Yunshi Corp And 2 Other Emerging Asian Small Caps With Solid Fundamentals

Reviewed by Simply Wall St

As global markets grapple with trade tensions and economic uncertainties, Asian small-cap stocks are gaining attention for their potential resilience and growth opportunities. In this environment, companies like Yunshi Corp stand out due to their solid fundamentals, offering investors a chance to explore emerging market players that are well-positioned to navigate these challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cystech Electronics | 5.63% | 4.88% | 14.53% | ★★★★★★ |

| NOROO PAINT & COATINGS | 10.55% | 4.93% | 13.28% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Tibet Weixinkang Medicine | NA | 14.86% | 35.28% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| AIC | 23.80% | 25.41% | 61.47% | ★★★★★★ |

| Xuelong GroupLtd | NA | -3.81% | -16.81% | ★★★★★★ |

| Philippine Savings Bank | NA | 6.09% | 23.58% | ★★★★★☆ |

| Uniplus Electronics | 27.23% | 44.40% | 74.50% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xuelong GroupLtd (SHSE:603949)

Simply Wall St Value Rating: ★★★★★★

Overview: Xuelong Group Co., Ltd specializes in the research, development, production, and sale of internal combustion engine cooling systems and automotive lightweight plastic products for commercial vehicles, construction machinery, and agricultural machinery sectors with a market cap of CN¥4.07 billion.

Operations: Xuelong Group generates revenue primarily from the sale of internal combustion engine cooling systems and automotive lightweight plastic products. The company has a market cap of CN¥4.07 billion.

Xuelong Group Ltd., a small player in the auto components sector, has demonstrated resilience despite earnings declining by 16.8% annually over the past five years. The company boasts high-quality past earnings and remains debt-free, which suggests financial prudence. Although its recent earnings growth of 5% lagged behind the industry average of 11.6%, Xuelong's positive free cash flow is a promising sign for future investments or expansions. With no debt to cover, interest payments are not a concern, positioning it well to navigate market volatility and capitalize on potential opportunities within its niche market segment.

Shanghai Kelai Mechatronics EngineeringLtd (SHSE:603960)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Kelai Mechatronics Engineering Co., Ltd. operates in the mechatronics engineering sector and has a market capitalization of CN¥6.64 billion.

Operations: The company generates revenue primarily through its operations in the mechatronics engineering sector. It has a market capitalization of CN¥6.64 billion, reflecting its position within the industry.

