- China

- /

- Auto Components

- /

- SHSE:605133

Market Might Still Lack Some Conviction On Jiangsu Rongtai Industry Co., Ltd. (SHSE:605133) Even After 30% Share Price Boost

Despite an already strong run, Jiangsu Rongtai Industry Co., Ltd. (SHSE:605133) shares have been powering on, with a gain of 30% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

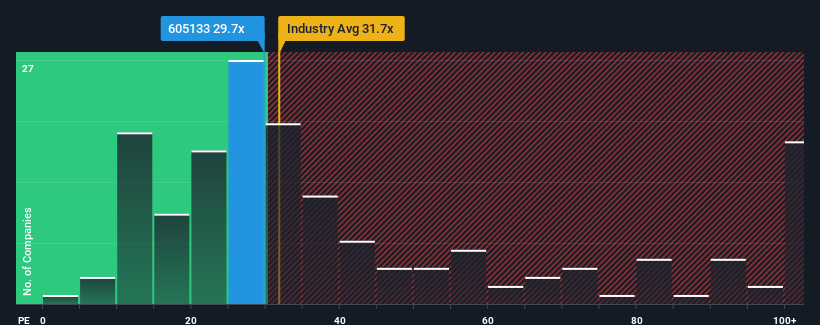

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider Jiangsu Rongtai Industry as an attractive investment with its 29.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times haven't been advantageous for Jiangsu Rongtai Industry as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Jiangsu Rongtai Industry

How Is Jiangsu Rongtai Industry's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jiangsu Rongtai Industry's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 9.1%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 11% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 70% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we find it odd that Jiangsu Rongtai Industry is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Jiangsu Rongtai Industry's P/E?

Jiangsu Rongtai Industry's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiangsu Rongtai Industry currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Jiangsu Rongtai Industry that you need to be mindful of.

Of course, you might also be able to find a better stock than Jiangsu Rongtai Industry. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Jiangsu Rongtai Industry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605133

Jiangsu Rongtai Industry

Engages in the research and development, production, and sale of automotive aluminum alloy precision die casting products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives