- China

- /

- Auto Components

- /

- SHSE:605128

Shanghai Yanpu Metal Products Co.,Ltd (SHSE:605128) Soars 30% But It's A Story Of Risk Vs Reward

Shanghai Yanpu Metal Products Co.,Ltd (SHSE:605128) shares have had a really impressive month, gaining 30% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

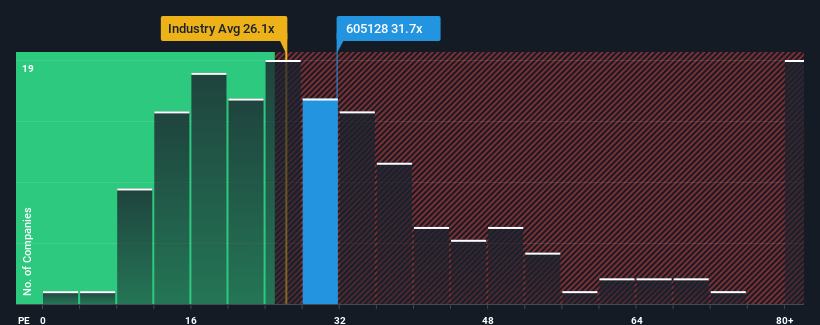

In spite of the firm bounce in price, there still wouldn't be many who think Shanghai Yanpu Metal ProductsLtd's price-to-earnings (or "P/E") ratio of 31.7x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for Shanghai Yanpu Metal ProductsLtd as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Shanghai Yanpu Metal ProductsLtd

Is There Some Growth For Shanghai Yanpu Metal ProductsLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shanghai Yanpu Metal ProductsLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 139% last year. As a result, it also grew EPS by 26% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 41% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

In light of this, it's curious that Shanghai Yanpu Metal ProductsLtd's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Shanghai Yanpu Metal ProductsLtd's P/E

Its shares have lifted substantially and now Shanghai Yanpu Metal ProductsLtd's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shanghai Yanpu Metal ProductsLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shanghai Yanpu Metal ProductsLtd you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Shanghai Yanpu Metal ProductsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605128

Shanghai Yanpu Metal ProductsLtd

Designs, manufactures, and sells stamping parts, assembly and welding parts, and stamping dies in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives