- China

- /

- Auto Components

- /

- SHSE:603949

Optimistic Investors Push Xuelong Group Co.,Ltd (SHSE:603949) Shares Up 31% But Growth Is Lacking

Xuelong Group Co.,Ltd (SHSE:603949) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

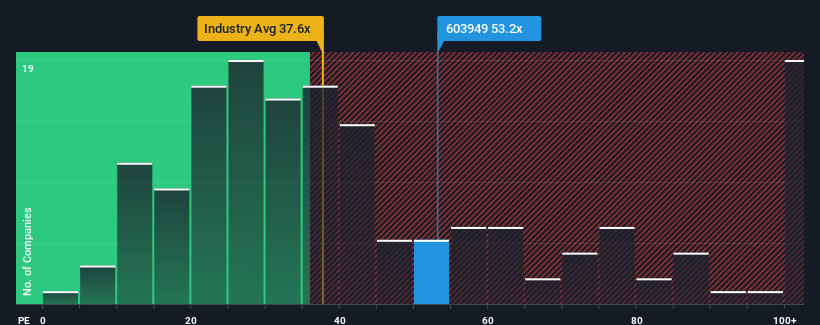

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 38x, you may consider Xuelong GroupLtd as a stock to potentially avoid with its 53.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for Xuelong GroupLtd, which is generally not a bad outcome. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Xuelong GroupLtd

Is There Enough Growth For Xuelong GroupLtd?

Xuelong GroupLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 59% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's an unpleasant look.

With this information, we find it concerning that Xuelong GroupLtd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

The large bounce in Xuelong GroupLtd's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Xuelong GroupLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Xuelong GroupLtd has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603949

Xuelong GroupLtd

Engages in the research, development, production, and sale of internal combustion engine cooling systems and automotive lightweight plastic products in China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion