- China

- /

- Auto Components

- /

- SHSE:688155

Has Shanghai SK Automation Technology Co.,Ltd's (SHSE:688155) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Shanghai SK Automation TechnologyLtd's (SHSE:688155) stock is up by a considerable 18% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study Shanghai SK Automation TechnologyLtd's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Shanghai SK Automation TechnologyLtd

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shanghai SK Automation TechnologyLtd is:

13% = CN¥311m ÷ CN¥2.3b (Based on the trailing twelve months to September 2024).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.13 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Shanghai SK Automation TechnologyLtd's Earnings Growth And 13% ROE

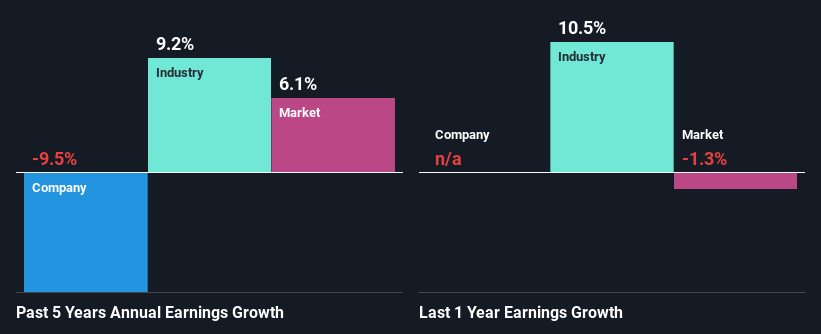

To start with, Shanghai SK Automation TechnologyLtd's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 8.3%. Needless to say, we are quite surprised to see that Shanghai SK Automation TechnologyLtd's net income shrunk at a rate of 9.5% over the past five years. We reckon that there could be some other factors at play here that are preventing the company's growth. These include low earnings retention or poor allocation of capital.

That being said, we compared Shanghai SK Automation TechnologyLtd's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 9.2% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Shanghai SK Automation TechnologyLtd is trading on a high P/E or a low P/E, relative to its industry.

Is Shanghai SK Automation TechnologyLtd Efficiently Re-investing Its Profits?

Looking at its three-year median payout ratio of 32% (or a retention ratio of 68%) which is pretty normal, Shanghai SK Automation TechnologyLtd's declining earnings is rather baffling as one would expect to see a fair bit of growth when a company is retaining a good portion of its profits. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, Shanghai SK Automation TechnologyLtd has been paying dividends over a period of four years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Conclusion

On the whole, we do feel that Shanghai SK Automation TechnologyLtd has some positive attributes. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn't the case here. This suggests that there might be some external threat to the business, that's hampering its growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 4 risks we have identified for Shanghai SK Automation TechnologyLtd.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688155

Shanghai SK Automation TechnologyLtd

Engages in the research, development, production, and sale of intelligent manufacturing equipment for new energy vehicles and fuel vehicles.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.