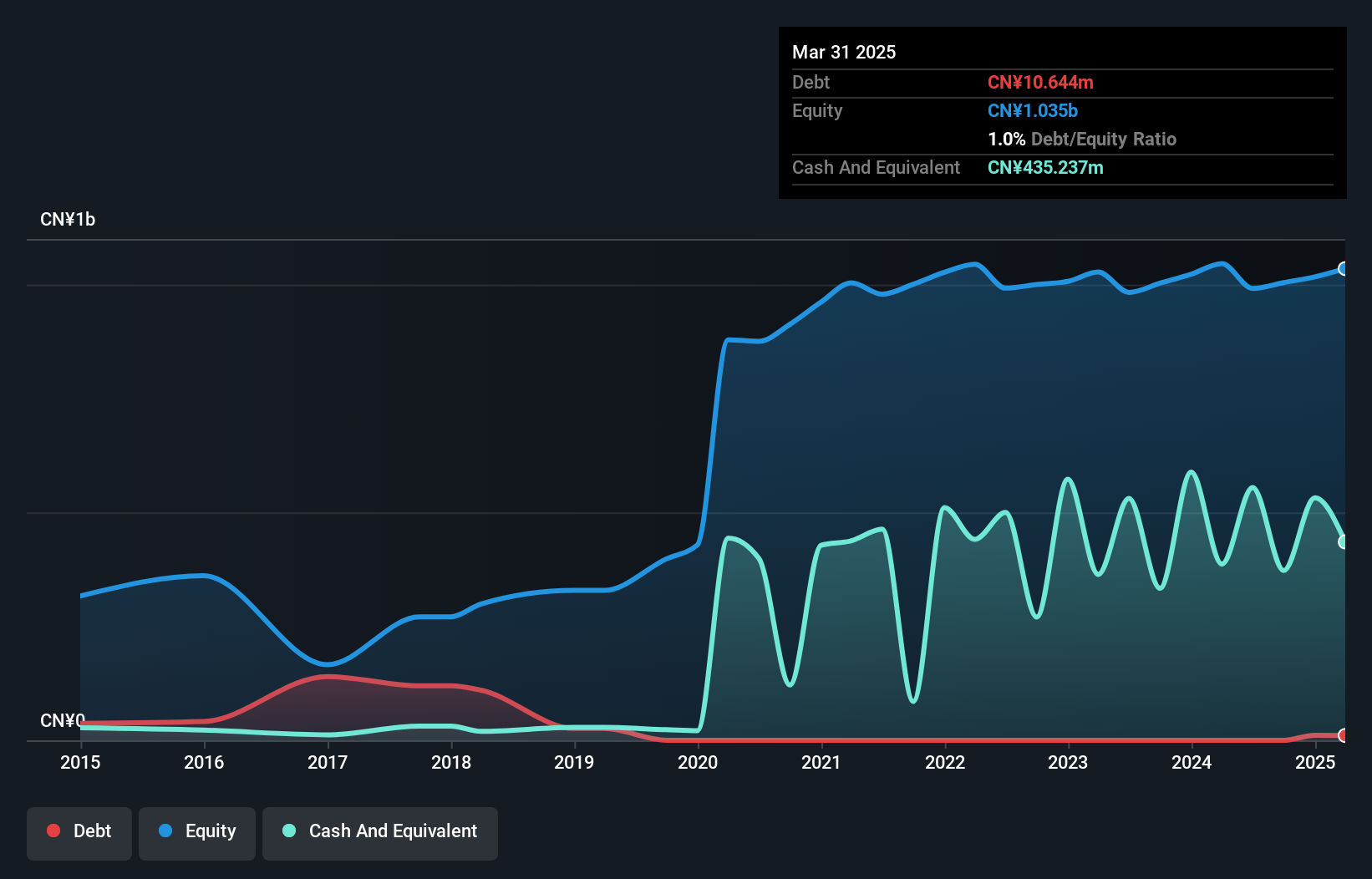

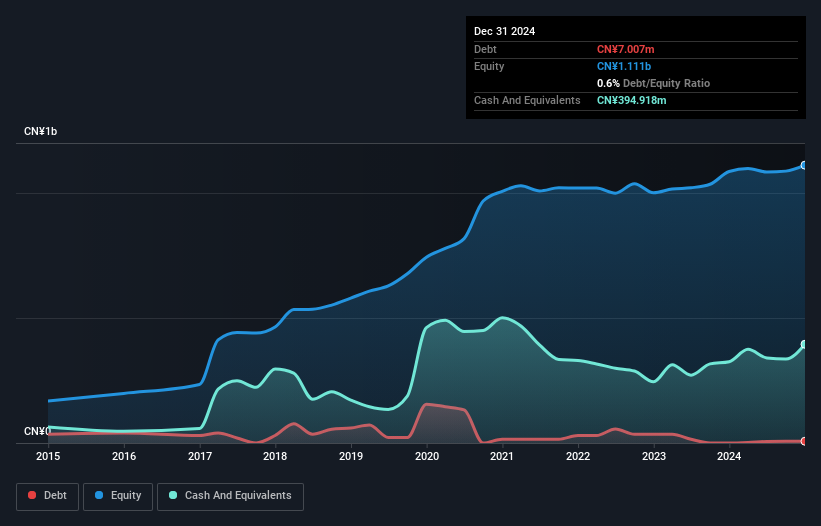

Shanghai Kelai Mechatronics Engineering, a smaller player in the machinery sector, has shown promising financial health with its debt to equity ratio dropping significantly from 3.3 to 0.6 over five years. The company enjoys robust earnings growth of 1.8%, outpacing the industry average of -0.2%. Its interest coverage is solid, indicating no concerns over interest payments, and it maintains a positive free cash flow position. With earnings projected to grow by 29% annually, Shanghai Kelai appears well-positioned for future expansion despite its current size in the market landscape.

Jiangsu Yawei Machine Tool (SZSE:002559)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Yawei Machine Tool Co., Ltd. specializes in the manufacturing and sales of metal forming machine tools and laser processing equipment both in China and abroad, with a market capitalization of CN¥7.21 billion.

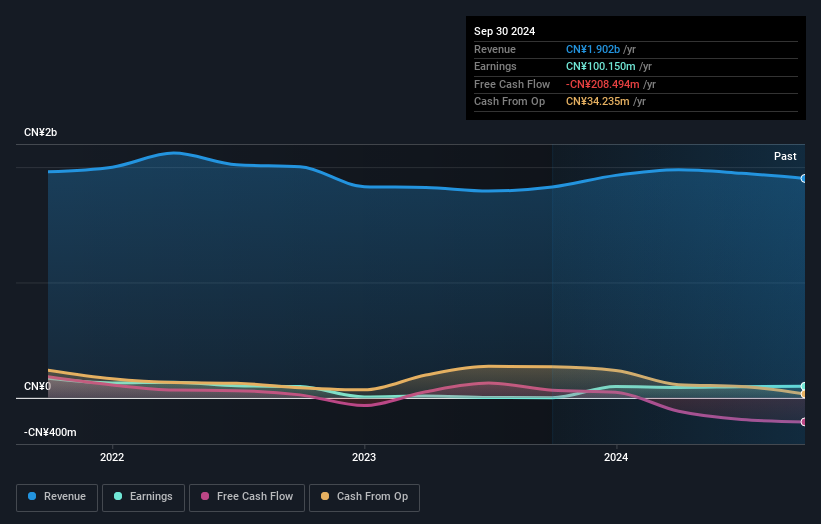

Operations: Yawei generates revenue primarily from its general equipment manufacturing segment, which reported CN¥1.90 billion.

Jiangsu Yawei Machine Tool, a smaller player in its field, has been making waves with an impressive earnings growth of 5296.9% over the past year, far outpacing the Machinery industry's -0.2%. Despite a significant one-off loss of CN¥29M impacting recent results, it remains profitable and not burdened by debt concerns as cash exceeds total debt. The company's strategic move to raise CN¥933.55M through private placement aims to bolster future growth prospects. With earnings projected to grow at 16% annually, Jiangsu Yawei seems poised for continued expansion within its industry context.

Taking Advantage

- Reveal the 2622 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002559

Jiangsu Yawei Machine Tool

Manufactures and sells metal forming machine tools and laser processing equipment in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives