- China

- /

- Auto Components

- /

- SHSE:603596

Sentiment Still Eluding Bethel Automotive Safety Systems Co., Ltd (SHSE:603596)

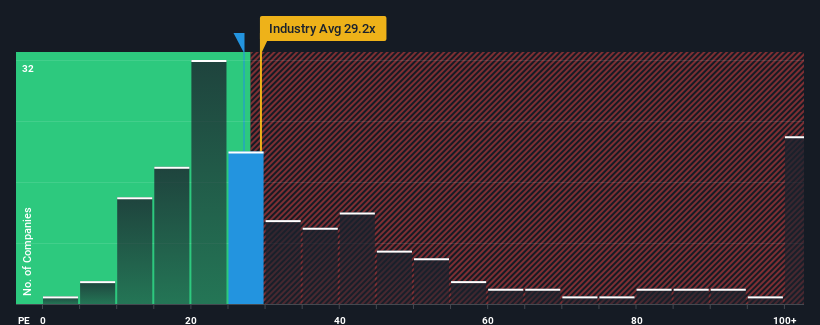

Bethel Automotive Safety Systems Co., Ltd's (SHSE:603596) price-to-earnings (or "P/E") ratio of 27x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Bethel Automotive Safety Systems certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Bethel Automotive Safety Systems

What Are Growth Metrics Telling Us About The Low P/E?

Bethel Automotive Safety Systems' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. The latest three year period has also seen an excellent 82% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 27% each year over the next three years. That's shaping up to be materially higher than the 20% per year growth forecast for the broader market.

In light of this, it's peculiar that Bethel Automotive Safety Systems' P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Bethel Automotive Safety Systems' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Bethel Automotive Safety Systems (1 is a bit unpleasant!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bethel Automotive Safety Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603596

Bethel Automotive Safety Systems

Develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives