- China

- /

- Auto Components

- /

- SHSE:603786

With EPS Growth And More, KEBODA TECHNOLOGY (SHSE:603786) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in KEBODA TECHNOLOGY (SHSE:603786). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for KEBODA TECHNOLOGY

How Fast Is KEBODA TECHNOLOGY Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. KEBODA TECHNOLOGY managed to grow EPS by 8.7% per year, over three years. That's a pretty good rate, if the company can sustain it.

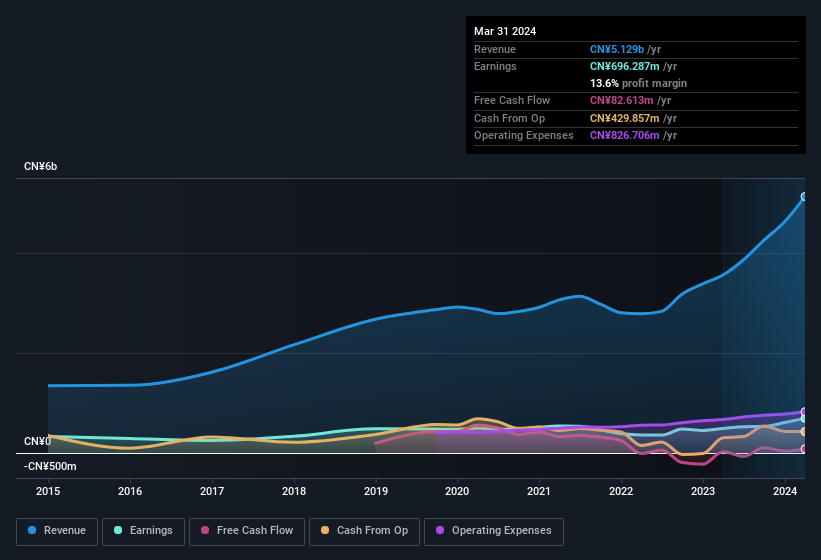

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of KEBODA TECHNOLOGY's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. KEBODA TECHNOLOGY maintained stable EBIT margins over the last year, all while growing revenue 44% to CN¥5.1b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for KEBODA TECHNOLOGY?

Are KEBODA TECHNOLOGY Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that KEBODA TECHNOLOGY insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth CN¥3.5b. That equates to 13% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to KEBODA TECHNOLOGY, with market caps between CN¥14b and CN¥46b, is around CN¥1.5m.

KEBODA TECHNOLOGY's CEO took home a total compensation package worth CN¥1.1m in the year leading up to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add KEBODA TECHNOLOGY To Your Watchlist?

As previously touched on, KEBODA TECHNOLOGY is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for KEBODA TECHNOLOGY, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with KEBODA TECHNOLOGY , and understanding it should be part of your investment process.

Although KEBODA TECHNOLOGY certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if KEBODA TECHNOLOGY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603786

KEBODA TECHNOLOGY

KEBODA TECHNOLOGY Co., Ltd. manufacture and sale of automotive electronics and related products for automotive industry in China.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026