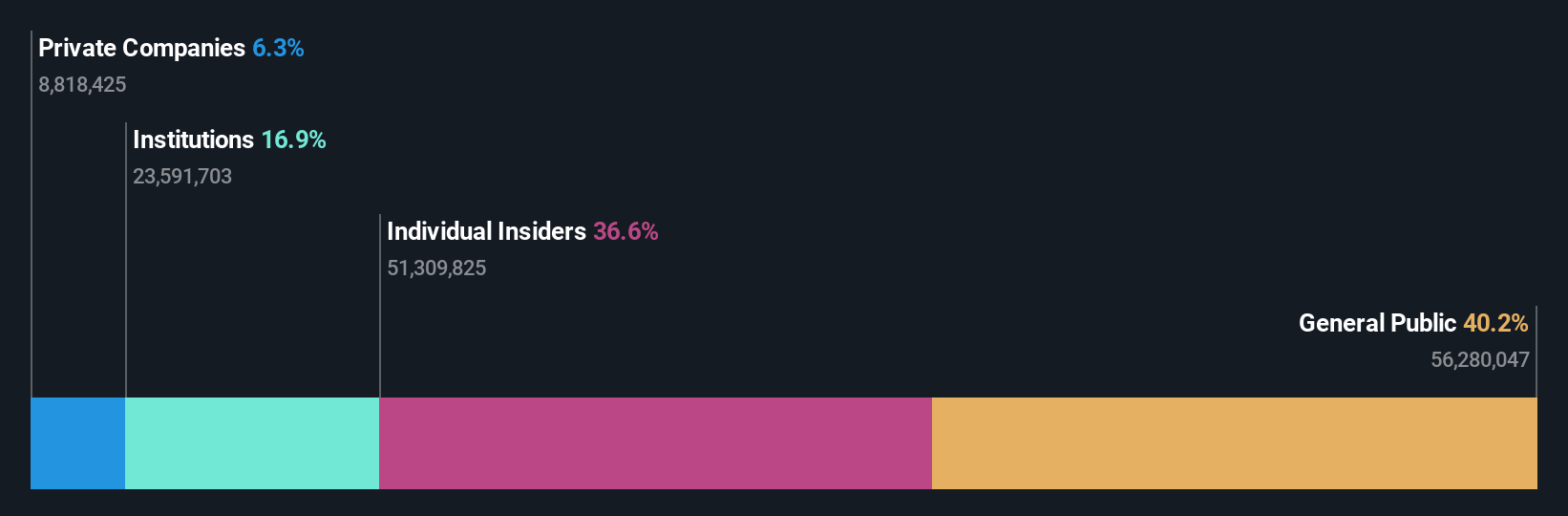

Insider Ownership: 36.6%

Intsig Information has shown strong financial performance, with revenue increasing to CNY 1.05 billion and net income rising to CNY 306.5 million for the first nine months of 2024. The company's earnings are forecasted to grow significantly at 25.23% per year, outpacing the Chinese market average. Despite a volatile share price recently, its price-to-earnings ratio of 57.2x suggests better value compared to the industry average, while insider ownership remains stable without recent substantial trading activity.

- Get an in-depth perspective on Intsig Information's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Intsig Information shares in the market.

Ninebot (SHSE:689009)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ninebot Limited is involved in the design, research and development, production, sale, and servicing of transportation and robot products globally, with a market cap of CN¥34.05 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 15.4%

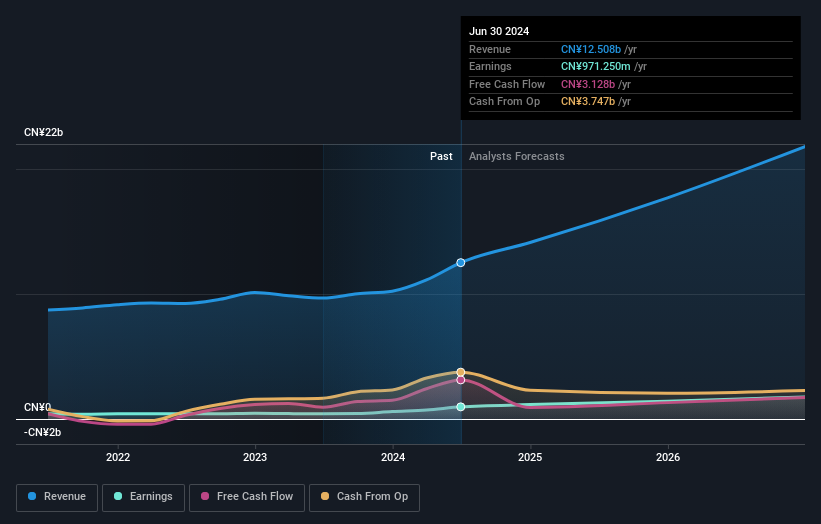

Ninebot Limited's recent earnings report highlights strong growth, with sales reaching CNY 10.91 billion and net income rising to CNY 969.67 million for the first nine months of 2024. The company is expected to continue this trajectory, with revenue and earnings forecasted to grow significantly above the Chinese market average at 24.1% and 27.6% annually, respectively. Despite no substantial insider trading recently, its price-to-earnings ratio of 28.6x indicates potential value in comparison to market norms.

- Delve into the full analysis future growth report here for a deeper understanding of Ninebot.

- According our valuation report, there's an indication that Ninebot's share price might be on the expensive side.

Suning.com (SZSE:002024)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suning.com Co., Ltd. operates in the retail sector in China with a market capitalization of approximately CN¥18.88 billion.

Operations: Suning.com Co., Ltd.'s revenue primarily comes from its retail operations in China.

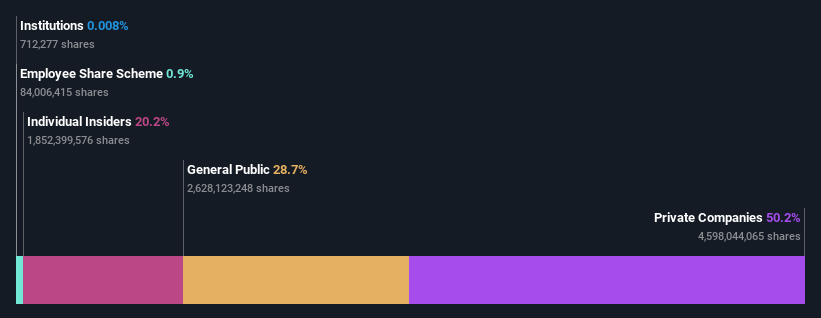

Insider Ownership: 20.2%

Suning.com has shown significant improvement, reporting a net income of CNY 599.22 million for the first nine months of 2024, reversing from a loss the previous year. Forecasts indicate substantial revenue growth at 20.6% annually, outpacing the Chinese market average of 13.6%, with profitability expected within three years. Despite trading well below estimated fair value and good relative value compared to peers, insider activity remains muted recently without notable buying or selling trends.

- Click to explore a detailed breakdown of our findings in Suning.com's earnings growth report.

- The analysis detailed in our Suning.com valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 1502 Fast Growing Companies With High Insider Ownership now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ninebot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:689009

Ninebot

Engages in the design, research and development, production, sale, and servicing of transportation and robot products worldwide.

Exceptional growth potential with flawless balance sheet.