- China

- /

- Electrical

- /

- SZSE:002335

Top Growth Companies With Significant Insider Ownership January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing another strong year despite recent volatility and economic data revealing both challenges and opportunities, investors are increasingly focused on identifying resilient growth companies. In this context, stocks with significant insider ownership often attract attention as they can indicate strong confidence from those closest to the company's operations and strategy, potentially aligning interests between management and shareholders in navigating current market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Underneath we present a selection of stocks filtered out by our screen.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally, with a market cap of approximately SEK5.44 billion.

Operations: The company's revenue is derived from four main segments: Future Snacking (SEK959 million), Sustainable Care (SEK2.34 billion), Quality Nutrition (SEK1.58 billion), and Nordic Distribution (SEK2.74 billion).

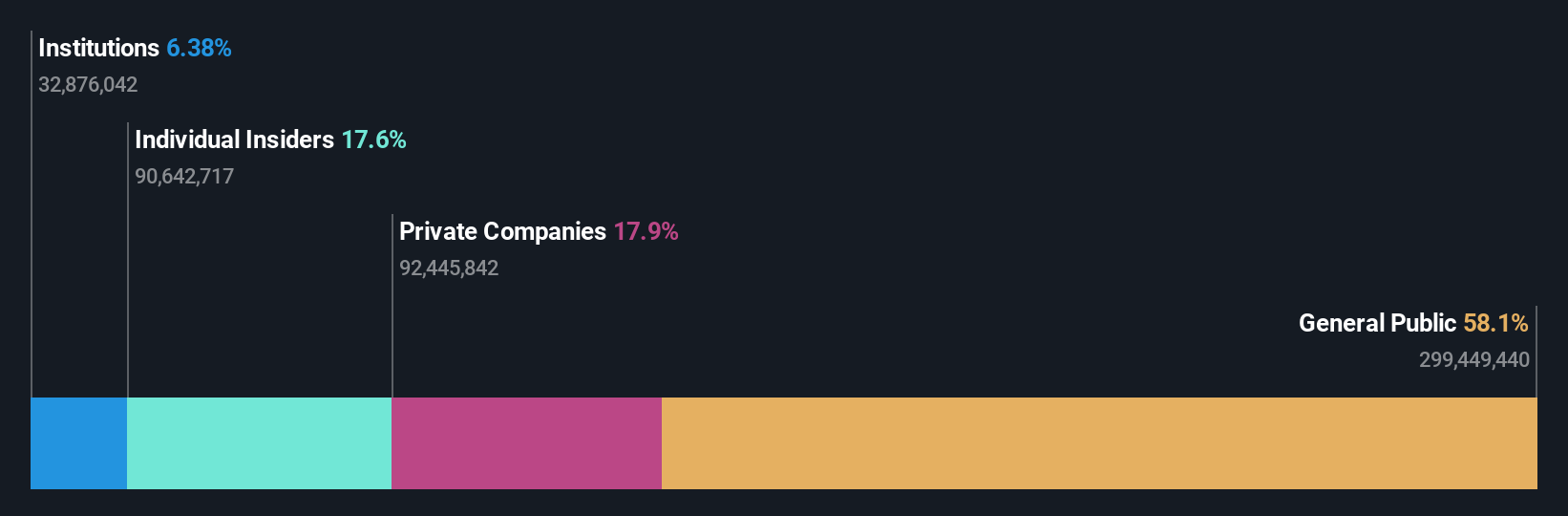

Insider Ownership: 14.7%

Earnings Growth Forecast: 65.1% p.a.

Humble Group, with substantial insider buying recently, is demonstrating strong growth potential. The company became profitable this year and reported a net income of SEK 27 million in Q3 2024, reversing a loss from the previous year. Revenue is forecast to grow at 11.8% annually, outpacing the Swedish market's average. Despite trading at a significant discount to its estimated fair value, Humble's earnings are expected to grow significantly over the next three years.

- Navigate through the intricacies of Humble Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Humble Group is priced higher than what may be justified by its financials.

Ningbo Jifeng Auto Parts (SHSE:603997)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Jifeng Auto Parts Co., Ltd. manufactures automotive interior parts in China and has a market cap of CN¥14.59 billion.

Operations: The company's revenue segments include the production of automotive interior parts in China.

