- China

- /

- Auto Components

- /

- SHSE:603758

Chongqing Qin'an M&E PLC.'s (SHSE:603758) Share Price Boosted 28% But Its Business Prospects Need A Lift Too

Those holding Chongqing Qin'an M&E PLC. (SHSE:603758) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Notwithstanding the latest gain, the annual share price return of 2.5% isn't as impressive.

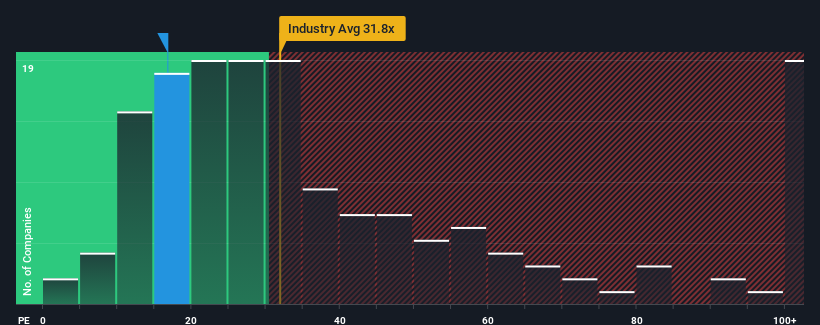

Even after such a large jump in price, Chongqing Qin'an M&E's price-to-earnings (or "P/E") ratio of 16.8x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 57x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Chongqing Qin'an M&E certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Chongqing Qin'an M&E

Does Growth Match The Low P/E?

Chongqing Qin'an M&E's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 42%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 16% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 40% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Chongqing Qin'an M&E's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Chongqing Qin'an M&E's P/E?

Chongqing Qin'an M&E's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chongqing Qin'an M&E maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Chongqing Qin'an M&E has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603758

Chongqing Qin'an M&E

Together with its subsidiary, engages in the research, development, production and sales of core components of automobile engines, key components of transmissions, new energy hybrid drive systems and other products in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026