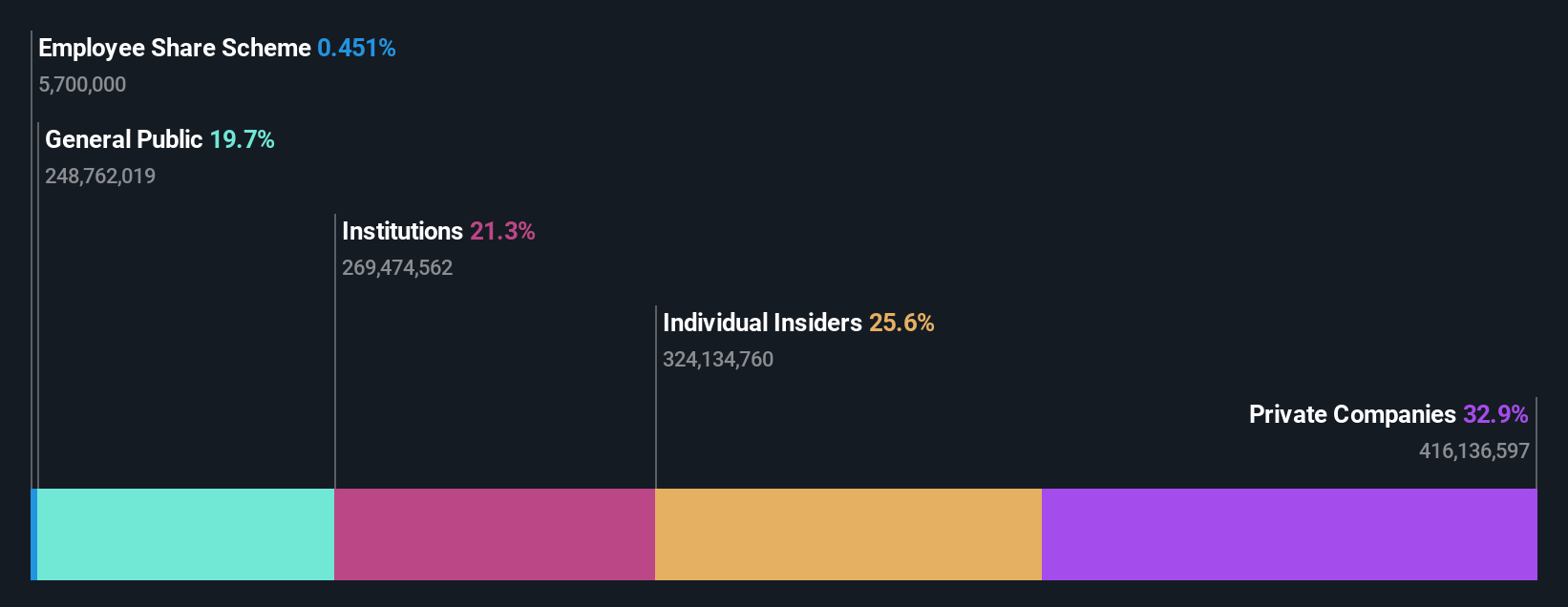

Insider Ownership: 25.7%

Earnings Growth Forecast: 114.3% p.a.

Ningbo Jifeng Auto Parts, despite reporting a net loss of CNY 531.94 million for the first nine months of 2024, is forecast to achieve profitability within three years. The company's revenue is projected to grow at 16.6% annually, surpassing the Chinese market average. Trading significantly below its estimated fair value and with no recent insider trading activity, Ningbo Jifeng presents a potentially undervalued opportunity in its industry.

- Get an in-depth perspective on Ningbo Jifeng Auto Parts' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Ningbo Jifeng Auto Parts' share price might be on the cheaper side.

Kehua Data (SZSE:002335)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation globally, with a market cap of CN¥13.30 billion.

Operations: Kehua Data's revenue is derived from its integrated solutions for power protection and energy conservation worldwide.

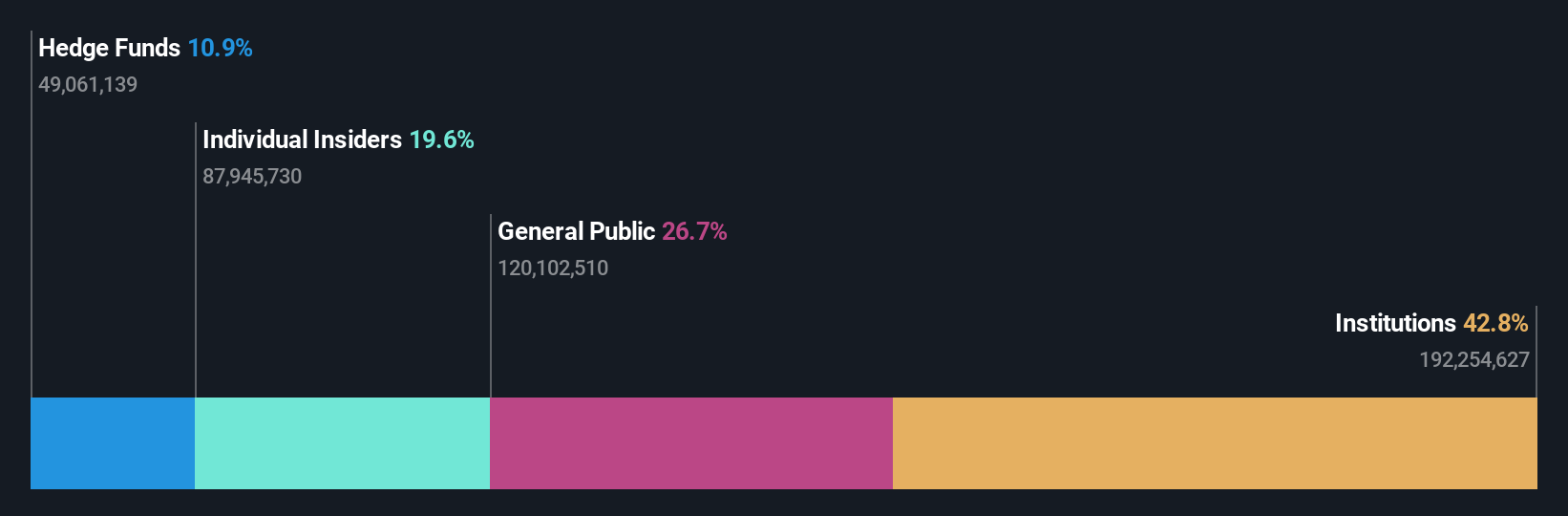

Insider Ownership: 21.5%

Earnings Growth Forecast: 42% p.a.

Kehua Data's earnings are forecast to grow significantly at 42% per year, outpacing the Chinese market average of 25.1%. However, recent financials show a decline in net income to CNY 238.07 million for the first nine months of 2024 from CNY 445.19 million a year ago. Despite trading at a substantial discount to its estimated fair value and no recent insider trading activity, revenue growth is expected below the threshold for high growth companies.

- Dive into the specifics of Kehua Data here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Kehua Data shares in the market.

Where To Now?

- Gain an insight into the universe of 1487 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kehua Data might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002335

Kehua Data

Provides integrated solutions for power protection and energy conservation worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives